Insights

2017 First Quarter Review

The stock market rally that picked up steam after the election of President Trump has continued. At the close of the first quarter of 2017, the S&P 500 was up 6.1% and international markets performed even better. International developed market stocks rose by 7.4% and emerging market stocks by 11.5%. After such rapid gains, investors may be concerned that the market has gone too far, too fast. While the U.S. and global economies are on increasingly sound footing, political risks may create volatility and investors should ensure that their portfolio risk levels are appropriate.

Stocks have generally become more expensive as global price increases have outpaced earnings growth, particularly in the U.S. In part, this reflects rising investor confidence in the global economy. U.S. economic growth is solid, Europe is enjoying a cyclical upswing, and China has stabilized. A more robust global economy should spur growth in corporate earnings. Although the Federal Reserve has begun to increase interest rates, board members have been cautious about the pace of future hikes so monetary policy remains accommodative for now. The inability of Congress to repeal and replace the Affordable Care Act also seems to have reduced the likelihood of inflationary pressure from major tax reform or infrastructure spending. However, we continue to expect some degree of modest fiscal stimulus this year, likely in the form of tax cuts.

This year is likely to be challenging for stock investors. While the global economy is strong, there is little “margin of safety” to protect investors from shocks. In this environment, we are exploring a number of targeted themes that we believe will enhance stock diversification and returns.

Equally-Weighted Indexing

We usually invest in U.S. stocks through low cost market capitalization indices such as the S&P 500. This has worked well, as active managers have had great difficulty outperforming the U.S. stock market. According to the Wall Street Journal, index funds received record inflows of over $400 billion in 2016. Investing in a market capitalization-based index is effective, but a small number of stocks with the highest market capitalization often comprise the bulk of the most popular indices. For example, the ten largest companies held in the S&P 500 make up nearly 20% of the total value of the index. As a result, a market capitalization weighted index can expose investors to significant individual company risk. There is another way to invest in this market, an equally-weighted index, which can provide investors with more diversified market exposure. As its name implies, an equally-weighted index simply applies equal weightings to each company included in the index.

An equally-weighted S&P 500 index has historically outperformed the market capitalization weighted S&P 500. A key reason is that in order to maintain equal weights to portfolio constituents, the index must rebalance at a regular frequency. This means that the equally weighted index will sell stocks that have recently appreciated, while purchasing shares that have fallen. The equally weighted index systematically buys low and sells high, a good practice for long-term investors.

Healthcare

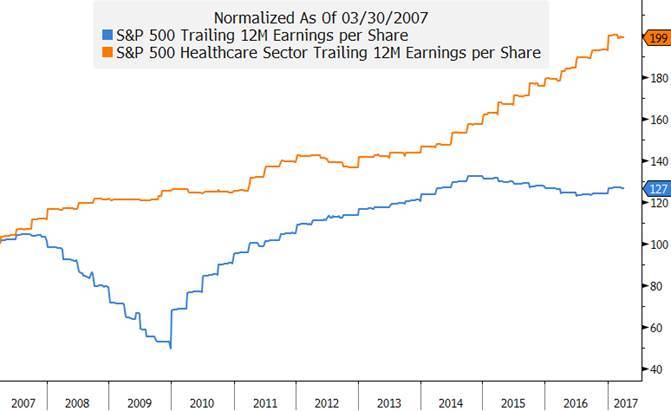

Healthcare stocks underperformed the broader U.S. stock market in 2016. At the same time, healthcare companies had superior earnings per share growth, which is the key driver for long term equity returns.

Healthcare Sector Earnings per Share has Grown at Faster Pace Than Broad Market

Source: Bloomberg

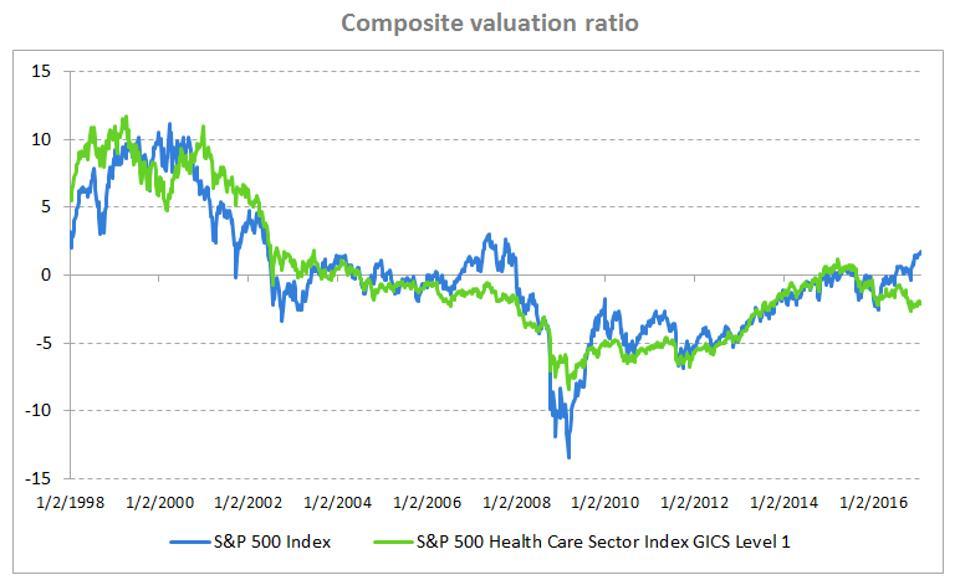

Healthcare stocks also have higher returns on equity and have traditionally outperformed in market downturns. Long-term fundamentals for the sector are positive, as an aging global population supports growth in future demand. Given its superior earnings growth and return on equity, the healthcare sector typically trades at a premium to the broader market. At present, however, healthcare stocks are inexpensive versus the rest of the market.

Healthcare Composite Valuation Currently Attractive Versus Broad Market

Source: Bloomberg, Choate

Unless the long-term relationship between healthcare stocks and the S&P 500 breaks down, this disparity of valuation indicates that healthcare stocks should perform well relative to the broader market.

Small Capitalization Emerging Market Stocks

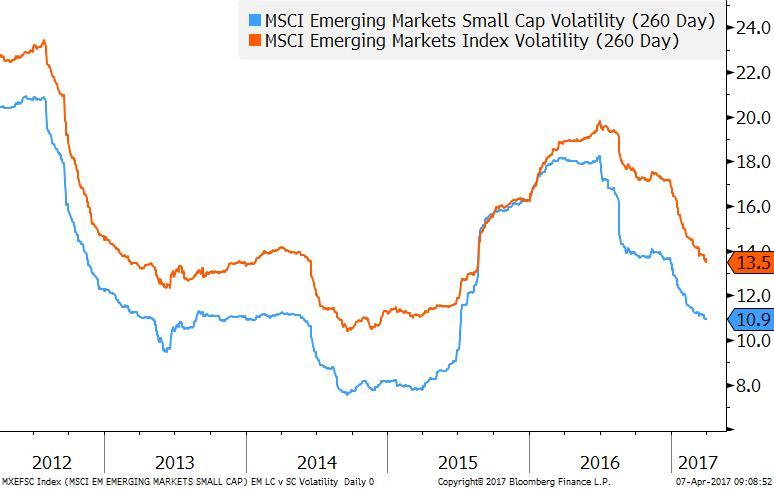

Investments in emerging market stocks can offer investors higher rates of long-term growth and diversification benefits for their portfolios. However, the large capitalization emerging market stock index is increasingly dominated by a small number of multinational companies. As a result, the standard emerging market stock index is also very correlated to developed market stocks, reducing the diversification benefits. Smaller capitalization emerging market companies tend to focus on growing segments of local economies such as healthcare, technology, and consumer products, and there are few smaller capitalization emerging market companies in the more volatile sectors such as banking and energy. This means that smaller capitalization emerging market stocks are less risky, in aggregate, than large capitalization emerging market stocks.

Volatility of Emerging Market Small Capitalization is Lower Than Large Capitalization

Source: Bloomberg

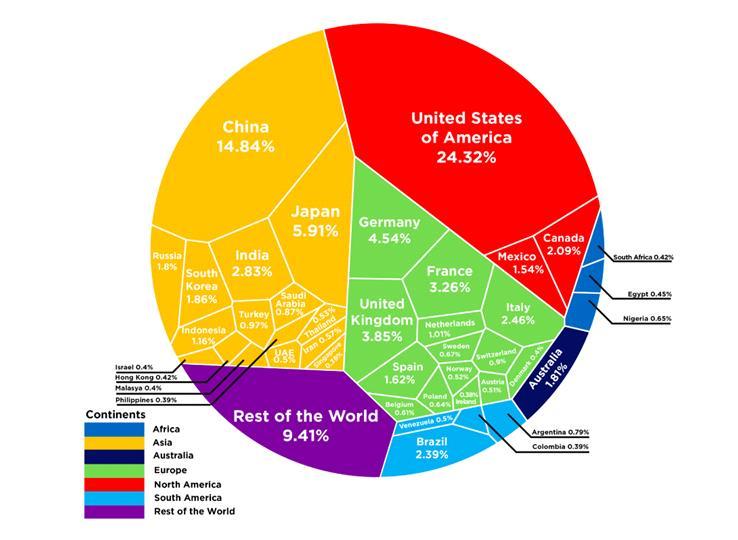

Finally, these small capitalization stocks are concentrated in Asia, the fastest growing and most attractive region in emerging markets for investors.

Asia is Home to Both the Largest and Fastest Growing Emerging Market Countries

Source: World Bank 2017

Despite the merits of these focused approaches to stock investing, all stock investments are risky and we recognize that political uncertainty is rising. Trade protectionism and a more restrictive immigration policy were core themes of the Trump campaign, and in both areas the President can act more autonomously than in matters of taxation or government spending. President Trump has already signaled that these goals are central to his governing platform. There are also several unanswered questions about the future direction of U.S. foreign policy. Significant shifts in U.S. policy, particularly with regard to China, NATO and the Middle East could have spillover effects on markets. We believe that market participants routinely underestimate political risks such as these.

It is a good time for all investors to review their long-term goals. The overall risk level of a portfolio should be a deliberate and disciplined choice, and not a result of current market action. Striking the right balance between risk and safety will help ensure that an investor will not be forced to turn a temporary loss into a permanent one.

Printable version.

Disclosures:

This presentation is for informational purposes and does not constitute investment advice, nor should it be considered a recommendation to purchase or sell any particular security. The opinions expressed are those of the Choate Investment Advisers (“ChoateIA”). Firm holdings for the last 12 months are available upon request. Investing involves the risk of loss of principal. Additional information about the risks can be found in Form ADV Part 2, which is available upon request.

ChoateIA is a registered investment adviser. Registration does not imply a certain level of skill or training. More information about the firm can be found in its Form ADV Part 2, which is available upon request by emailing info@choateinvestmentadvisors.com.