Insights

2017 Third Quarter Review

Strong equity market performance continued this quarter, once again led by both international and emerging market securities. So far this year, emerging market stocks are up 28.1% and international developed stocks are up 20.5%. The S&P 500, though up 14.2%, has lagged international markets by a wide margin.

Global Stock Market Returns Year-to-Date Through September 30, 2017

Source: Bloomberg

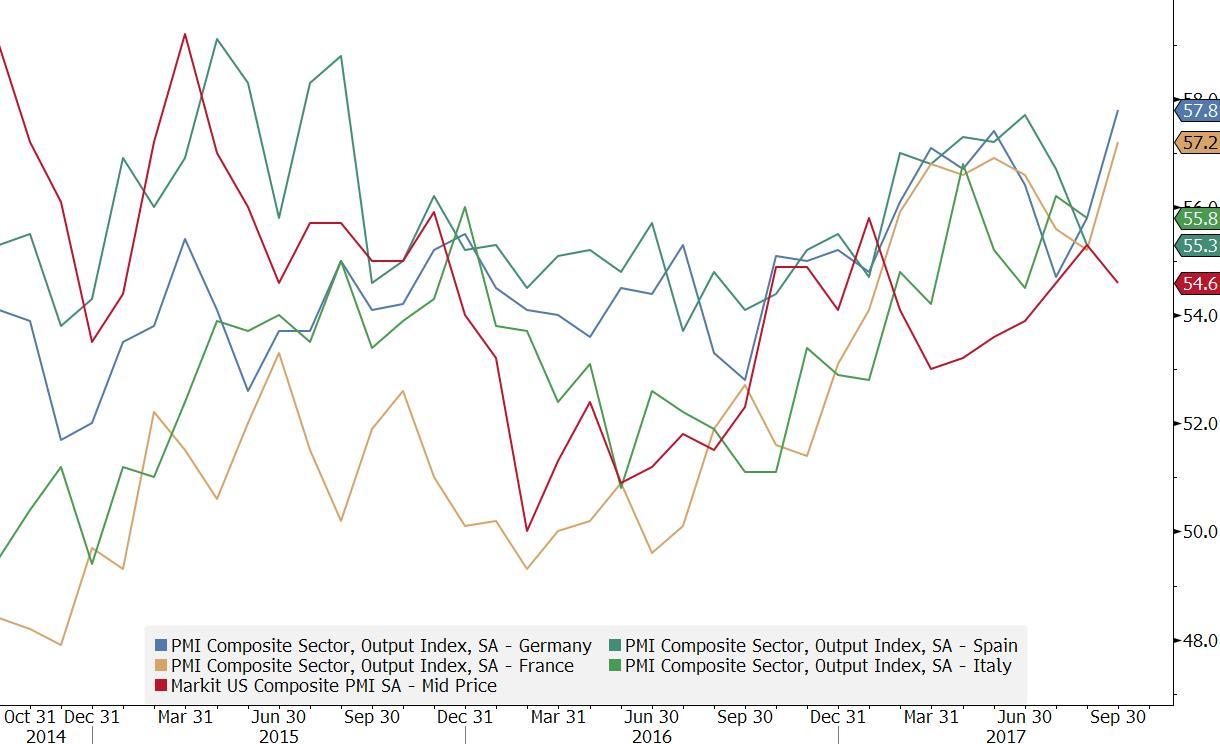

The 2017 market rally has been supported by economic fundamentals. For the first time since 2007, all the world’s largest economies are seeing economic expansion. The Purchasing Managers’ Indexes (PMI) for the United States and the four largest economies in Europe continue to indicate expansion in the manufacturing sector.

Purchasing Managers Indices for U.S. and Key European Countries

Source: Bloomberg

China’s growth has also stabilized, with the latest GDP figures showing growth of 6.9% year-on-year. This favorable economic backdrop led to strong growth in corporate earnings. Emerging market company earnings are up 21.6% year-on-year. Firms in international developed markets increased earnings by 18% year-over-year and earnings for S&P 500 companies in aggregate are up 11.2%.

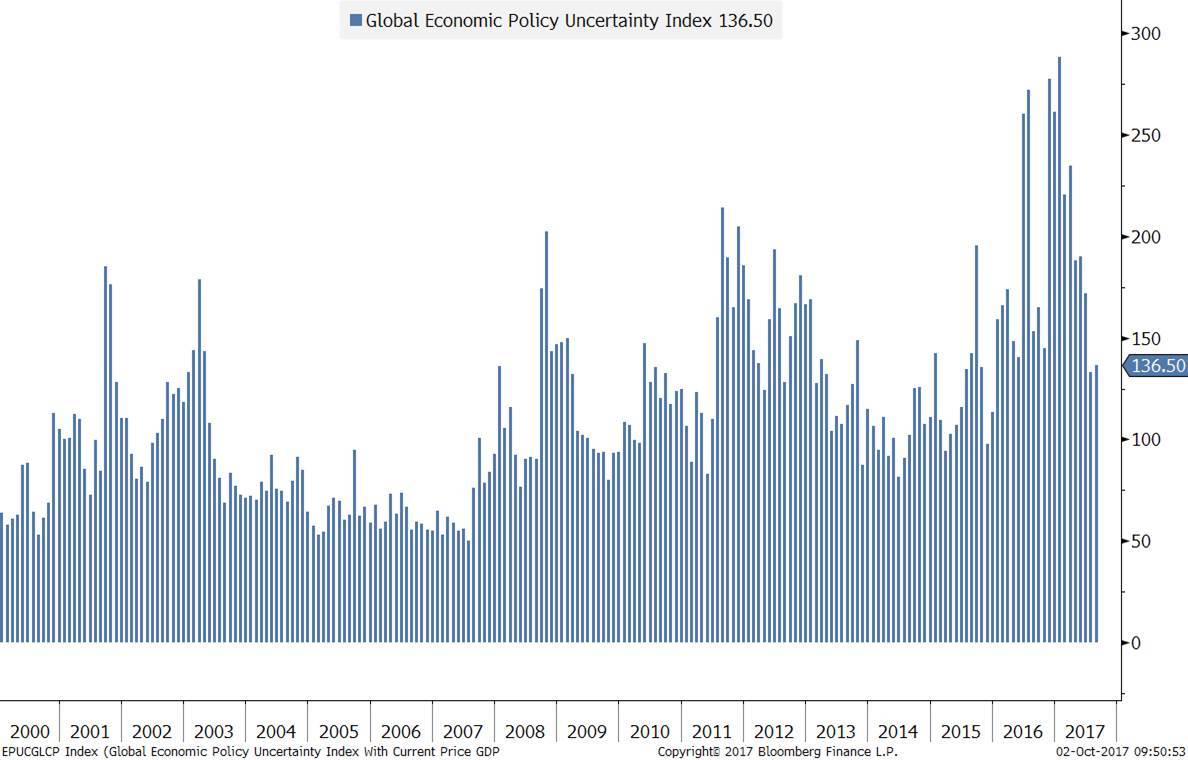

Despite this positive economic backdrop many investors are understandably concerned about current political events. The recent increase in political turmoil, as reflected in recent readings of the Global Economic Policy Uncertainty Index, warrants attention.

Global Economic Policy Uncertainty Index

Source: Bloomberg

Investors are faced with a variety of risks, from potential conflict with North Korea to populist unrest in Europe and the U.S. to the impact of natural disasters such as Hurricanes Harvey and Irma. Though it is important to follow the latest headlines, investors should focus on structural factors and trends as the key building blocks in portfolio construction. Many near-term risks are inherently unpredictable, and the best way to prepare for infrequent and unexpected events is to ensure that a portfolio is strategically positioned at an appropriate level of risk. Given the strong recent stock market performance, this is a good time to consider whether a portfolio may be over-risked, as another crisis in the future is inevitable.

When crisis occurs, investors look for a policy response from a few key decision makers. In the 2008 crisis, it was the actions of the U.S. Federal Reserve, pumping liquidity into the global financial system, that initially stabilized the global economy. United States fiscal policy has been limited by political gridlock, so monetary policy has been the main channel for policy response to economic events. As the U.S. dollar is still the global reserve currency, U.S. monetary policy heavily influences global policy.

The massive fiscal stimulus from China in 2008 helped to spark a global recovery. The 2008 Chinese fiscal stimulus in response to the financial crisis was 13.4% of China’s GDP, compared to 6% in the U.S. China is now 15% of the global economy, second only to the U.S., therefore how China responds to the next economic slowdown will be pivotal.

These two critical power centers of the global economy will be shortly undergoing a transition in personnel:

- The Federal Reserve will undergo a major transition. On September 6th, Stanley Fischer, the Vice Chairman of the Federal Reserve, announced his retirement. In February, Janet Yellen’s term as Chairman ends. This means that President Trump has the opportunity to fill five vacancies out of seven positions on the Board of Governors of the Federal Reserve System. There are no clear cut favorites to replace Janet Yellen and the President has not articulated a clear philosophy with regard to monetary policy. Consequently, both the near-term pace of interest rate hikes as well as how the Federal Reserve responds during the next recession is yet to be determined.

- China will select its new Politburo at the 19th National Congress of China’s Communist Party this October, and each Politburo member will serve for five years. Most investors will use the 19th Party Congress to gauge how much power President Xi consolidates. Many wish to see President Xi gain more power as he will be more capable of implementing necessary economic reforms. This summer, the International Monetary Fund stated that current strong growth “comes at the cost of further large and continuous increases in private and public debt, thus increasing downside risks in the medium term”. Unfettered economic growth has led to dangerous pollution levels. According to a World Health Organization study in 2016, China is the world’s deadliest country for outdoor air pollution. In addition, over half of China’s groundwater has been deemed unsafe according to Chinese officials. President Xi may prioritize long term social stability and choose to rein in credit growth, increase environmental regulations and target a more sustainable trajectory to the detriment of near-term targets. Alternatively, he may opt to only make minor changes to current policies and trade near-term results for long-term risks. The path China embraces will signal how China is likely to react in a future economic downturn.

Given the current strength of the global economy, it is unlikely that the U.S. will experience a recession soon. But when the next economic slowdown comes, the reaction of the Federal Reserve and China’s leaders will be of paramount importance. Investors should closely follow the current transitions at both the Federal Reserve and the Chinese Politburo, as these decision makers will likely be in place for the next downturn.

As the year draws to a close, this is a good time to review your personal situation and assess what level of risk is appropriate to reach your long-term goals with peace of mind. The best way to effectively prepare for an unexpected crisis is to be sure that you understand and are comfortable with the level of exposure in your portfolio.

Printable version.

Disclosures:

This presentation is for informational purposes and does not constitute investment advice, nor should it be considered a recommendation to purchase or sell any particular security. The opinions expressed are those of the Choate Investment Advisers (“ChoateIA”). Firm holdings for the last 12 months are available upon request. Investing involves the risk of loss of principal. Additional information about the risks can be found in Form ADV Part 2, which is available upon request.

ChoateIA is a registered investment adviser. Registration does not imply a certain level of skill or training. More information about the firm can be found in its Form ADV Part 2, which is available upon request by emailing info@choateinvestmentadvisors.com.