Insights

2018 Fourth Quarter Review

We are writing to you at the end of a difficult year. Stocks declined significantly at the end of the fourth quarter. The S&P 500 had its worst December since 1931, and was down a total of -13.5% over the fourth quarter of 2018. The global stock market declined -9.4% over the course of 2018, and bond markets also had disappointing returns, as the Barclays Aggregate Bond Index was flat for the year. As noted in our quarterly updates during 2018, we have taken steps to insulate our clients’ portfolios from negative returns by steadily reducing risk:

- Risk - at the asset class level, we sold stocks and bought bonds.

- Asset Allocation - within stocks and bonds, we shifted to less risky asset classes. For example, we reduced high yield bonds and purchased treasuries. Within stocks, we added to low volatility stocks, while reducing international small cap stocks.

- Manager Selection - we invested with managers that have outperformed the market during past downturns.

The market drop at the end of December was particularly dramatic, but it is important to note that market liquidity and trading volume is very low at the end of year. This often creates more erratic moves in stock prices than the “fundamentals” of the underlying companies would otherwise dictate.

While we remain concerned about future prospects for global markets in 2019 and beyond, we do not see any obvious bubbles similar to technology stocks in 2000 or the housing market in 2008. In our first quarter market update of 2018, we expressed five key areas of concern, which remain relevant for 2019:

- Fiscal policy. The recent tax cut legislation provides a fiscal boost to the economy in the near term, but likely exacerbates budgetary pressures longer term. The fiscal pulse from the recent tax cut has the greatest impact on the economy and corporate earnings in 2018, when it is arguably least necessary. In a downturn, deficits will rise further, perhaps well above 10% of GDP. In addition, many states have not been increasing their rainy day funds but are instead lowering taxes. As states need to run balanced budgets, without these additional reserves there will inevitably be pressure to cut spending during the next downturn. We therefore do not expect the same level of fiscal stimulus in a future downturn that was present in both the 2001 and 2008 recessions. Instead, there may be push for budget cuts and austerity, which would prolong an economic slowdown and delay an eventual earnings recovery.

- Monetary policy. Given that interest rates are quite low on an absolute basis, it is likely that the United States Federal Reserve will have less scope to provide monetary stimulus than was the case in 2001 and 2008. It may be that even a shallow economic downturn will see interest rates drop quickly back down to zero. Once interest rates reach the lower bound, the Federal Reserve may need to employ aggressive and creative policy, as it did in 2008. It remains to be seen whether the current Federal Reserve leadership will be willing to do this.

- Deglobalization. Recent events indicate that the free trade consensus that governed Washington since World War II may be coming to an end. Even prior to President Trump’s election, the Obama Administration’s effort to ratify the Trans Pacific Partnership was deeply unpopular with Democrats and Republicans alike. President Trump’s latest protectionist actions have met little political resistance. Historically, calls for protectionism surge during difficult economic times. Therefore, tariffs and quotas may increase significantly during the next slowdown, with negative impact for the economy and the markets.

- Corporate debt. Over the past five years, corporate leverage has increased significantly. High levels of corporate borrowing could intensify the negative effects of the next downturn as companies cut wages or capital expenditures to meet debt obligations. According to an analysis by the economic research firm Bank Credit Analyst, interest coverage ratios (a measure of the level of corporate indebtedness) have declined even while corporate margins are at highs and interest rates are very low.

- Valuations. Equity market valuations currently reflect an optimistic view of future economic growth and corporate earnings. While valuations are not at the stratospheric levels of the late 1990s, they are well above the valuations levels of the market in 2007. Much of the stock market gains in the U.S. over the past five years were the result of higher valuations rather than improved corporate earnings. In fact, corporate revenue growth and margin expansion over the past five years was below the historic long-term average.

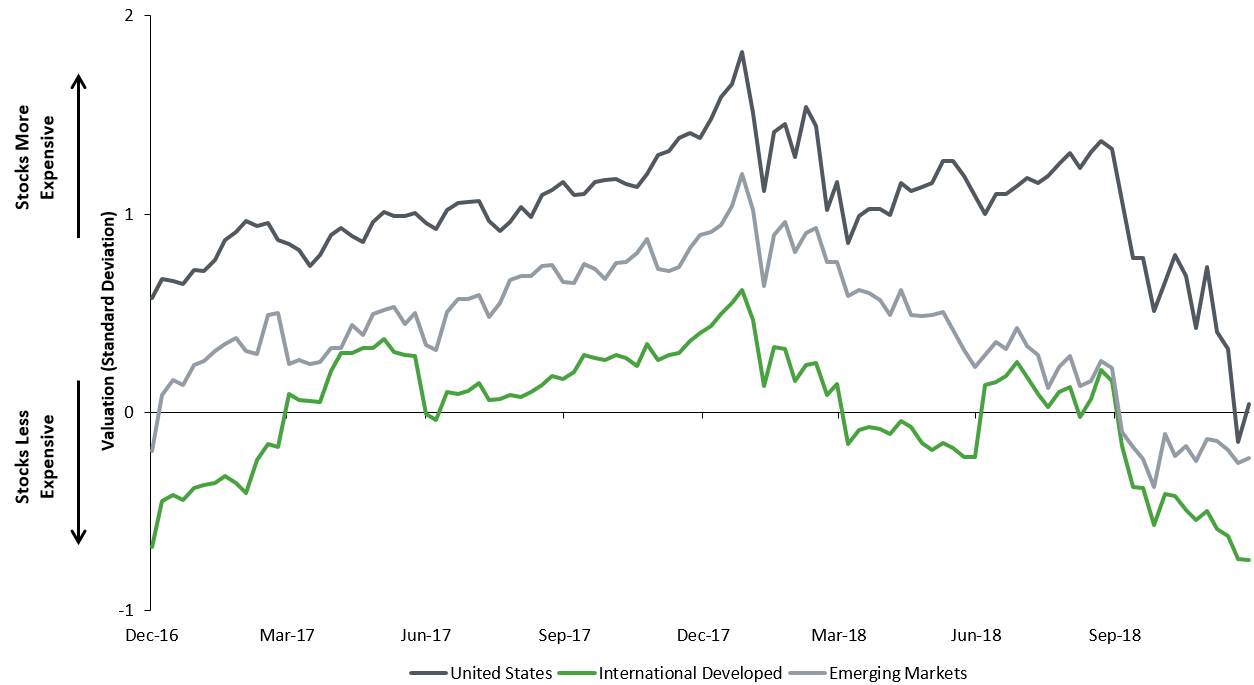

After recent market declines, stock valuations have improved, although market valuations are not yet “cheap” across the board. Our composite valuation measures now show international stock to be somewhat undervalued relative to their historical levels, and U.S. stocks to still be at a “fair” average valuation level.

Composite valuation measures by market

Source: Bloomberg, Choate Investment Advisors. Each composite is based on P/E, P/B, P/S, Price-to-Cash Flow, and Dividend Yield figures for the given market.

Data as of 12/28/2018.

We therefore expect each of the five factors to continue to be relevant in 2019. In addition to Federal Reserve monetary policy, we expect deglobalization and trade conflict in particular will move the markets. Until recently, investors had become accustomed to the positive impact of falling trade barriers and declining tariffs. These declining tariffs and the increased globalization of supply chains and capital flows coincided with increased corporate profit margins, larger end markets, and lower aggregate interest rates. In contrast, the burgeoning trade conflict between China and the U.S. began impacting overseas markets this spring, leading to a wide dispersion in returns between U.S. and international stocks.

U.S. investors might initially take comfort in the fact that they live in a relatively closed economy. According to the World Bank, only a quarter of the U.S. economy (adding all exports and imports) is exposed to trade. Therefore, the economic impact from a trade conflict on the U.S. economy should not be severe. Goldman Sachs estimates that an increase in tariffs will have a negative impact on the U.S. economy of only -0.2% of GDP.

Investors should remember, however, that they do not own the U.S. economy, but rather shares in public companies. According to Standard & Poor’s, 43% of S&P 500 company revenues in 2017 came from overseas. These companies have a lot to lose from a protracted trade war. They are vulnerable not only to tariff increases, but also to regulatory and other barriers that could favor domestic champions or non-U.S. firms. The largest S&P 500 sector, technology, draws 57% of its revenues from overseas. Apple gets 20% of its revenue from China alone. As tensions with China escalate, Apple’s share price is sinking.

A protracted trade conflict with China may force many U.S. companies to revamp and relocate their global supply chains. In effect, companies would have to close plants in China and build new plants somewhere else. During this transition period, the supply of some key inputs may be disrupted causing problems well out of proportion to their value. This would impact return on invested capital and hurt both earnings and valuation multiples, and therefore stock market returns.

Asia is a particularly vital market for global companies, but many are finding it increasingly difficult to compete. According to the World Bank, Chinese millennial income should overtake their peers in the U.S. by 2035. Surveys show that millennials in both the U.S. and China are skeptical of large global brands and favor local products. We believe this creates opportunities for domestic firms. In consumer products, local firms are already gaining market share at the expense of global brands. For example, in India, the dominant toothpaste brand Colgate has lost share to Patanjali Ayurved, a consumer product developed by a prominent yogi. Ayurved now has approximately 20% market share, up from zero ten years ago. At the same time, Colgate’s share dropped by almost 4% in 2015 alone. Colgate has had to respond to this new entrant by developing new products and lowering prices, which impacted profitability. As a result of changing market dynamics like this, investors now need to own shares in local emerging market companies to capitalize on local opportunities.

At the beginning of a new year, investors naturally begin to anticipate what the next year will bring. In the midst of political turmoil and volatile markets, one can anticipate a number of scenarios depending on factors as diverse as the evolution of U.S. trade policy, the future of Brexit, Italy’s economic direction, or future Federal Reserve monetary policy. There could be good news on these fronts as well. The market now expects the Fed to pause its interest rate hikes, and we believe a more dovish Fed would be a positive for stocks. Trade tensions may ease, which would also be a positive for the stock market.

While it is important to think about the future, it is also vital to reflect on the past and distill its lessons. We classify the investment lessons of the past into two broad categories. The first is objective investment results. Example questions in this first category would be: Did portfolio construction work as planned? Was the portfolio exposed to unanticipated risks? What surprises did you encounter from your underlying investments? Investors should ensure that the baseline allocation between defensive and aggressive assets in their portfolios is aligned with their long-term goals and personal circumstances. The fourth quarter of 2018 has demonstrated the importance of proper risk management.

The second category is subjective behavior. Example questions in the second category would be: How have you responded to market volatility? Are you comfortable with your level of risk? How have your circumstances changed? Ten years ago, you may have been content to ride the stock market roller coaster down and back up, but your personal circumstances may have changed and your portfolio risk should as well. After a long bull market, investors may forget how a sharp market downturn really feels. A typical market decline during a recession is more than -30%.

By reviewing how your portfolio and, importantly, how you reacted to recent market stresses, we believe you can better prepare for a potentially more stressful environment in the future. The lessons of 2018 should be quite valuable in 2019. We expect that volatility will increase into 2019 as both the U.S. economic and corporate earnings growth slow. Markets never go up or down in a straight line. A pause in Federal Reserve interest rate hikes or an easing of trade tensions could spark a stock rally. But we believe that the global economy is getting close to the end of an expansionary business cycle and investors should generally be cautious.

Printable version.

Disclosures:

This report is prepared by Choate Investment Advisors LLC (“ChoateIA”), a subsidiary of Choate, Hall & Stewart LLP. ChoateIA is registered as an investment advisor with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the firm can be found in its Form ADV Part 2, which is available upon request by emailing info@choateinvestmentadvisors.com.

This presentation is for informational purposes and does not constitute investment advice. None of the information contained in this report constitutes, or is intended to constitute, a recommendation of any particular security, trading strategy or determination by ChoateIA that any security or trading strategy is suitable for any specific person. Investing involves the risk of loss of principal. To the extent any of the information contained herein may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

The opinions expressed are solely those of ChoateIA. The information contained in this report has been obtained and derived from publicly available sources believed to be reliable, but ChoateIA cannot guarantee the accuracy or completeness of the information. Past performance is no guarantee of future results.