Insights

2019 Second Quarter Review

The first half of 2019 brought the unusual combination of strong equity markets coupled with declining bond yields. Year to date, the global stock markets are up 16.2%, with the S&P up 18.5%. At the same time, 10-year U.S. Treasury bond yields have declined from 2.7% on January 1st to 2.0%. This dichotomy of falling bond yields and rising stock markets is a paradox we discussed in our Q1 2019 newsletter.

Marking an investment period from the start of the calendar year is simply convention, and is only relevant to investors who put cash to work on January 1st. If we consider other periods such as the past nine months, global markets are up only 1.4% and the S&P is up 2.5%. In fact, since January 2018, the global stock market is down -1.9% and the S&P is up just over 5.4%, while the Barclays Aggregate Bond Index outperformed equities and returned 7.1%. Risk taking was not rewarded over the past 18 months, as safe bonds have earned more than stocks.

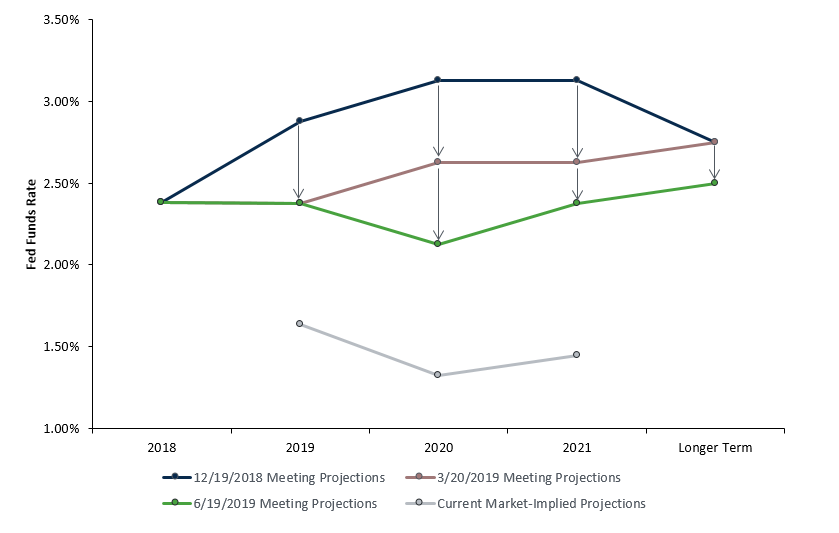

Recently, equity markets have been bolstered by the noticeable shift in Federal Reserve policy which began last year. The Federal Reserve is currently signaling that a rate cut is imminent, and investors have moved even more aggressively from expecting three rate hikes in 2019 in as of a year ago to now expecting three rate cuts.

As shown in chart 1, the Federal Reserve has materially lowered its interest rate projections.

1 - Federal Open Market Committee Target Interest Rates versus Current Market Projections

Source: Bloomberg. Current Market-Implied Projections are based on Fed Funds futures contracts as of 06/19/2019.

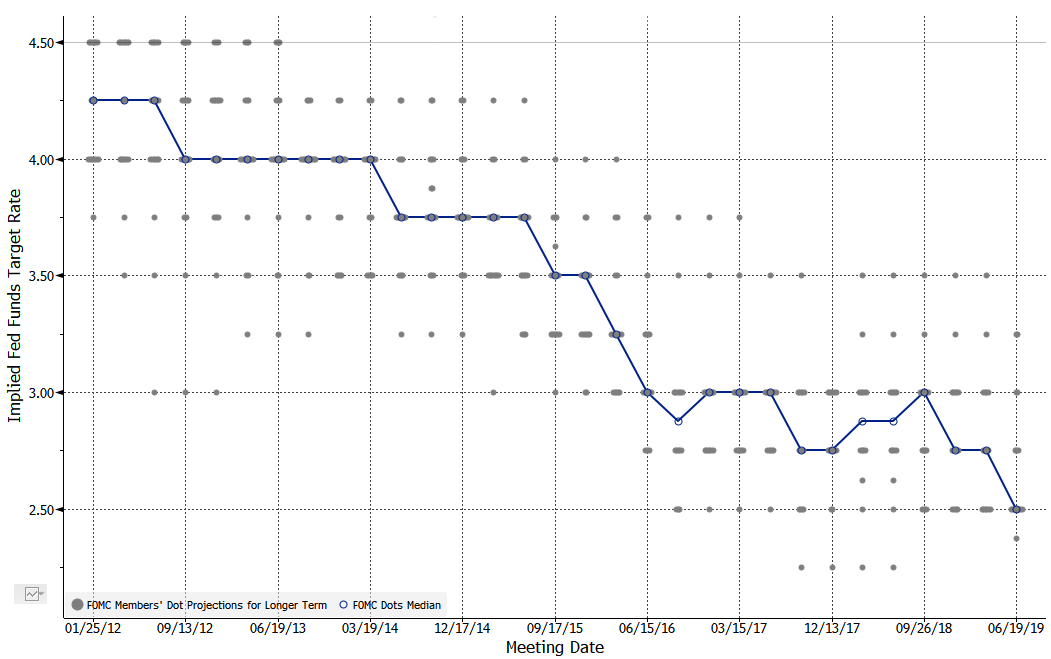

As shown in chart 2, the Federal Reserve has also lowered its long-term projected neutral rate for interest rates.

2 - Implied Fed Funds Target Interest Rate

Source: Bloomberg as of 06/19/2019.

The fact that the Federal Reserve has materially lowered its projections is a dovish signal for market participants. However, it is also an acknowledgement that the U.S. economy cannot support interest rates anywhere close to the pre-financial crisis norm. The decline in the 10-year Treasury yield is also a signal that Federal Reserve policy will be easing and economic growth has slowed. Assuming the Federal Reserve follows through and reduces interest rates, historically the first rate cut does not signal a market trough, as typically the central bank is behind the curve and economic conditions continue to deteriorate. Earnings disappointment and subsequent market declines can happen even with the Federal Reserve cutting rates.

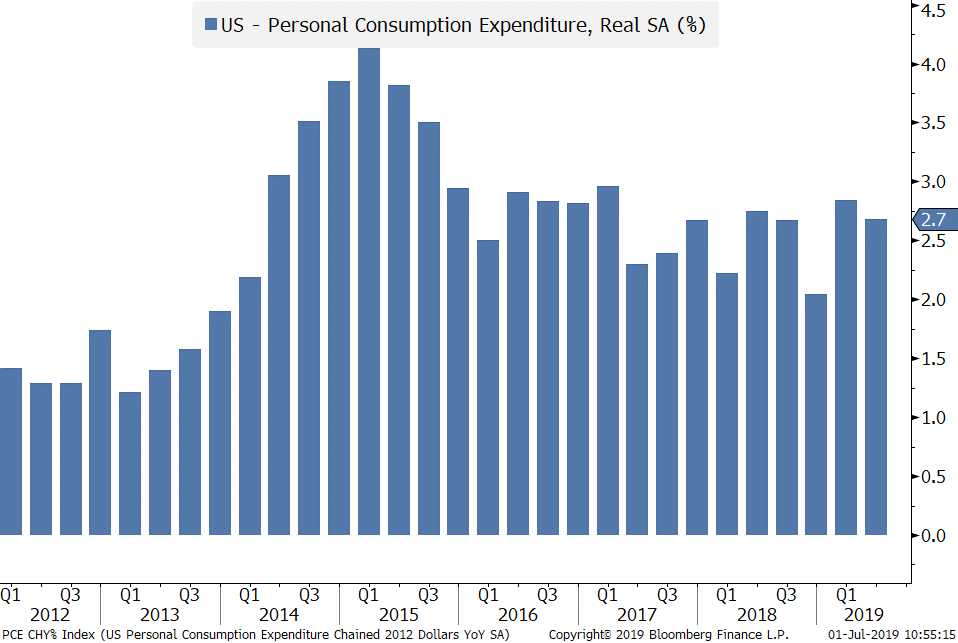

With valuations back to elevated levels, economic fundamentals need to improve both in the U.S. and abroad for a sustained market rally. We currently view the U.S. economic picture as mixed. On the positive side, the consumer sector is strong, as unemployment is low and consumer leverage is low by historical standards. The current savings rate of 6.7% is in line with the post-crisis norm and still well above the 2.5% low of 2005, confirming that the consumer is not extended.

As shown in chart 3, real consumer spending shows no sign of slowing.

3 - U.S. Consumer Spending

Source: Bloomberg as of 05/31/19.

Additionally, corporate profitability remains high, and there are signs that China’s economy may be bottoming and poised to pick up as the positive impact from government measures takes effect. Overall, we believe looser U.S. monetary policy coupled with China’s stimulus may be enough to revive the global economy.

On the negative side, the industrial sector is struggling and trade uncertainties have curtailed capital investment plans. Current global growth is low. Unfortunately, the U.S. tax cuts did not spur a virtuous cycle of capital investment because firms opted to accelerate share repurchases instead. This weak global growth is also leading to negative bond yields for many countries in Europe as well as Japan.

In our Q1 2018 newsletter, we highlighted our primary concern that still pertains to our positioning today:

Even if the next recession is relatively mild, it could trigger an outsized decline in market values for investors. As such, we have begun to gradually reduce risk across our portfolios. In this environment it is particularly important for investors to understand and be comfortable with the level of risk exposure in their portfolios.

As stated last year, we began to reduce risk across client portfolios, and we still remain conservatively positioned today for two important reasons.

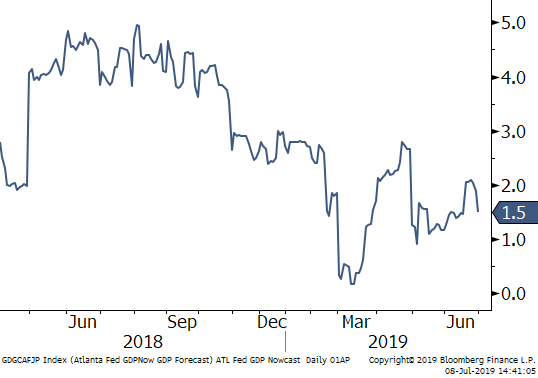

First, uncertainty remains high in the current market environment. For example, trade conflict impacts global multinational corporations to a much greater extent than the entire overall economy. China is a large and growing market for many firms and a key link in the global supply chain. Adapting to a new trade dynamic will be costly for companies, and there is still a lot of uncertainty about what changes will be necessary. Investors benefited from globalization, but now signs of de-globalization are evident beyond trade. For example, Brexit is still unresolved. Growth in the U.S. as captured by the Atlanta Fed GDP forecast has clearly slowed from this time last year, with Q2 2019 expectations of 1.5% year on year growth.

4 - Atlanta Fed GDPNow Forecast

Source: Bloomberg as of 06/30/2019.

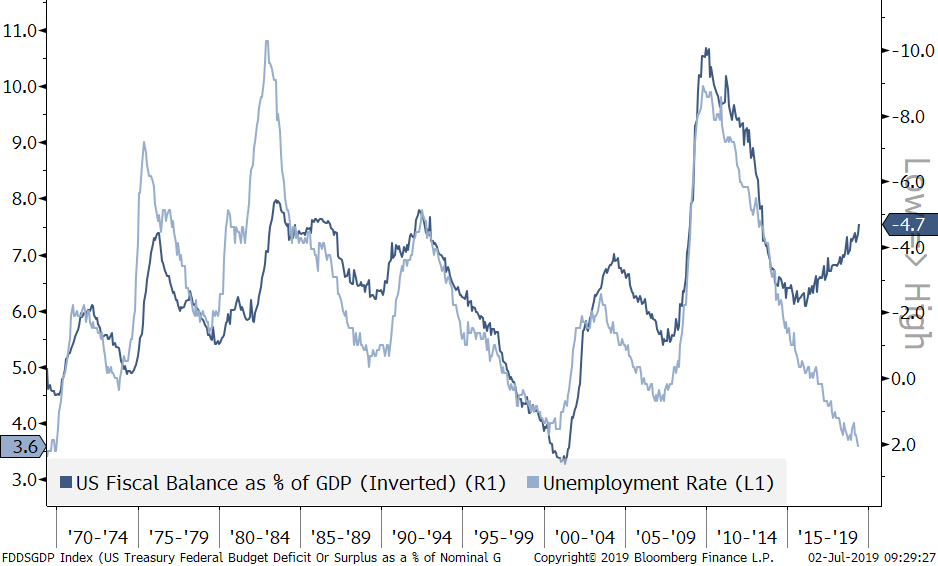

Second, the global economy is fragile and even a shallow recession would likely be painful for investors. Elevated market multiples and extended corporate margins leave investors vulnerable. Most importantly, there is limited room for policy action given where global interest rates are today globally. Conventional monetary policy is largely ineffective in Europe and Japan. In the U.S., the Federal Reserve is moving toward cutting rates with unemployment at 3.6% in an effort to raise inflation expectations. This leaves little room for conventional monetary policy during an actual recession. We expect that even a mild recession will bring long-term interest rates close to zero, and significantly raise deflationary fears. Fiscal policy is also constrained in the U.S. as the recent tax cut has led to rising deficits despite low unemployment.

5 - U.S. Fiscal Spending versus Unemployment

Source: Bloomberg as of 05/31/2019.

China is also unwilling to embark on a significant stimulus as it did in 2008. Absent an effective policy response, even a mild recession can lead to protracted period of anemic growth, disappointing earnings, and significant market declines.

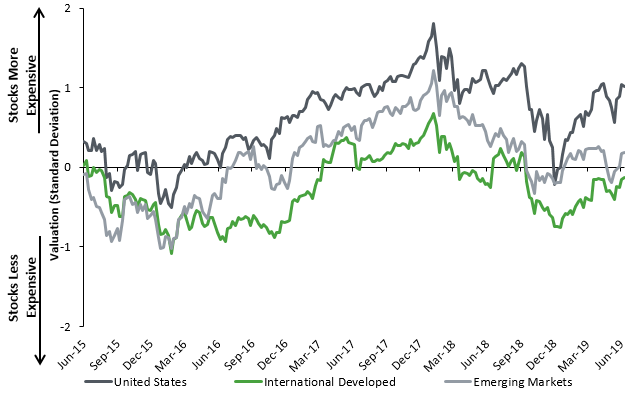

Despite these two concerns, the employment picture remains robust in the U.S. and there are no clear “bubbles” in the global economy. Could this be another “growth scare” similar to late 2015? Possibly, but market valuations are significantly higher than in 2015-2016 and there is no impending tax cut to spur corporate earnings. In February 2016, valuations were below average for all major regional stock markets. Presently, no market is at bargain prices and the U.S. stock market is somewhat expensive, leaving less room for error.

6 - Composite Valuation Measures by Market

Source: Bloomberg, Choate Investment Advisors. Each composite is based on P/E, P/B, P/S, Price-to-Cash Flow, and Dividend Yield figures for the given market. Data as of 06/30/2019.

The past nine months have been highly volatile, and it is important to remember that markets are back to where they were last September. We also continue to reiterate our recommendation from our Q3 2018 newsletter:

We also advise investors to reflect upon their current situation and long-term goals. We believe the most certain way of limiting downside risk is to be appropriately conservative, recognizing that dramatic attempts to time the market usually leave one worse off.

Ensuring that your portfolio strategy remains appropriate for your long-term goals is fundamental to navigating market drawdowns. Stemming the impact of a large decline is the key to compounding wealth over time.

Printable version.

Disclosures:

This report is prepared by Choate Investment Advisors LLC (“ChoateIA”), a subsidiary of Choate, Hall & Stewart LLP. ChoateIA is registered as an investment advisor with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the firm can be found in its Form ADV Part 2, which is available upon request by emailing info@choateia.com.

This presentation is for informational purposes and does not constitute investment advice. None of the information contained in this report constitutes, or is intended to constitute, a recommendation of any particular security, trading strategy or determination by ChoateIA that any security or trading strategy is suitable for any specific person. Investing involves the risk of loss of principal. To the extent any of the information contained herein may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

The opinions expressed are solely those of ChoateIA. The information contained in this report has been obtained and derived from publicly available sources believed to be reliable, but ChoateIA cannot guarantee the accuracy or completeness of the information. Past performance is no guarantee of future results.