Insights

2019 Fourth Quarter Review

Both the equity and bond markets were strong in 2019. Global stocks gained 26.6% and the Barclays Aggregate Bond index was up 8.7% due to declining interest rates.

Much of the 2019 market surge was an unwinding of late 2018’s steep declines. The global stock market index is up just 10% from the prior market peak in September 2018. In late 2018, investors grew concerned that the Federal Reserve’s rate hike policy, coupled with growing trade conflict, would push the global economy into recession. The Federal Reserve changed course in early 2019, and forecasts of three rate hikes in 2019 shifted to the reality of three rate cuts. This about-face sparked a stock market surge during the first three months of 2019, making up some of the prior quarter’s decline. The change in U.S. monetary policy had a significant impact beyond the stock market. Lower rates revitalized a housing market that was under pressure in 2018. The labor market continued to be strong and investors chose to ignore clear signs of an industrial slowdown and an inverted yield curve. Markets treaded water through the middle of the year, as investors continued to grapple with the ramifications of the U.S.-China trade conflict, and then resumed their climb in the back half of the year thanks to increasing signs of a trade “truce.”

Though investor expectations improved, corporate earnings did not. U.S. corporate earnings in 2019 were barely more than 1% higher than they were in 2018. As investors became more confident, they became willing to pay for more for a current dollar of earnings. Essentially all of the stock market appreciation in 2019 stems from an increase in valuation. Valuation measures are now stretched, with the S&P 500 significantly above long-term averages.

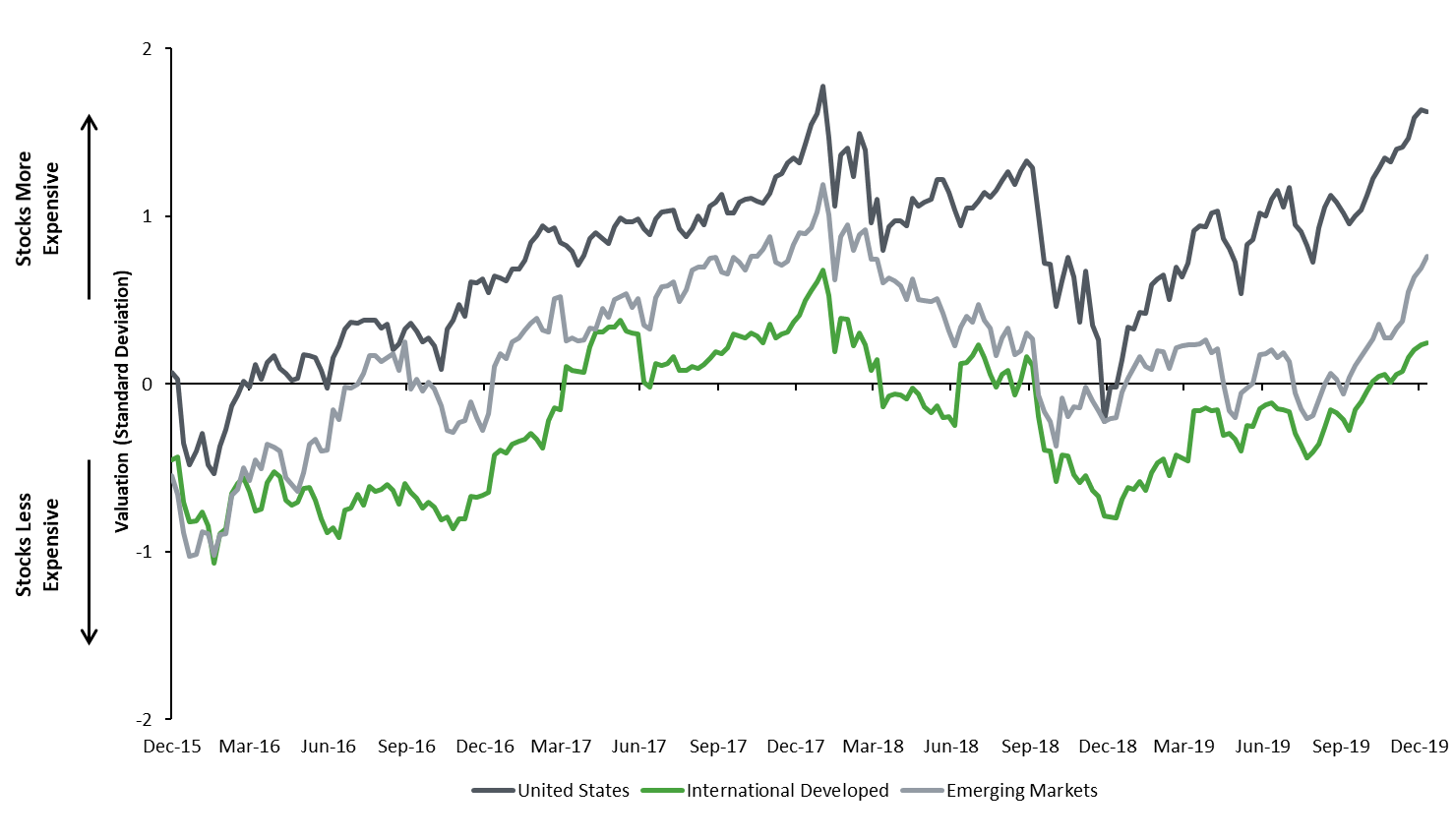

1 - Valuation Composite for Regional Indices

Source: ChoateIA, Bloomberg.

We estimate that company valuations in the U.S. are approaching 1.7 standard deviations over long-term averages. This means that since 1996, stock markets have been more expensive than they are right now less than 5% of the time. Expensive valuations by themselves will not cause markets to falter next year, but these stretched valuations demonstrate the high level of optimism that stock market investors have going into 2020. We think current market consensus reflects several “feel good” conclusions:

- The trade war between the U.S. and China will stay on hold.

- There will be no recession in 2020 and growth will instead pick up.

- Corporate earnings growth will accelerate.

- Inflation will remain subdued and central banks will remain supportive of risk assets.

We think that these assumptions could be challenged in 2020.

- 1. The “truce” in the trade war between China and the U.S. is unlikely to persist beyond the election regardless of the outcome. It is increasingly clear that none of the real long term issues around technology and intellectual property are likely to be resolved. We believe investors will start to factor in downside risks from trade once again in 2020.

- Many economic forecasters are predicting that global growth will accelerate. But both the U.S. and China are expected to have slower growth in 2020 than they did in 2019. Therefore global growth will need other economies such as India, Brazil and Russia to pick up the slack. In our view, there is greater downside risk to growth estimates than upside.

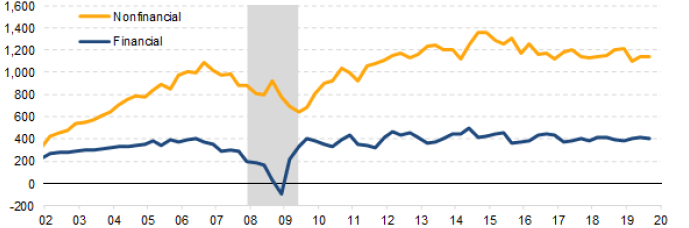

- With commodity prices and wages continuing to trend higher, it is not evident that companies will be able to achieve the 9% growth that Wall Street analysts are forecasting for the S&P in 2020. In fact, pre-tax earnings growth for companies has been mediocre for quite some time. S&P 500 companies benefited from the 2018 tax cut, share buybacks, and multiple expansion in recent years, which supported strong market returns. Only share buybacks can be counted on for 2020.

2 - Pretax Corporate Profits

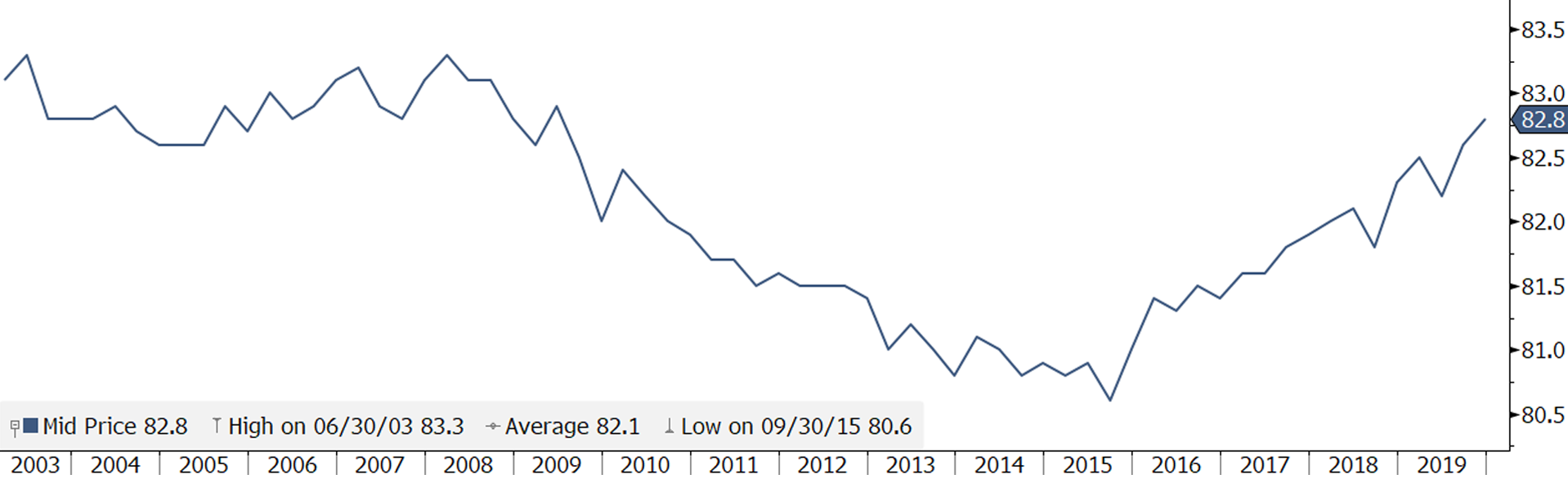

Source: BEA, CreditSights. - Low inflation has enabled the Federal Reserve to use rate cuts to maintain momentum in the economy. An inflation surprise would curtail the Federal Reserve’s room to maneuver and could lead to a rise in rates. While still low, inflation expectations have been trending upwards.

3 - Implied Inflation Expectations

Source: Bloomberg.

Labor force participation for the key 25-54 segment of the workforce is back to pre-recession levels and a tight labor market could lead to unexpected rise in inflation. This could force the Federal Reserve off the sideline. We think an interest rate hike would be completely unexpected and would likely lead to stock price declines.

4 - Labor Market Participation Ages 25-54

Source: Bloomberg.

In summary, 2019 was a great year for investors as both stocks and bonds did exceptionally well. Though we are not forecasting a recession in 2020, we do not expect returns in 2020 to be as strong as they were in 2019. With valuations significantly higher than a year ago, we would characterize 2020 as a “show me” year. The dramatic shift in Federal Reserve policy and the temporary truce in the trade war are already factored in to asset prices. This year requires fundamentals, such as strong earnings growth, to validate investor optimism. With U.S. presidential elections looming, and geopolitical tensions on the rise, we think further multiple expansion is unlikely. Many risks skew to the downside.

With a strong year in the rearview mirror, now is a good time to review your portfolio and consider whether your current portfolio strategy remains appropriate for your long-term goals.

Printable version.

Disclosures:

This report is prepared by Choate Investment Advisors LLC (“ChoateIA”), a subsidiary of Choate, Hall & Stewart LLP. ChoateIA is registered as an investment advisor with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the firm can be found in its Form ADV Part 2, which is available upon request by emailing info@choateia.com.

This presentation is for informational purposes and does not constitute investment advice. None of the information contained in this report constitutes, or is intended to constitute, a recommendation of any particular security, trading strategy or determination by ChoateIA that any security or trading strategy is suitable for any specific person. Investing involves the risk of loss of principal. To the extent any of the information contained herein may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

The opinions expressed are solely those of ChoateIA. The information contained in this report has been obtained and derived from publicly available sources believed to be reliable, but ChoateIA cannot guarantee the accuracy or completeness of the information. Past performance is no guarantee of future results.