Insights

2021 Fourth Quarter Review

2021 was another strong year for equity markets. The global stock market returned +18.5%. By contrast, bonds struggled with low coupon rates as well as rising yields, and the Barclays Aggregate bond market index was down -1.5% in 2021. However, January 2022 is off to a turbulent start, with many equity indices declining over 10% since their highs in November. This represents the first market ‘correction’ since the March 2020 Covid crisis, and it is very unusual to have almost two years without a significant pullback in the stock markets.

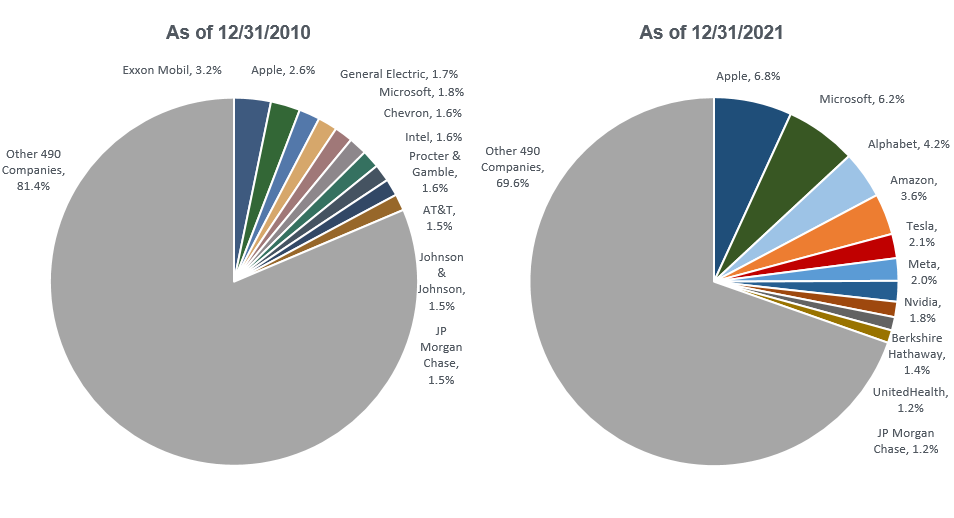

Reviewing 2021, our decision to overweight equities in all our strategies helped portfolio performance. For safe assets, we seek bonds that are less sensitive to the rise in interest rates. Unlike in 2020, our active managers did not enhance performance last year. Our US large cap managers posted strong growth relative to their peer group, but were unable to keep up with the S&P 500 Index, which was dominated by mega cap stalwarts such as Apple, Microsoft, and Google, as well as more speculative stocks such as Tesla and Nvidia.

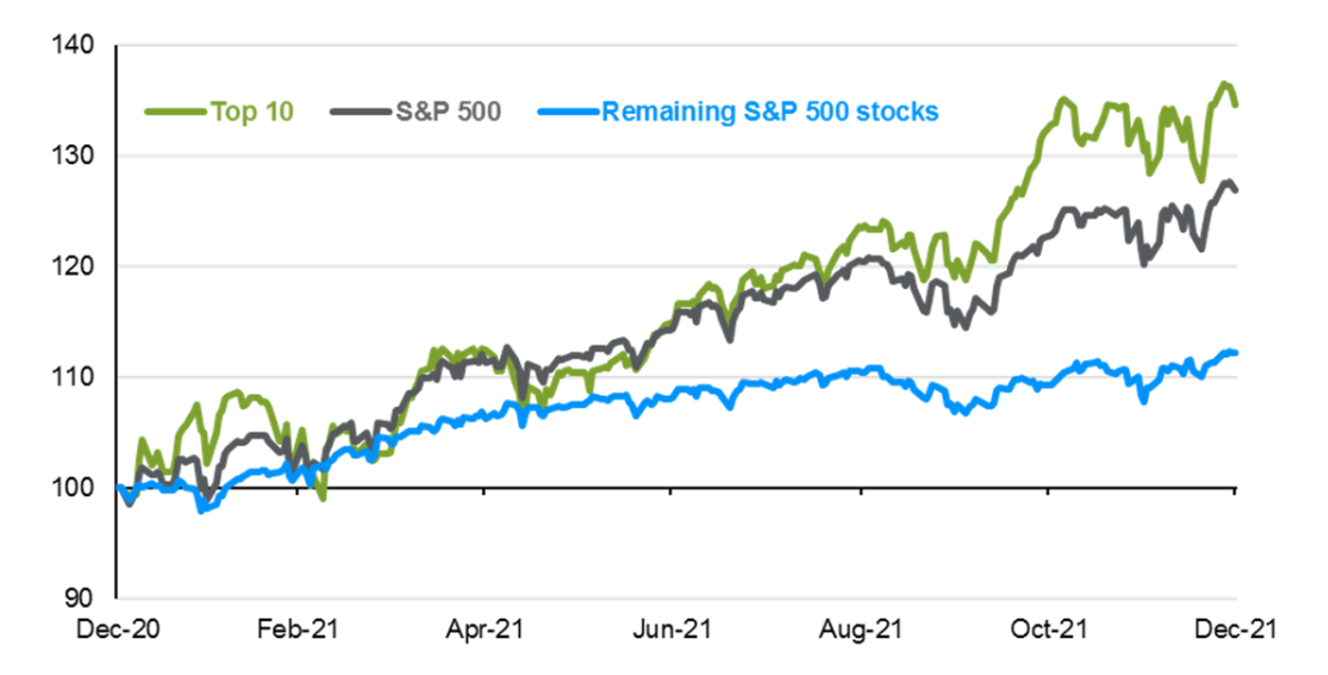

The top 10 S&P 500 names drove 2021 market performance

Source: Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Top 10 stocks include: AAPL, MSFT, AMZN, FB, GOOGL, GOOG, TSLA, BRK.B, JPM, JNJ, and V. Data as of 12/31/2021.

As 2022 begins, Apple and Microsoft each represent over 6% positions in the S&P 500, and the top five companies account for more than 20% of the total capitalization of the index. In essence, the S&P 500 has morphed into a quasi-concentrated fund, rather than a well-diversified pool of 500 stocks. When these mega caps do well, it is hard for active managers to keep pace. As we look at the longer term, all three of our US large cap managers have outperformed the S&P 500 over the prior three years, and we remain confident in our research process.

Top 10 holdings in S&P 500 now account for 30% of index weight, up from 18% in 2010

Source: Bloomberg. Data as of 12/31/2021.

Stocks from US small cap and China (big drivers of 2020 performance) were additional sources of underperformance in 2021. US small cap stocks significantly lagged US large cap stocks, and our US small cap manager’s 2020 winners disappointed in late 2021. We conducted extensive due diligence with the portfolio manager and opted to trim the position accordingly.

Currently we are underweight emerging markets with a narrow focus on China. Our China managers outperformed their benchmarks, but Chinese securities have struggled due to a slowing economy and significant regulatory pressure on major technology firms. We still think that China’s large market and innovative companies are likely to outgrow most other international markets, but we expect volatility to continue.

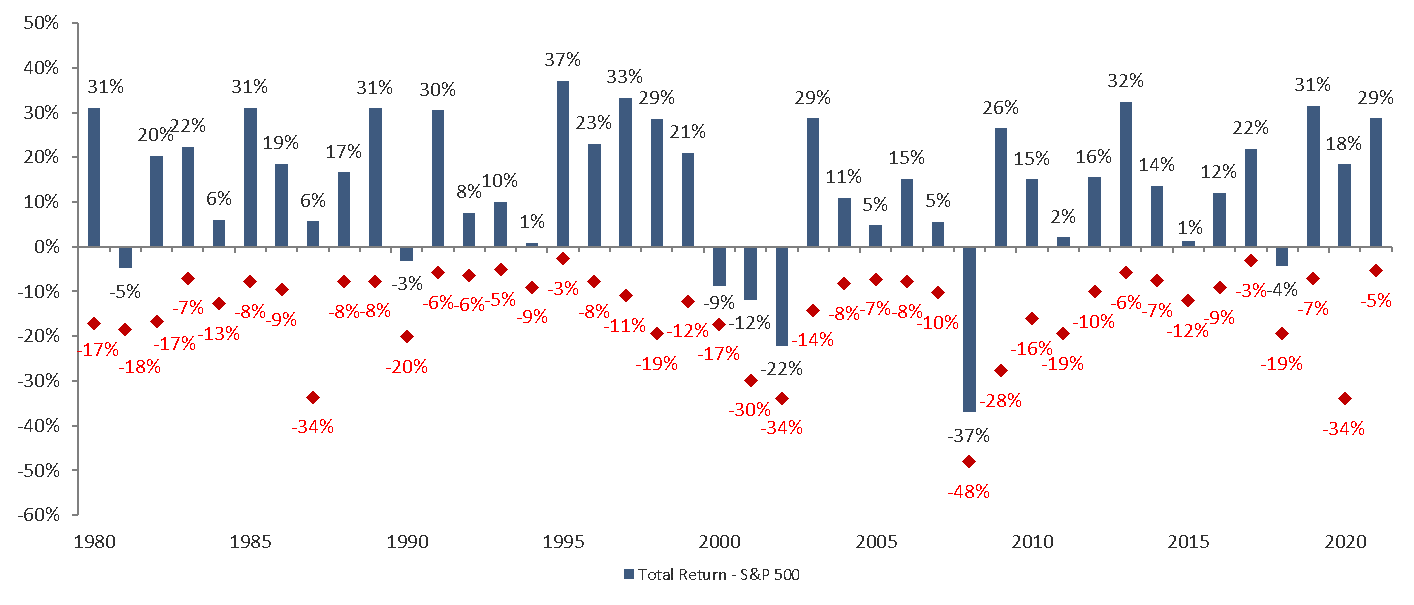

Despite January’s rocky start, we are cautiously optimistic as we look to 2022 and the likely increase in interest rates in coming months. Market corrections happen most years and this latest decline is in line with historical norms and is not an indicator of eventual 2022 returns.

S&P 500 Max Drawdown versus Calendar Year Total Returns

![]()

Source: CIA analysis, Bloomberg. Data as of 12/31/2021. Returns are based on total return net of dividends. Max drawdown refers to the largest market drop from a peak to a trough during the calendar year.

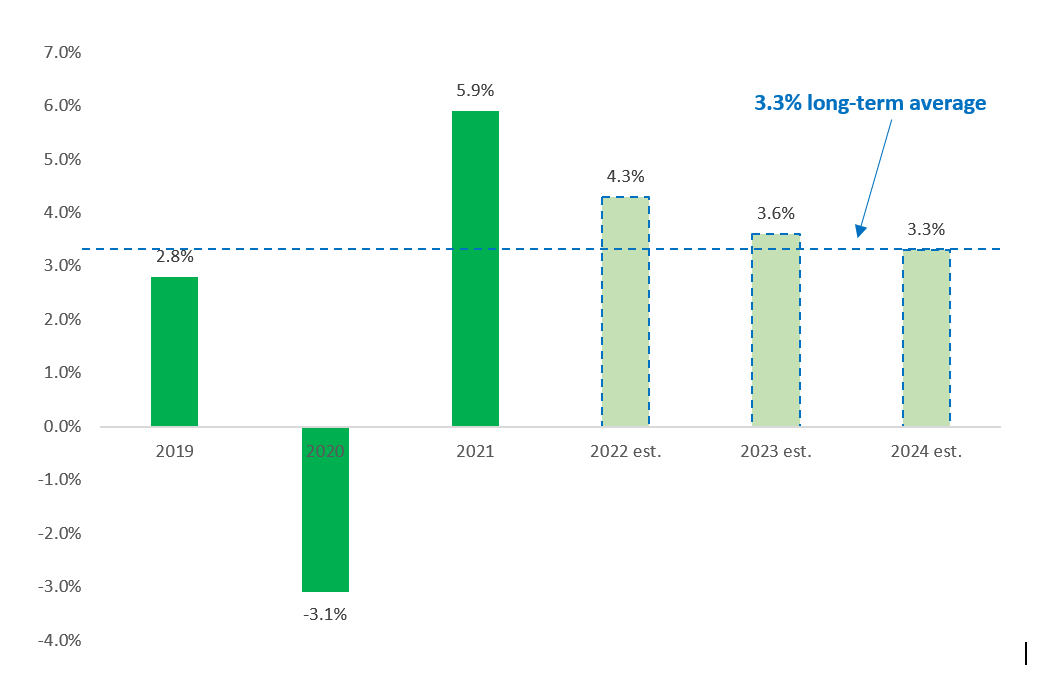

We expect a continued rise in corporate earnings, but the nation’s overall strong economic growth will likely decelerate. We note several cautionary flags for stocks, including rising inflation, stretched valuations, and possible peak profit margins. Therefore, we think it seems reasonable to project mid-single digit equity returns, although investor sentiment and valuation multiples remain a concern. We expect bond returns will struggle in light of rising interest rates. We therefore remain slightly overweight equities as we begin 2022.

Positive (above zero) US composite leading economic indicators point to continued economic strength

Source: Bloomberg. As of 12/31/2021.

Global real GDP growth (% change, YoY) forecast to be above long term trends

Source: Goldman Sachs Research, Bloomberg. Data as of 1/13/2021. Global real GDP long-term average from 1961-2021.

We pay attention to the overall stock market’s valuation, but we also look closely at key individual stocks. Most companies that we categorize as having resilient and attractive business fundamentals are trading at more than one standard deviation (+17%) above their historical average valuation. Thus, we think the market’s price/earnings valuations are more likely to see some multiple compression than expansion, although investor sentiment can be fickle and hard to predict.

S&P 500 12-month forward price to earnings ratio beginning to normalize

Source: Bloomberg. Data as of 1/20/2021.

Inflation is an emerging concern for investors. Central banks around the world appear vigilant and will respond by increasing interest rates. Monetary policy tightening works by slowing economic activity. Rising yields hurt bond investors by reducing bond prices, and this action affects stock investors through two broad channels:

- Raising the discount rate on future company earnings, thus lowering their value today.

- Raising the cost of borrowing money and slowing economic activity.

Inflation can also be a concern for specific companies that may see their profit margins squeezed and unable to pass higher costs through to customers. With company margins at cyclical and secular highs, margins could decline as labor pressures and other costs rise.

Moreover, the ongoing Covid pandemic is clouding the inflation picture:

1. Consumers are changing their purchasing habits by buying more goods versus services. This increased demand for products is adding pressure to supply chains already disrupted from other pandemic aftershocks as well as endemic staffing shortages.

2. Certain key economic sectors, such as automobiles, are experiencing significant supply disruptions. This has increased the price of new and used vehicles. However, many of these supply constraints are beginning to ease.

3. Labor force participation is still low and affected by the pandemic. It is not clear how these workers will return to the workforce, and what impact this shift may have on wages and pricing.

Thus, there are certainly signs pointing to some inflation drivers cresting and moderating. However, we still foresee continuing increases in housing prices and wage growth pressure.

As further economic improvement fuels employment growth, we remain cautiously optimistic for 2022, despite Covid’s lingering grip and the recent market volatility. At the same time, however, the government’s fiscal support is waning before the mid-term elections, and central banks are pivoting to address inflation. This makes 2022 a potentially more volatile year for investors, and we will seek to adapt as market conditions shift. Though we continue to expect that continued economic growth and corporate earnings create a favorable environment for patient investors, it is also important to have the right mix between safe assets such as bonds and more volatile growth-oriented assets such as equities.

Thank you for your continued confidence, and please reach out with any questions or comments.