Insights

2022 Fourth Quarter Review

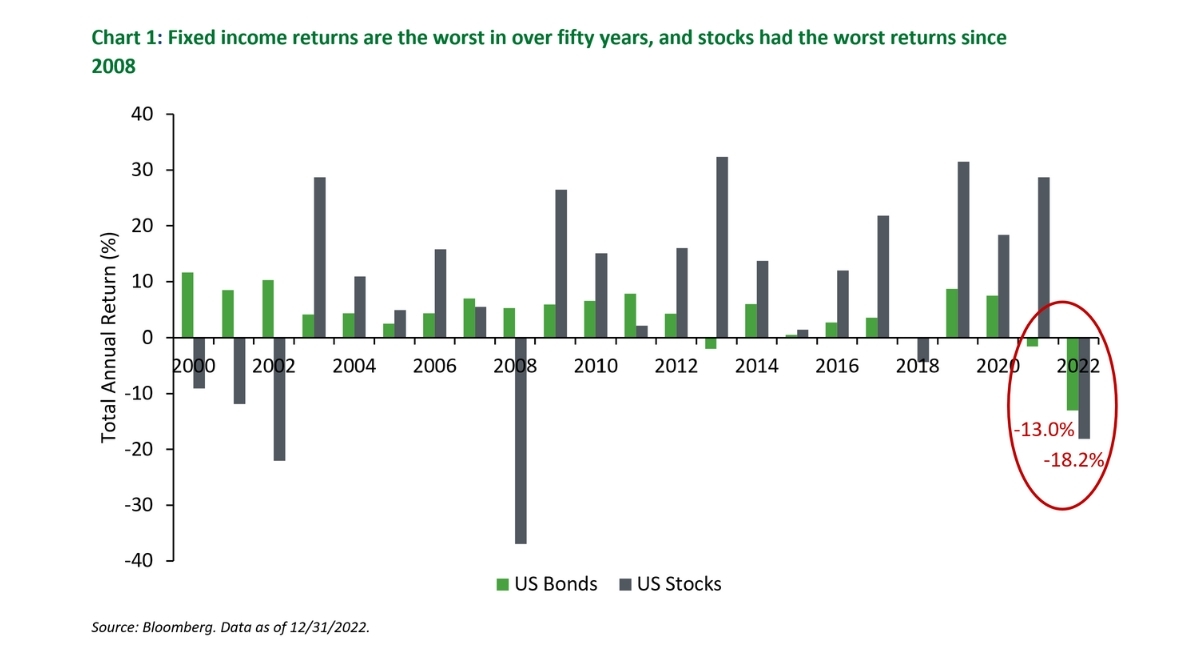

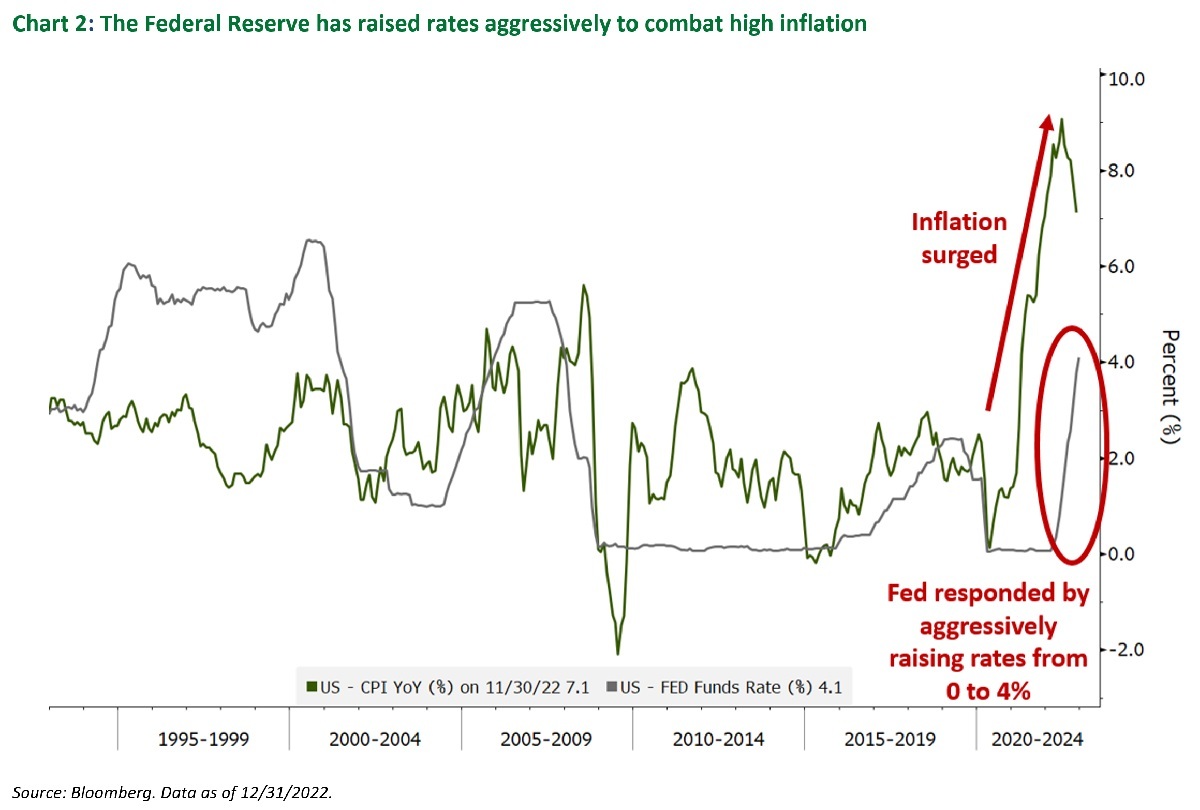

2022 can be summarized by some of the worst stock and bond returns of the last 50 years. The Federal Reserve and other central banks rapidly raised interest rates to combat high inflation made worse by lingering supply chain issues (and further exacerbated by the Ukraine War), and investors grappled with falling bond prices, stock valuations and the rising risk of an economic recession. The S&P 500 declined 18.2%, the MSCI All Country World Index (ACWI) declined 18.4% and the Bloomberg Aggregate Bond Index (AGG) declined 13% - one of the worst years for bond investors on record. Below we review 2022 and provide our outlook on 2023.

2022 was difficult year for investors in either stocks or bonds. However as highlighted in the chart above, stocks and bonds provided solid long term returns over the past decade and we expect these assets to form the cornerstone of any long term portfolio.

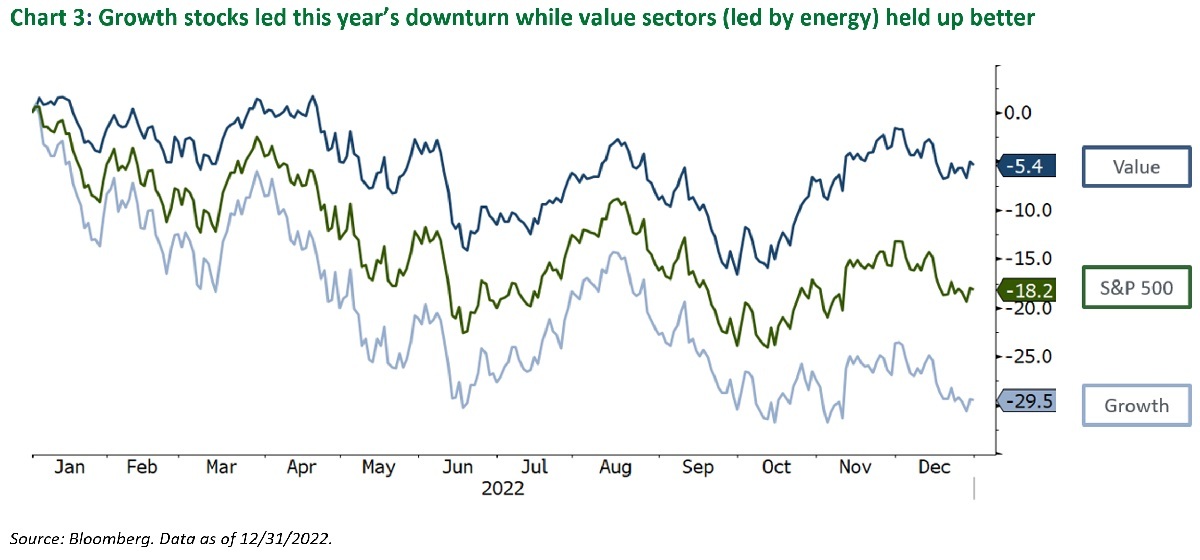

Global stock markets entered ‘bear market’ territory (a greater than 20% decline) on two occasions this year. While many consumer, communications and technology companies performed well during the pandemic, growth stocks were hard hit in general in 2022. By contrast, energy stocks performed very well, buoyed by surging commodity prices.

At Choate Investment Advisors, we lowered our equity allocations in late 2021. We were still overweight growth equities at the beginning of 2022, and we took additional steps to reduce risk over the course of the year:

- We generally removed exposure to high valuation growth companies.

- We trimmed our recommended international exposure and exited our small China position as geopolitical risks escalated.

- Most importantly, we adjusted our US large capitalization allocation in order to balance our growth and value exposure.

Still, our returns disappointed during the first 4 months of the year, before stabilizing on a relative basis for the remainder of 2022. In addition, where we had invested in actively managed equity funds, some of them underperformed in 2022, as the fund managers were slow to anticipate lower corporate and consumer spending.

On the bond side, we have generally benefitted from our shorter-duration positioning, and so our results performed better than the benchmarks but this still reflects a negative return for most investors. The negative bond returns are particularly unsettling when combined with negative stock returns. The silver lining is that both money market and bond yields have risen significantly over the past year, and therefore, we expect income generation across our US fixed income allocation will be higher in 2023, which should help offset further bond price declines.

In response to the underperformance of equity funds, our initiatives include 1) continuing to probe the managers of these funds on a regular basis, 2) analyzing our asset allocations daily, and 3) adding talent and resources to our research team. ChoateIA added two new analysts and an experienced portfolio manager in 2022 and we look forward to introducing them to you in the New Year. In addition, we plan on further expanding the investment team in 2023. Lastly, we were also active in harvesting tax losses where appropriate.

Turning to 2023, The Federal Reserve continues to strike a balance between fighting inflation and avoiding a recession; bond market expectations are mostly positive. Investors anticipate only a ‘few’ more interest rate hikes as inflation is beginning to trend down. However, if we enter a recession, interest rates may begin to fall. In addition, bond yields are significantly higher entering 2023 than they were entering 2022 providing investors with more interest income which boosts expected bond returns.

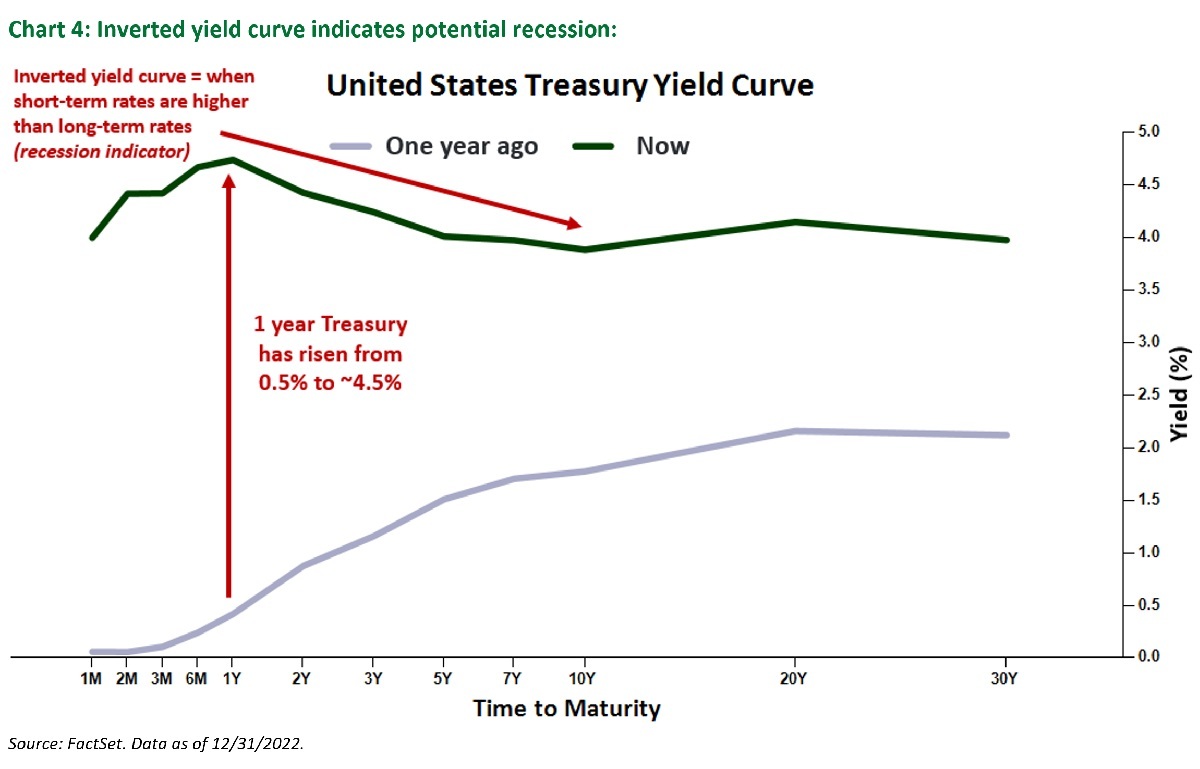

At present, the yield curve is “inverted” with short term yields near 4.5% and the ten year yield at 3.7%. An inverted yield curve is very unusual, as investors normally demand a greater yield for lending money for a longer period. An inverted yield curve is seen as a harbinger of a recession because it indicates that investors may be expecting short term yields to fall as the central bank will reduce interest rates to support the economy.

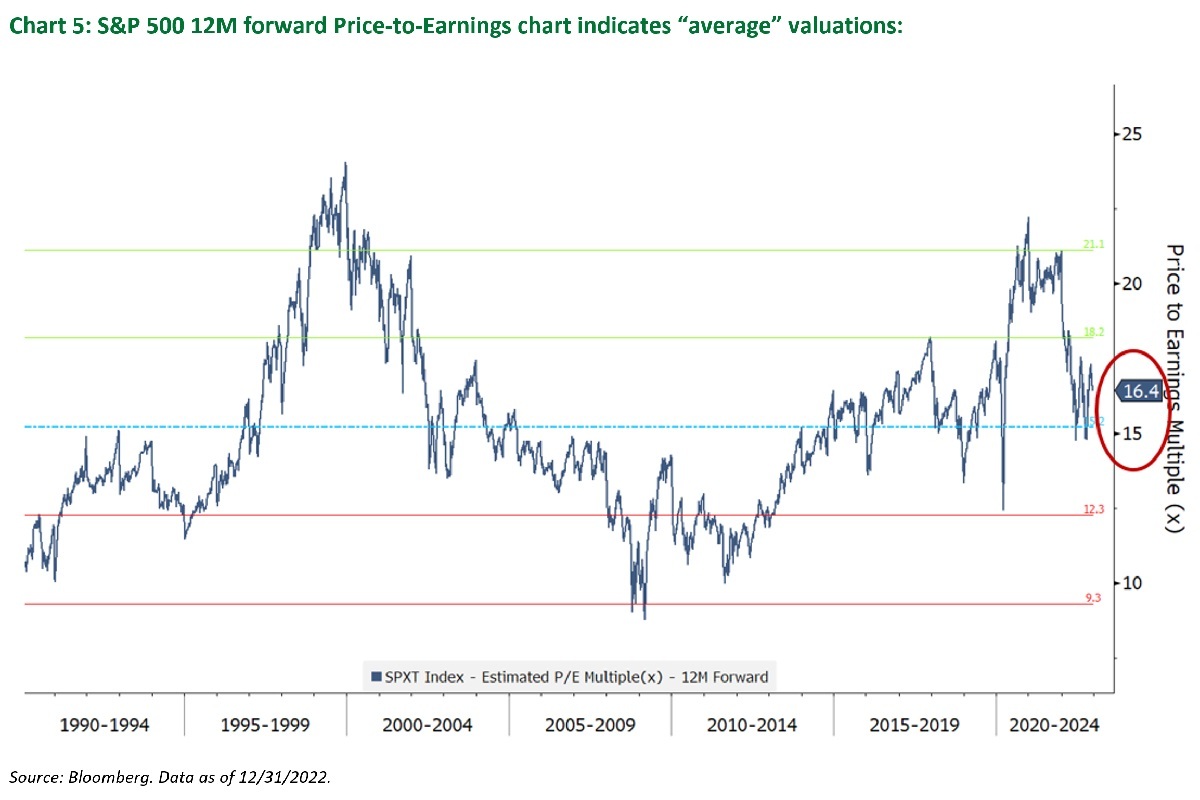

Forecasting next year’s stock returns is dependent on the shape of inflation and the economy avoiding a recession. From a valuation perspective, we believe stocks are “neutral” based on forward price-to-earnings ratio (P/E).

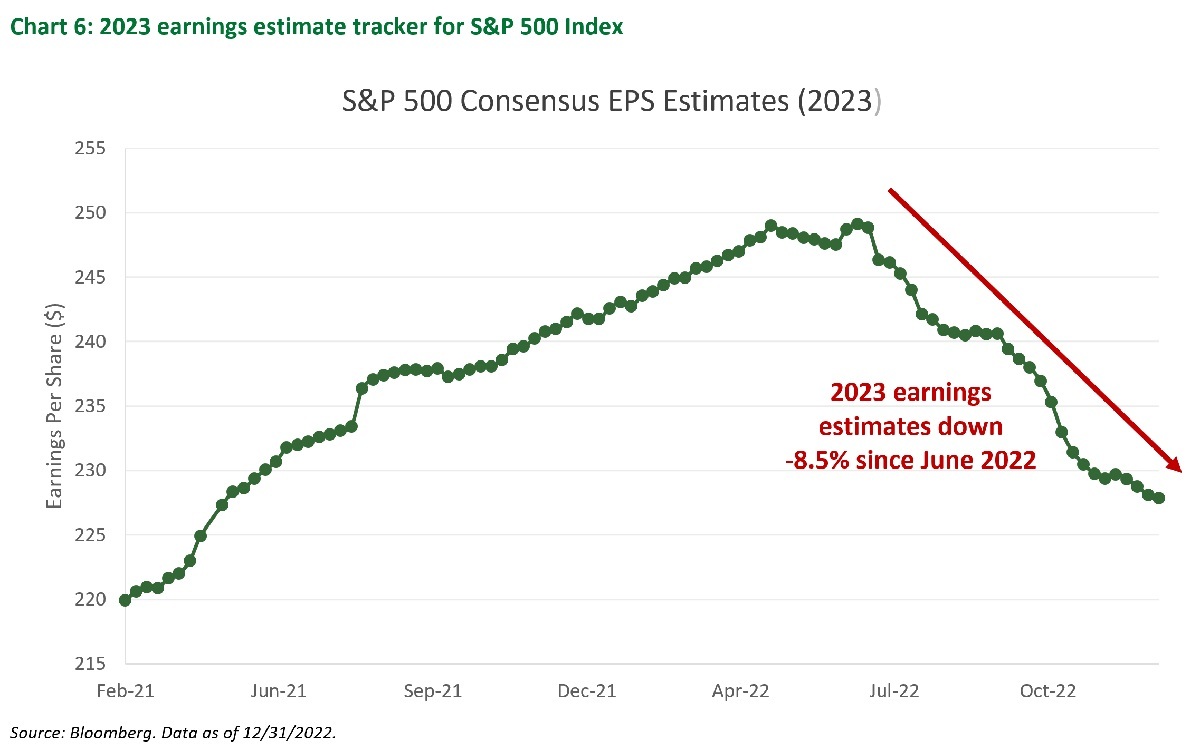

Company earnings per share (EPS) estimates for 2023 continue to decelerate (see Chart 6), suggesting that investors are concerned about the US economy slipping into a recession in 2023. The chart below tracks forecasts for 2023 EPS since February 2021. These forecasting estimates pertain to the S&P 500. The EPS estimates rose throughout 2021 and peaked at $250/share, and then the EPS estimates declined (8.5%) to $228/share since June 2022, putting pressure on stock prices. Even at $228/share, forecasting estimate still represents approximately 2-3% earnings growth from the actual earnings in 2022, and so we expect these estimates will move lower as revenues and margins continue to erode. If we were to have a recession, investors should expect further downward revisions, as earnings typically contract by at least 10% in a typical recession.

Until earnings trends stabilize and begin to move higher, we believe it is hard to have conviction on higher stock prices. Therefore, we generally recommend owning fewer stocks and holding more bonds across client portfolios. We believe that many companies will reduce their earnings guidance for 2023 when they report Q4 2022 earnings in the coming weeks. This could provide more clarity to investors, which may provide an opportunity for us to add to stocks.

A looming fight over raising the debt ceiling is a risk both for investors and the economy. Interest expense equals 8% of total federal outlays, so if the government prioritizes interest payments and mandatory programs (Medicare and Social Security) over discretionary spending, there is less risk of a default on federal debt, and government bonds may rise in price as they did in 2011. However, a sharp cut in discretionary outlays will have a large impact on the economy, and any protracted political fight will hurt investor sentiment. It is certainly another reason to be cautious about the stock market, and we likely will return to this topic in our next quarterly update.

Conclusion:

In this volatile market, it is important to remain patient and adapt to shifting market conditions. We look forward to hearing from you, understanding your portfolio goals, and discussing your accounts and our outlook for this year. We want to help you navigate this nervous market and prepare for favorable conditions on the horizon.

Best regards,

The ChoateIA Investment Team