Insights

2019 Third Quarter Review

Markets remained volatile in the third quarter. After sharp losses in early August tied to ongoing trade concerns, global markets recovered in September and ended the quarter with the MSCI All Country World Index almost unchanged since June 30th. At the same time, the S&P 500 rose just over 1.5% and the Barclays Aggregate Bond Index outperformed stocks, rising more than 2%. Over the past 12 months, the Aggregate Bond Index is up more than 10%, handily outperforming both the S&P 500 and the MSCI All Country World stock indices. The strong returns in the bond market stem largely from price appreciation due to falling interest rates, which will reverse if yields move higher. Looking back even further, the global stock market has been going sideways for some time. Global equity markets are down just under 2% since the highs of January 2018, and the broad bond index has outperformed all stock markets, including the S&P 500, over the past 18 months. Although U.S. stocks have appreciated in 2019, this year’s rally is retracing the decline of late 2018.

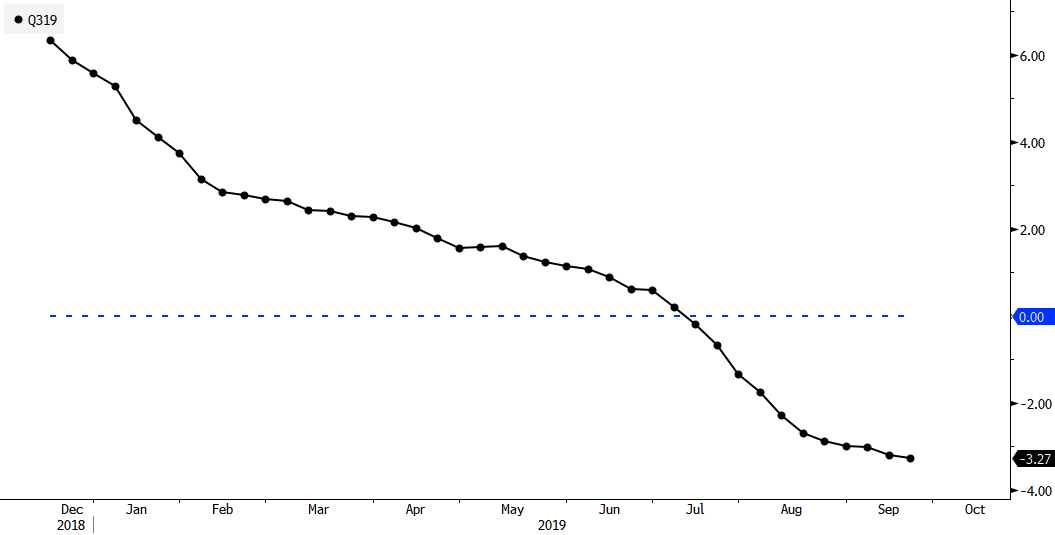

A key challenge facing investors continues to be the dichotomy between declining bond yields and buoyant stock prices. The stock and bond markets are telling different stories about the health of the economy.

1 - U.S. 10-year Treasury Yield and S&P 500 since October 2018

Source: Bloomberg.

As we noted in our Q1 2019 newsletter:

Typically long-term yields rise when investors’ growth expectations and/or inflation expectations rise and fall when investors become more cautious and/or inflation figures decline. At quarter end, the yield curve inverted, meaning that the yield on 10-year Treasuries was lower than the yield on 2-year Treasuries. An inverted yield curve has historically been an important signal of future economic difficulties.

Given that lower long-term bond yields generally indicate economic pessimism, stocks typically fall when long-term yields decline. This was the case late last year. However, once the Federal Reserve reversed course on monetary tightening in early 2019, stocks rallied. We think that the warning from the bond market is more likely to be correct, for three reasons:

1. Stock market fundamentals

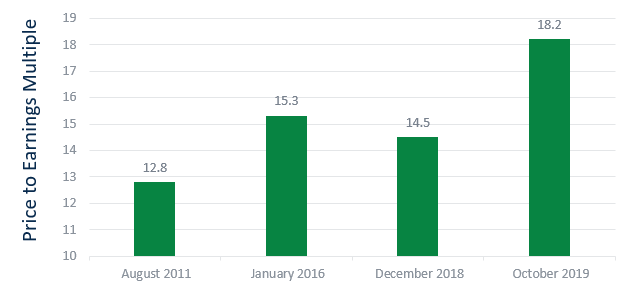

The forecast for Q3 2019 corporate earnings declined throughout the course of 2019 and is expected to be negative year-over-year. Additional stock market appreciation will require a 2020 earnings upswing.

2 - Consensus Earnings Expectations for Q3 2019

Source: Bloomberg.

The lack of earnings growth this year means that market returns have come exclusively from multiple expansion as the market continues to price in an economic re-acceleration. Stock valuations are now well above levels seen during other recent economic slowdowns.

3 - Price to Earnings Ratio During Recent Economic Slowdowns

Source: Bloomberg.

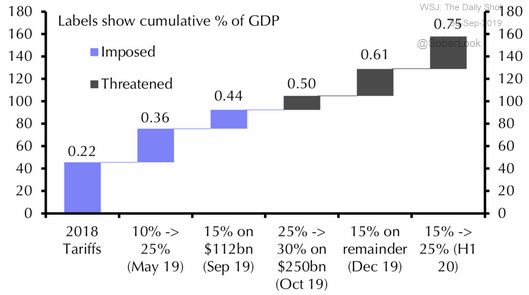

2. Trade uncertainties

The global consensus on free trade seems to be unraveling, particularly with regard to trade relations between the U.S. and China. Escalating trade restrictions remain a key risk for stocks. As we noted in our Q4 2018 newsletter:

A protracted trade conflict with China may force many U.S. companies to revamp and relocate their global supply chains. In effect, companies would have to close plants in China and build new plants somewhere else. During this transition period, the supply of some key inputs may be disrupted causing problems well out of proportion to their value. This would impact return on invested capital and hurt both earnings and valuation multiples, and therefore stock market returns.

After an eight month pause, tariffs are once again on the rise, causing additional disruption to supply chains and margins. Newly imposed tariffs in 2019 have already doubled the impact of the 2018 tariffs to over $80 billion a year. Additional threatened tariffs would double the impact again to $160 billion a year.

4 - Value of Tariffs in Place ($bn)

Source: Capital Economics.

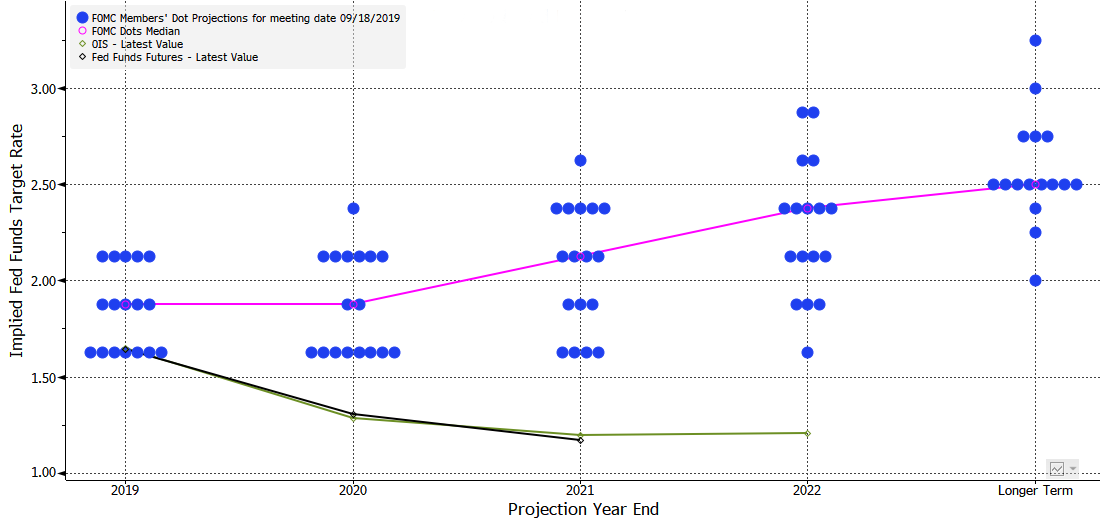

3. Future central bank policy

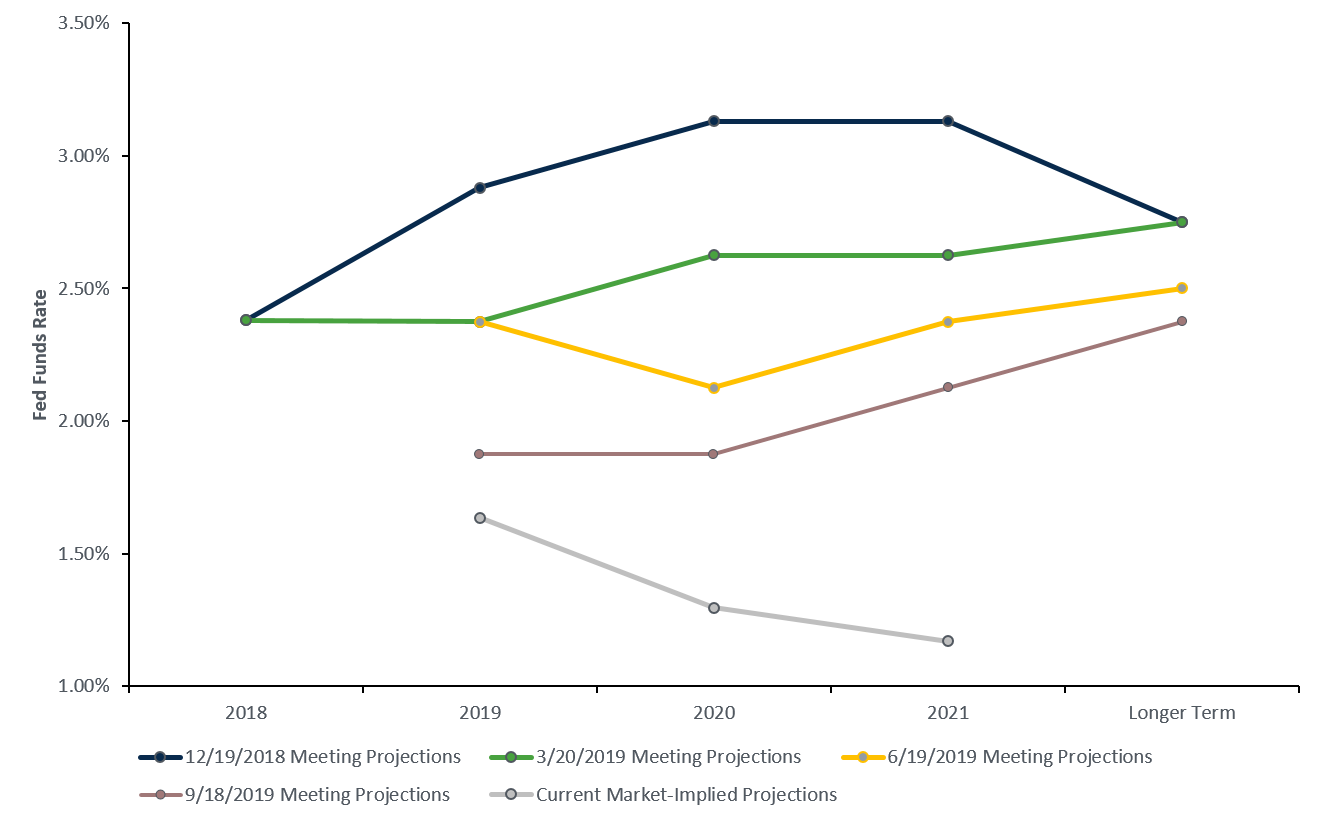

The ambiguity of the current economic data is mirrored by a split in forecasts by members of the Federal Reserve. The release of the latest Federal Open Market Committee (“FOMC”) dot chart, where each dot represents a member’s forecast of future interest rates, points to the division of FOMC members into two distinct and almost equal camps. The “bearish camp” believes that more interest rate cuts will be needed in the near future while the “bullish camp” believes that the FOMC should be raising interest rates to prevent inflation.

5 - Implied Fed Funds Target Rate

Source: Bloomberg.

Equity markets seem to be hoping for the best of both worlds: the upbeat economic forecasts of the bullish camp together with the dovish interest rate policy of the bearish camp. We think the stock market will be disappointed with either the direction of interest rates or the strength of the economy. A stronger economy would bring the prospect of higher inflation and would likely prompt the Federal Reserve to begin raising rates anew. This dynamic would be the inverse of this year’s environment, where fears of a slowing economy led to interest rate cuts. Chart 6 illustrates how significantly forecasts of Federal Reserve governors have shifted since December of last year. At the same time, market expectations (in grey) continue to point to even more aggressive interest rate cuts.

6 - Federal Reserve Interest Rate Projections

Source: Bloomberg.

In this uncertain environment, we seek to insulate client portfolios from steep losses in either a bull or bear economic outcome. Our equity positioning remains consistent with what we described in our Q1 2019 newsletter:

…we remain conservatively positioned. We remain invested in our high conviction ideas and plan to await a future opportunity to deploy capital back into equities.

This underweight equity position reduces exposure to a stock market decline and provides our clients with “dry powder” to reinvest in stocks at lower prices. On the bond side, we continue to take less interest rate risk because we invest in bonds for safety and regular coupon payments, and not to wager on the effect interest rates have on bond prices. We therefore favor shorter maturity bonds which would be less impacted by rising interest rates should the economy recover.

Markets are largely unchanged from the prior quarter, and geopolitical uncertainties remain significant. We think it is appropriate to reiterate our advice from last quarter:

Ensuring that your portfolio strategy remains appropriate for your long-term goals is fundamental to navigating market drawdowns. Stemming the impact of a large decline is the key to compounding wealth over time.

Printable version.

Disclosures:

This report is prepared by Choate Investment Advisors LLC (“ChoateIA”), a subsidiary of Choate, Hall & Stewart LLP. ChoateIA is registered as an investment advisor with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the firm can be found in its Form ADV Part 2, which is available upon request by emailing info@choateia.com.

This presentation is for informational purposes and does not constitute investment advice. None of the information contained in this report constitutes, or is intended to constitute, a recommendation of any particular security, trading strategy or determination by ChoateIA that any security or trading strategy is suitable for any specific person. Investing involves the risk of loss of principal. To the extent any of the information contained herein may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

The opinions expressed are solely those of ChoateIA. The information contained in this report has been obtained and derived from publicly available sources believed to be reliable, but ChoateIA cannot guarantee the accuracy or completeness of the information. Past performance is no guarantee of future results.