Insights

2021 Second Quarter Review

Investors were rewarded in the second quarter of 2021 as company earnings beat expectations and stock markets continued rising with further optimism in the recovery. During the quarter, the MSCI All Country World Index returned 7.4%, and is now up 12.3% year to date through June. Surging earnings elevated the equity markets, leading to lower valuation multiples.

Given the recent spike in inflation headlines, this quarter we take a closer look at the trends in rising prices. In addition, with various proposals for raising capital gains taxes, we review our philosophy regarding portfolio rebalancing and capital gains management.

Before we dive into those topics, let us take a look back at the prior year. The second quarter of 2020 was the panic peak for the economic fallout from the Covid pandemic. However, markets had already begun to recover by late March as it became apparent that massive policy intervention from both the Federal Reserve and Congress were starting to support the economy and would help contain the fallout from the dislocation. It is amazing to note the resilience and adaptability of many people, communities, and companies to survive and eventually thrive during such a disruptive crisis over the last 18 months. Few pundits anticipated the speedy pace and success of the recovery for both the economy and the financial markets.

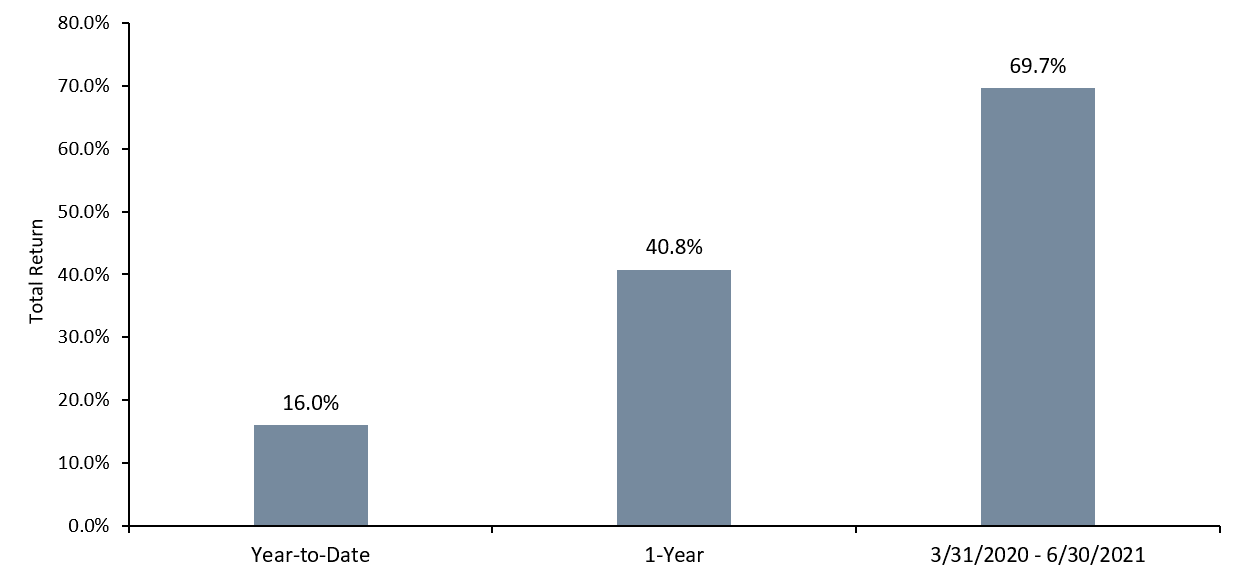

Total Return of S&P 500 as of June 2021

Source: Bloomberg. Data as of 6/30/2021.

The S&P has returned over 40% since June 30th of 2020, and over 65% since March 30th of 2020. Investors who strayed from their long-term investment strategy in order to become more defensive during the dislocation were left behind by the market’s rapid recovery. This resurgence was propelled by rising forward earnings growth expectations. The chart below shows how earnings forecasts for the S&P 500 have changed since the start of the pandemic.

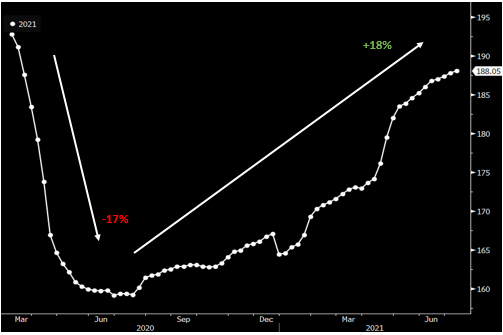

Although it may appear we are entering a bubble, we believe earnings growth will overcome these valuations. The white line in the chart below shows how 2021 estimates went on a pandemic-led roller coaster. Last year, expectations declined by 17% from $192/share in earnings per share (EPS) in February of 2020 to $159 EPS in June of 2020. Since that point, estimates have risen by 18% to $188 EPS. We anticipate that earnings for 2021 will eventually exceed pre-pandemic forecasts. Similarly, estimates for 2022 declined dramatically at the beginning of 2020, and we are now expecting 2022 earnings to also exceed this year’s EPS estimates and the pre-pandemic forecasts.

S&P 500 Forecasted Aggregate Earnings for 2021 Shows Strong Growth since 2020 Trough

Source: Bloomberg. Data as of 6/30/2021.

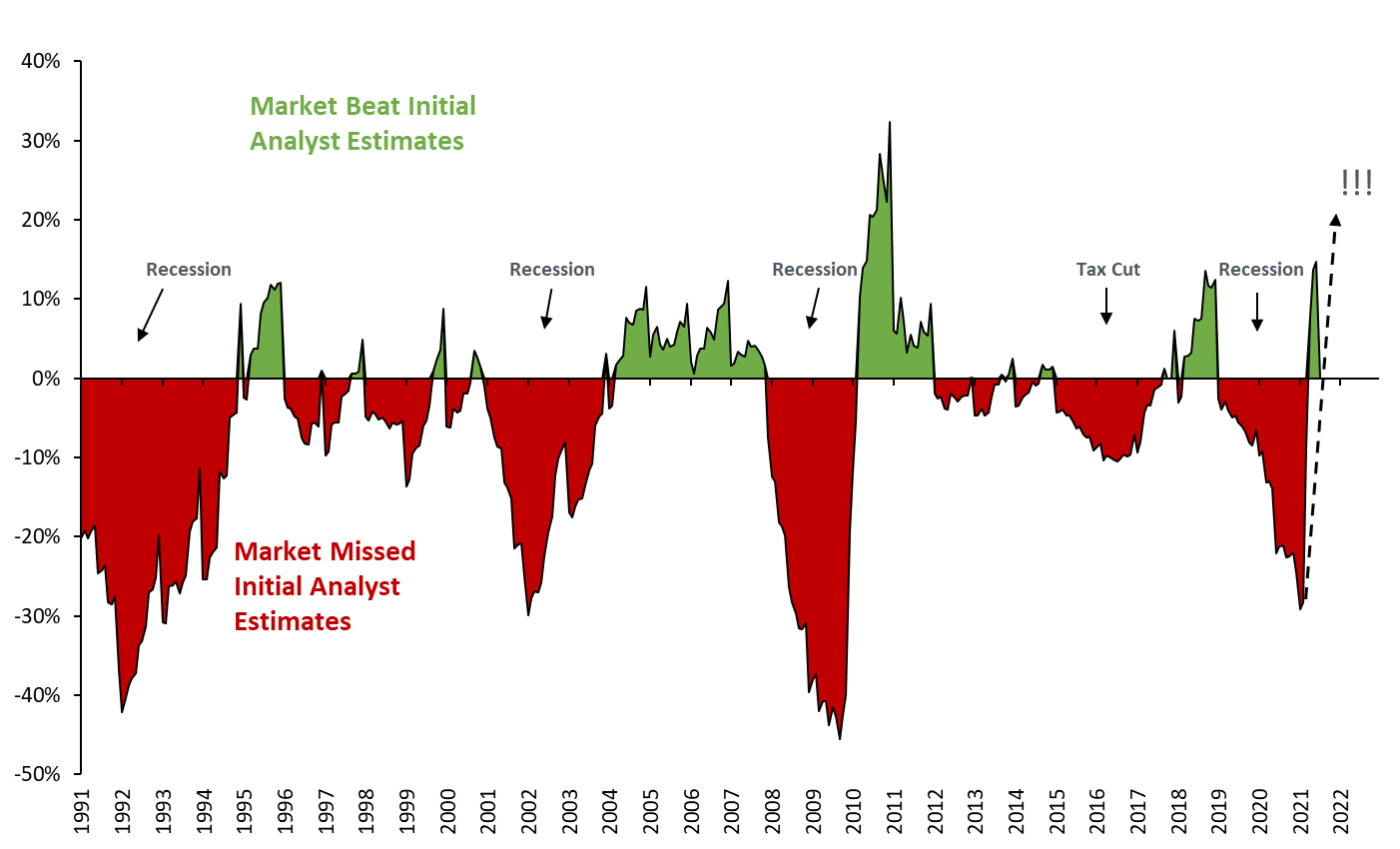

This dramatic shift in expectations is not a surprise as forecasters and investors always struggle to forecast inflection points. This generally leads to earnings estimates being too optimistic entering a recession and too pessimistic exiting a recession. The chart below details that analysts often fail to predict when there is a reversal in trend at the beginning and end of expansion-recession cycles, as shown by the green and red peaks and troughs.

Analyst Forecasts Typically Miss both Recessions and Recoveries

S&P 500 Earnings Minus Analyst Forecasts From One Year Earlier

Source: Bloomberg, ChoateIA. Data as of 6/30/2021. Dotted line represents hypothetical future data and is shown for illustrative purposes only.

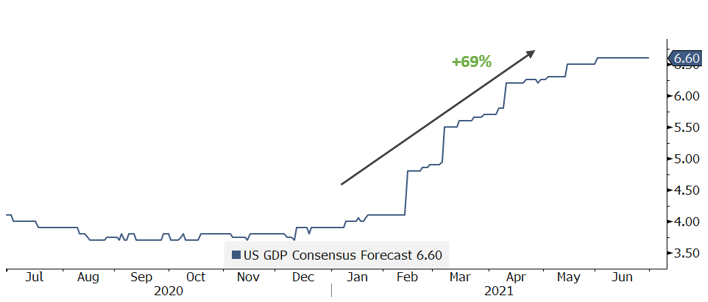

Since the trough in March 2020, the recovery in the stock market has mirrored the underlying strength of the economy as GDP forecasts have continued to move higher. We began 2020 with consensus forecasts of 3.9% GDP growth for 2021, and this forecast has steadily increased during the first half of the year to 6.6% expected GDP growth for this year. The increase has been driven by both 1) stimulus spending and 2) the rollout of vaccines, which has sparked consumer confidence and a surge in activity.

US 2021 GDP Forecast Has Increased 69% YTD

Source: Bloomberg. Data as of 6/30/2021.

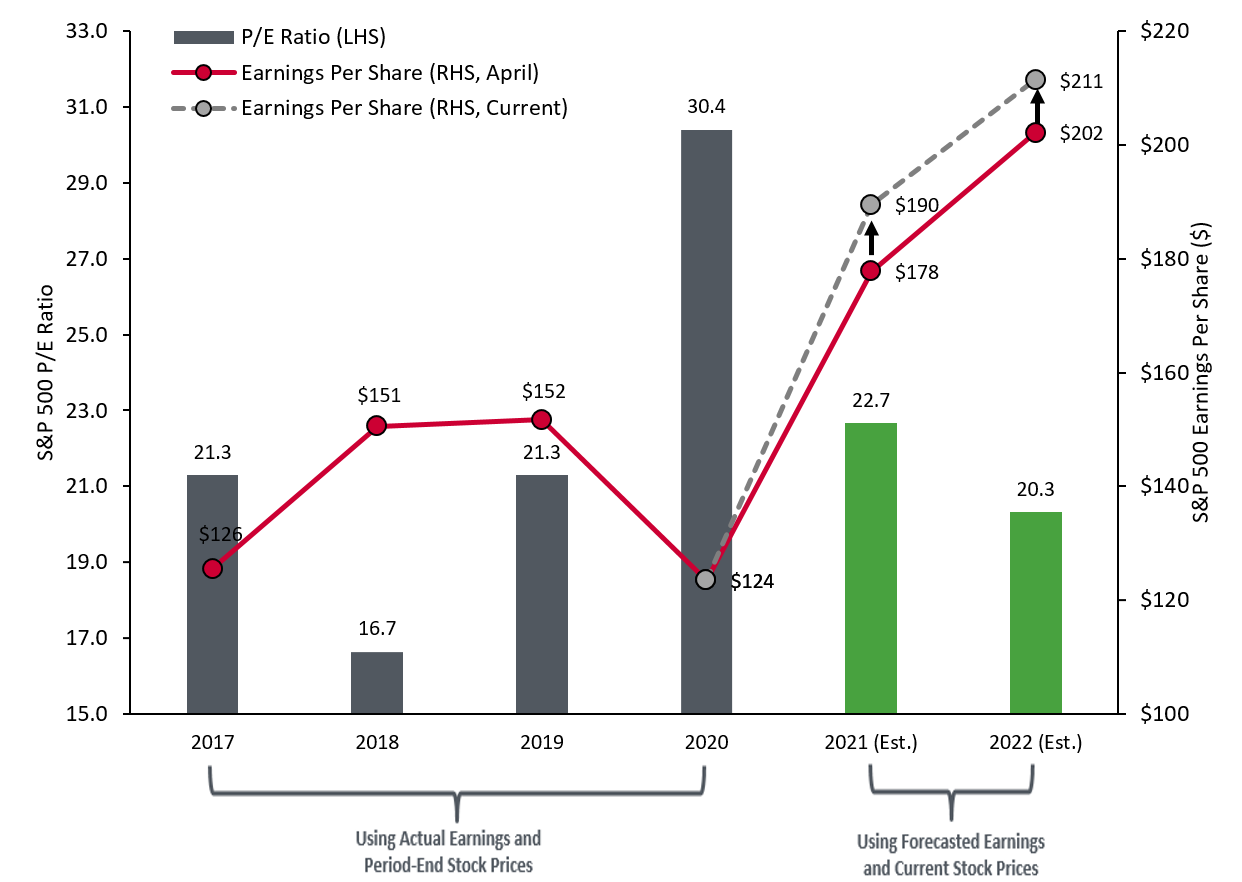

Right now, we do not see the potential obstacles for the global economy becoming a headwind as part of our baseline scenario. We expect a strong recovery to continue to drive GDP and corporate earnings higher, which will reduce elevated stock market valuations lower (assuming stock prices remain the same). Specifically, the market is forecasting $190 of earnings per share for the S&P 500 in 2021 and $211 per share for 2022, driving multiples down from a high of 30.4x in 2020 to 22.7x and 20.3x in 2021 and 2022, respectively. During the two month period from April to June alone, these forecasts grew by a substantial 7% and 4% for 2021 and 2022, respectively. Now valuations are much more in line with S&P 500 historical averages, making stocks look more reasonably priced on a going forward basis.

Rising Earnings Growth Rates Make Forward Valuations Reasonable

Source: ChoateIA, Bloomberg. Data as of 6/30/2021.

In response to these observations, ChoateIA has consistently added stocks to client portfolios. For the reasons highlighted above, we recommend an overweight equity position since we continue to expect stocks to outperform bonds over the next 6-12 months.

As a potential threat to this outlook, inflation remains a primary risk that we are monitoring. Inflation has been prominently covered in the news, with Google search interest surging this quarter to the highest level we have seen over the last 15 years. Even though talk about inflation picking up has made a lot of recent headlines, the Federal Reserve and most market participants remain quite sanguine on the future path for inflation. In fact, the yield for 10-year Treasury bonds actually declined in the second quarter from 1.7% to 1.5%, which is contrary to investor expectations regarding future inflation concerns. Gold is typically viewed as another traditional inflation hedge, and the precious metal has declined 7.2% year to date.

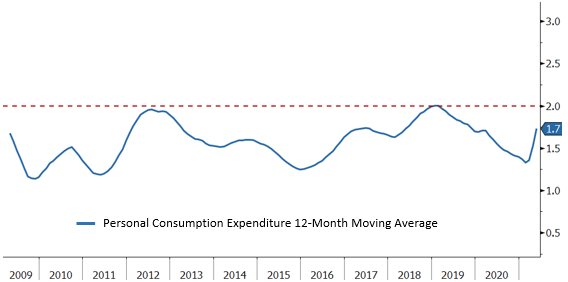

While it is clear that consumer prices have increased in certain categories, the question remains whether inflation will prove persistent and corrosive. The Federal Reserve’s target is a long-term average inflation rate of 2% annually, meaning that there will need to be some periods of inflation above 2% to reach that target for the average. It is important to mention that inflation has averaged below 2% for a long time, even before the Covid pandemic, as shown by the 12-month moving average in the chart below. Despite the recent increase of year-over-year growth in Personal Consumption Expenditure inflation to 3.4%, the average over the last 12 months is only up to 1.7%.

Inflation Has Been Below 2% Fed Target for More than 10 Years

Source: Bloomberg. Data as of 6/30/2021.

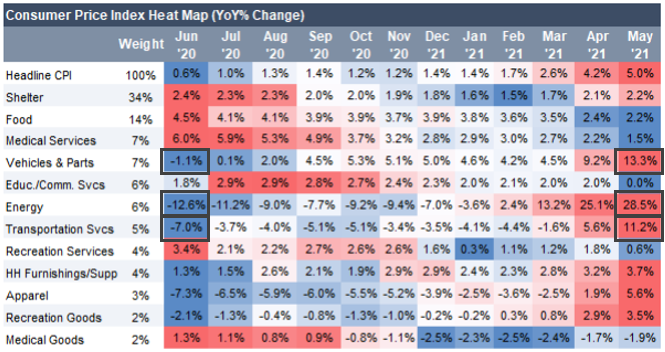

As a result, it would take consistently higher levels of inflation to push the Federal Reserve into action of increasing interest rates. At the same time, we believe many of the inflationary trends we are experiencing now are a response to the pandemic’s whiplash decline-recovery and may be temporary, not permanent. The chart below provides a breakdown of recent inflation numbers by various purchase categories, where some categories have experienced a more substantial change in prices than others.

Year-over-Year Inflation by Category Highlights Lack of Consistent Inflation Across all Purchase Categories

Source: CreditSights. Data as of 5/31/2021.

Looking at the grid, three categories stand out:

- Energy prices surged after collapsing last year, leading to year-over-year inflation of 28.5% as of May 2021. As the collapse rolls off the year-over-year comparison, it is likely that these numbers will decline during the second half of the year.

- Transportation’s increase of 11.2% as of May 2021 is driven by a rebound in air fares. Again, we believe this may prove to be temporary since the year-over-year comparison is based off a low point in May 2020.

- The vehicles category saw supply chain disruptions and used car prices increased significantly, with a 13.3% year-over-year increase as of May 2021. Given the discretionary nature of auto purchases and the intense competition in the sector, we think that auto price inflation will abate once supply chain issues are resolved.

Our current outlook for inflation mirrors the Federal Reserve, where we believe current price increases are impacting goods more than services and may prove transitory. Services categories where price changes have historically been more consistent, such as education and medical services, are not seeing a big upward move, while production goods are leading inflation higher. Historically, price increases in goods prove transient because the goods sector is much more vulnerable to global trade, disruption, and competitive changes. Moreover, services form the bulk of household purchases, so the more muted inflation in the service sector is a positive sign for investors.

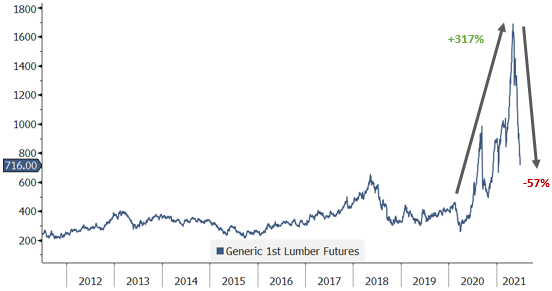

On the commodity front, an old saying goes that the “cure for high prices is high prices”. Lumber prices skyrocketed over 300% since the beginning of 2020 to a peak in May 2021, but have already started to adjust downwards. Other commodity prices will likely stay elevated but decelerate as there has been insufficient investment in new supply.

Supply and Demand Dislocation in Lumber Leads to Transitory Inflation Spike During Pandemic

Source: Bloomberg. Data as of 6/30/2021.

Another risk we are monitoring is that investors are concerned about possible changes in the tax code. At this point, it is unclear if any changes will get passed through the deadlocked Congress. However, the general expectation is that tax rates on capital gains will likely go up in the future and not down. As such, we believe this a good time to review our approach to managing client portfolios in a tax-aware fashion for three main reasons:

- It is important to note that the majority of our clients pay taxes. We manage each individual client portfolio in a tax-aware fashion, which includes choosing managers with low turnover, along with our thoughtful approach to portfolio construction and rebalancing. Our holistic approach seeks to incorporate the sophisticated and leading tax and estate planning methods of the Choate Wealth Management practice.

- Realizing capital gains is necessary for routine portfolio rebalancing and redeployment. Discipline around ‘selling high’ and ‘buying low’ adds value and manages risk over time. In addition, large positions must be managed appropriately, and portfolios must adapt to changing market cycles.

- The next few years may warrant realizing higher capital gains than the recent past. Equity markets have experienced several years of strong growth leading to high levels of unrealized gains. In addition, we have increased our equity exposure to capitalize on the strong markets. At some point, we expect to reallocate to assets with more defensive qualities. When we do this, we will factor the benefits of deferring gains against shifts in state and federal tax policies.

We will cover the topics of inflation and our approach to capital gains in subsequent podcasts, and we hope that you have the opportunity to review our library of podcasts here.

We remain optimistic on economic prospects, but are ready to trim our sails if conditions deteriorate. We thank you for your continued confidence in allowing us to steward your investment assets.