Insights

2018 Second Quarter Review

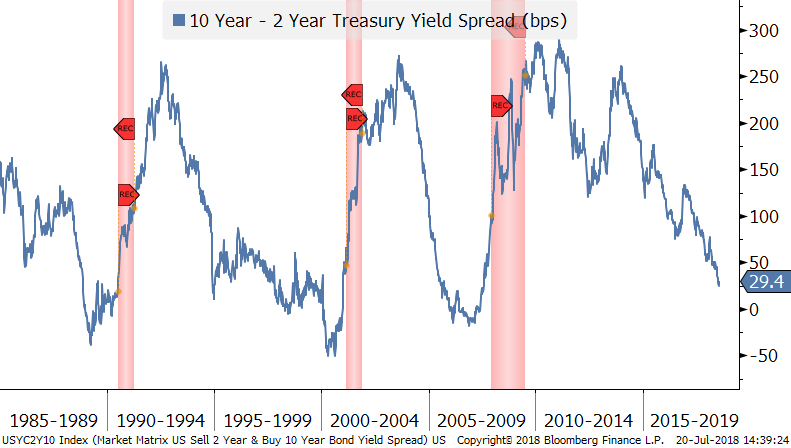

Stocks were turbulent in the first half of 2018. Despite this volatility, global stock markets are little changed from the start of the year, down 0.4% through the end of June. This past quarter, global stocks eked out a small gain of 0.5%. United States markets led the way in the quarter, with the S&P 500 rising 3.1% , and now up 2.5% for the year. The outperformance of U.S. stocks so far this year is due in large part to a stronger dollar, which appreciated by 5% over the past two months. This enabled U.S. stocks to erase their deficit versus international stocks from earlier in the year.

Market Returns in 2018

Source: Bloomberg

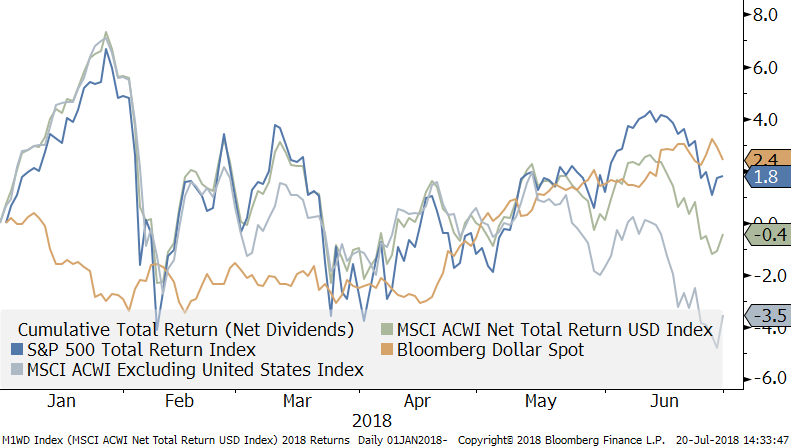

Investors face a challenge. Despite strong corporate earnings, stock markets have stalled, and concerns about future growth are rising. Potential headwinds for the markets include the impact of trade conflict, rising interest rates, and a projected slowdown in corporate earnings growth after the absorption of the tax cuts.

S&P 500 Adjusted Earnings Per Share Growth

Source: Goldman Sachs

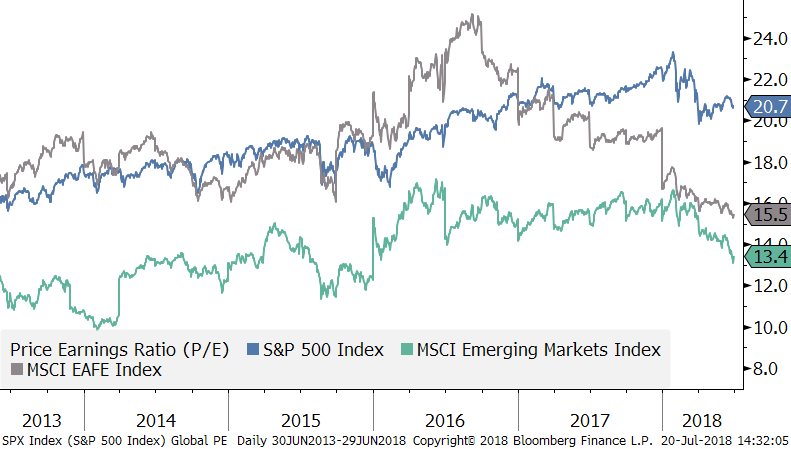

We mentioned the elevated valuation of equities, particularly U.S. stocks, in our last update. U.S. stocks remain relatively expensive versus both emerging market and international developed stocks, as the latter two regions have seen valuations decline this year.

Stock Market Price to Earnings Ratios

Source: Bloomberg

An important reason for falling stock valuations in Europe is Italy’s recent election, which exposed once again the stress within the European Monetary Union framework. Italy has struggled with low growth over the past twenty years, and its per capita income has declined. Public debt is large and the Italian economy is poorly positioned to endure another global recession. In March, Italy’s general election led to a hung parliament, as no political group won an outright majority. Eventually, a coalition government was formed between two “populist” parties, the Five Star Movement and the League of the North. These insurgent parties articulate two major complaints of the electorate: 1) declining living standards and 2) mass immigration sparked by the refugee crisis.

The Five Star Movement is more an expression of economic anxiety, while the League of the North reflects cultural anxiety. Key to investors’ concerns is that both of these parties are Euro skeptics. Though the two parties are not currently advocating an exit from the Eurozone, they may embrace such a radical step in a protracted economic downturn. The systemic influence of Italy on European financial markets is huge. For example, Italy’s public debt of 2.3 trillion Euro is 10 times Greece’s borrowings in 2007. Italy’s exit from the Euro remains a low probability event, but the risk is pro-cyclical in that it rises if economic conditions deteriorate.

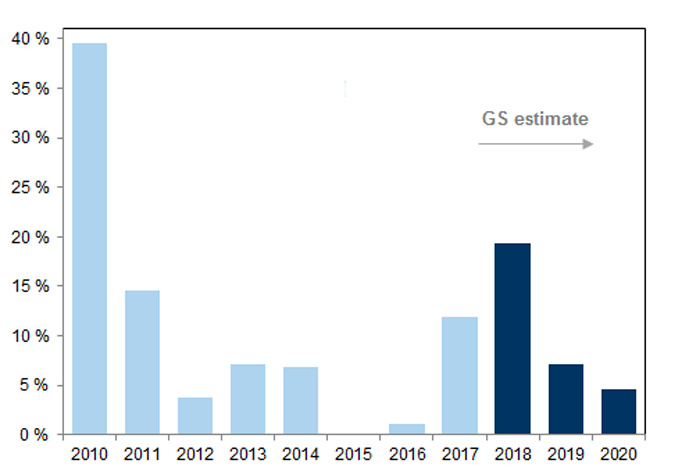

To monitor the risk of an impending recession and the chance of deteriorating economic conditions, one of the indicators we track is the shape of the yield curve. Historically, a negatively sloped yield curve (when long-term treasury bonds have a lower yield than short-term treasury bonds precedes) a recession in that it reflects low expectations of economic growth. Although the yield curve has not inverted, it has flattened rapidly this year.

The Yield Curve and Recessions

Source: Bloomberg

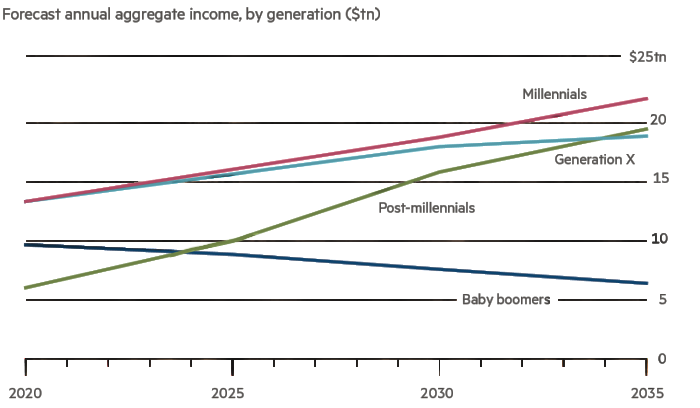

This will likely lead to sustained volatility in the market, so we believe it is important to continue to pursue compelling long-term opportunities. Identifying and investing in long term investment themes provides conviction to hold certain assets through the business cycle. China, and, to a lesser extent, India anchor a part of the world that we view as particularly compelling in the long term. As millennials start to drive global consumption, global economic activity will increasingly shift to countries in Asia.

Global Millennial Spending Power

Source: Financial Times, World Data Lab

Emerging and developing economies, largely in Asia, are home to 86% of all millennials. According to the World Bank, Chinese millennial income should overtake their peers in the U.S. by 2035. Surveys show that millennials in both the U.S. and China are skeptical of large global brands and favor local products. This creates opportunities for domestic players to disrupt global brands in economies such as China. Aided by the consumer distribution infrastructure that Alibaba provides, local companies are able to bypass the distribution network advantage that incumbent multinationals have developed. In consumer products, local firms are already gaining market share at the expense of global brands. For example, in India, the dominant toothpaste brand Colgate has lost share to Patanjali Ayurved, a consumer product developed by a leading yogi. Ayurved now has approximately 20% market share, growing rapidly from zero market share 10 years ago. Colgate’s share dropped by almost 4% in 2015 alone. Colgate has had to respond by developing new products and lowering prices, which impacts profitability. Investors can capitalize on these kinds of opportunities by owning shares in local emerging market companies.

China is now the world’s largest automobile market, accounting for the sale of close to 30 million vehicles in 2017. By comparison, U.S. vehicles sales were around 17 million in 2017. Driven by the need to combat urban pollution, China has set ambitious goals in electric vehicles. China is investing substantial resources into battery and vehicle development and is applying its clout as the world’s largest vehicle market to shape the industry. We expect Chinese firms to play a much bigger role in the global vehicle market in the future. China is also investing billions into a nascent biotech industry. It is the second largest pharmaceutical market in the world, and has just revamped its regulatory framework bringing it up to global standards. The new policies provide major incentive for innovation and drug development. We expect Chinese firms to develop into global leaders over the next few decades. In technology, Chinese firms such as Baidu, Tencent and Alibaba are pouring billions of dollars into research on artificial intelligence and big data. In mobile payment, transactions have reached $15.4 trillion in 2017 according to iResearch, far surpassing the estimated $100 billion in transactions in the U.S.

Two decades ago, investors had few options to invest in China. As we highlighted in our fourth quarter 2017 newsletter, the share of state owned enterprises of the MSCI China index has declined from 90% in 2005 to 40% in 2017. Markets are increasingly dominated by private firms that are capitalizing on the transition from an export-oriented, manufacturing economy to one geared to domestic consumption. Some of these firms provide compelling investment opportunities. On a smaller scale, we see similar development in other Asian countries. In India for example, privately held banks are gaining share at the expense of state owned financial institutions saddled with bad loans. Though corporate governance remains a risk when investing in these developing capital markets, the trend is in the right direction. As domestic pools of capital grow, regulators are facing more pressure to protect domestic investors and foreign investors will stand to benefit.

To grow a portfolio or even to maintain purchasing power, investors must accept risk. However, in challenging markets, investors are best served by ensuring that they are taking the proper level of risk. Too little risk, and long term goals may not be achieved. Too much risk and a short term market decline could damage long term plans. Though we continue to expect volatility to rise going forward, taking targeted risks is still necessary to achieve adequate returns over time.

Printable version.

Disclosures:

This presentation is for informational purposes and does not constitute investment advice, nor should it be considered a recommendation to purchase or sell any particular security. The opinions expressed are those of the Choate Investment Advisers (“ChoateIA”). Firm holdings for the last 12 months are available upon request. Investing involves the risk of loss of principal. Additional information about the risks can be found in Form ADV Part 2, which is available upon request.

ChoateIA is a registered investment adviser. Registration does not imply a certain level of skill or training. More information about the firm can be found in its Form ADV Part 2, which is available upon request by emailing info@choateinvestmentadvisors.com.