Insights

2022 Third Quarter Review

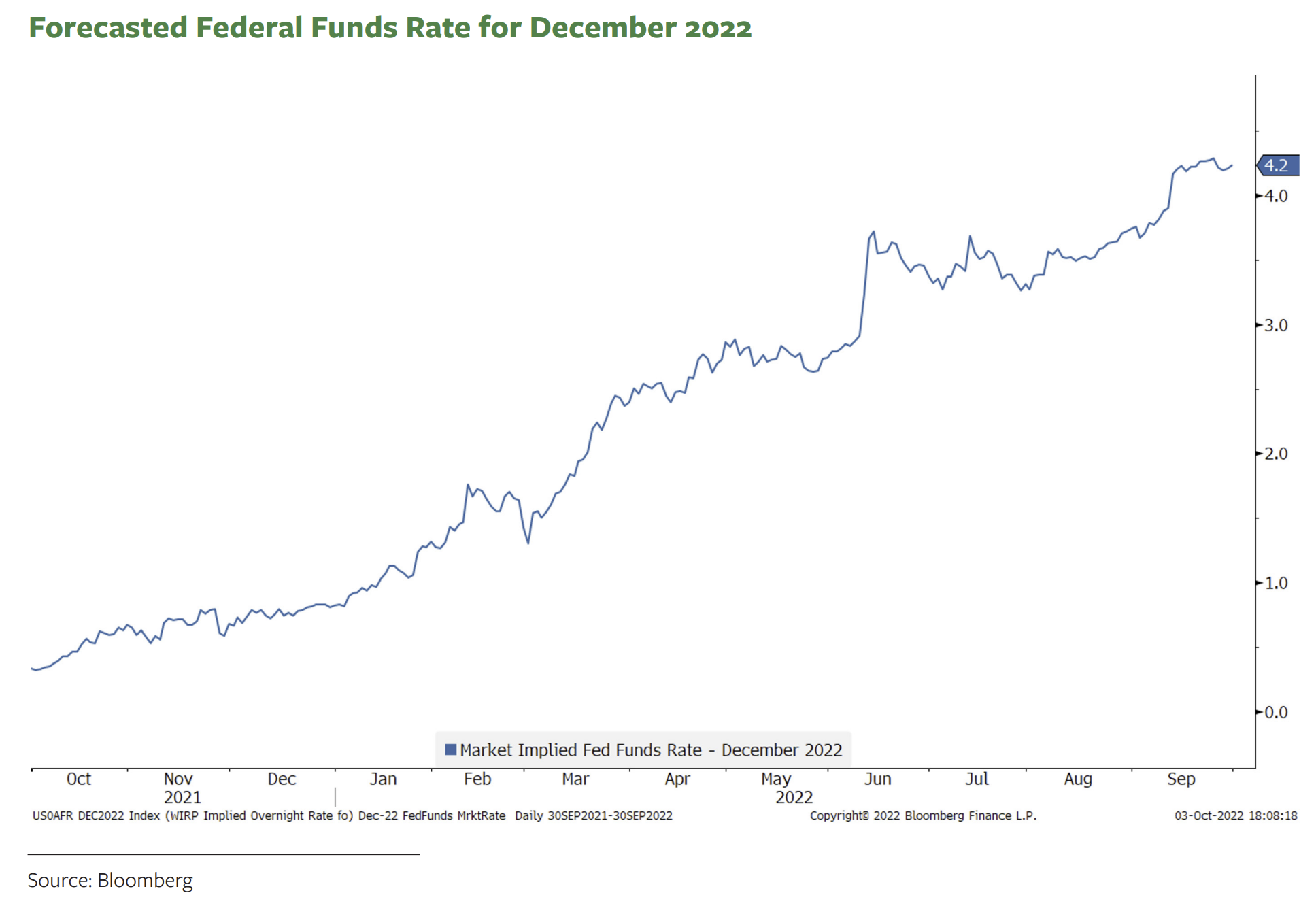

Markets continue to struggle with the possibility of a recession and the push against inflation. The global economy is reacting to the rapid increases in interest rate policy from government central banks as they seek to restrain inflation. The Federal Reserve’s Fed funds rate is rising rapidly (beginning the year at 0.0% and now at 2.75%, and expected to end the year above 4.0%).

The size and pace of these increases surprised both stock and bond investors.

The Bloomberg Aggregate US bond index is down -14.6% year-to-date through September 30th, the worst performance of this index in the past 50 years. The MSCI All Country world index (the global stock market) closed the quarter down -25.6%. As interest rates rise, 1) economic growth slows, and 2) investors discount future earnings more and thus apply a lower multiple to current earnings.

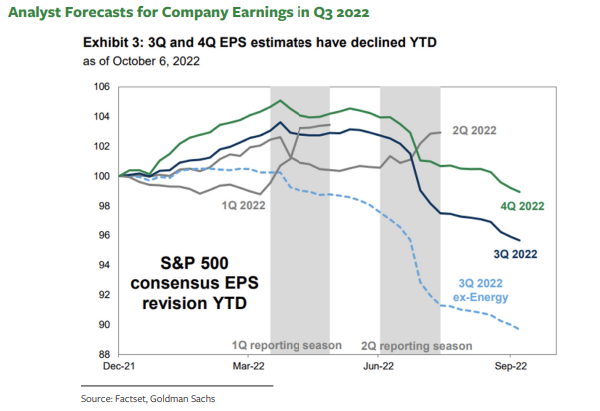

Over time, rising interest rates affect the economy by raising the cost of capital for businesses and households. Right now, the reported rate of unemployment remains low in America, and the US economy is still relatively strong. However, we are seeing increasing signs of deterioration (the housing market slowdown, hiring freezes and rising layoffs), and companies are deferring or canceling expansion plans. Investors are gauging the impact of an economic slowdown on company earnings for the rest of 2022 and 2023. Analyst earnings forecasts are trending down for the S&P 500, but we believe these estimates remain too optimistic.

Excluding energy stocks, analyst forecasts for company earnings are down significantly for Q3 2022.

Since the global financial crisis in 2007-08, we’ve enjoyed a decade of low inflation, slow but steady economic growth, and consistently rising earnings. The COVID pandemic, its aftershocks, and the government stimulus policies to counter the pandemic ended this status quo.

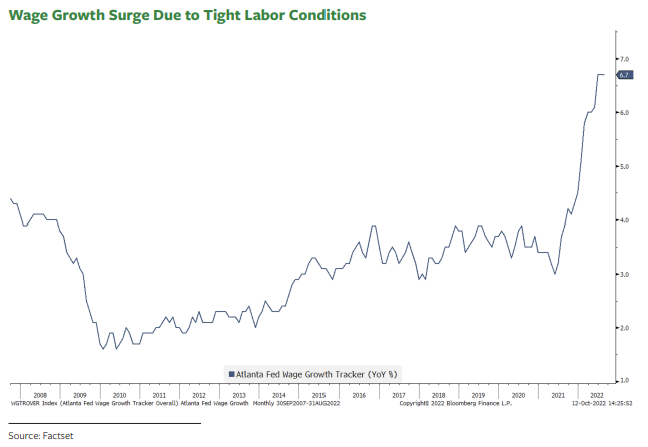

The pandemic caused major disruptions and shifts in employment, consumer buying behavior, household lifestyles, and supply chains. Governments reacted to the shock of the pandemic with unprecedented fiscal and monetary support to the economy. Households, since people were stuck at home, shifted purchases to more goods and less services, adding further pressure to already disrupted supply chains. As the pandemic began to ease, economic activity surged and the reported rate of unemployment plummeted. However, many workers (especially the elderly) exited the workforce and pressured staffing shortages.

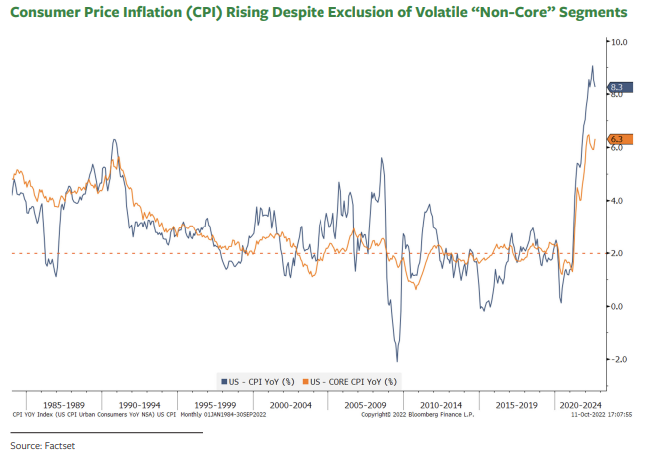

Inflation, anchored at under 2% since 2008, began to rise throughout 2021, even excluding the “non-core” CPI segments of food and energy. Entering 2022, the Federal Reserve and other central banks began to fear that these inflationary pressures were rippling throughout the economy. The Ukraine war and continued COVID lockdowns in China further exacerbated the “supply” side of the economic equation, and central banks deployed the only tool they had for reducing inflation –they embarked on an aggressive rate hike cycle, which is designed to curtail “demand.”

A further economic slowdown is inevitable, though its length and depth are still unknown. We anticipate that more companies will guide down their earnings estimates. Valuation measures, like price-to-earnings (P/E) ratios, still do not indicate that markets are “cheap.” Therefore, a decline in earnings would make valuations even less compelling at current prices.

We continue to take steps to reduce risk in your accounts this year, including 1) reducing your overall equity exposure, 2) reducing interest rate risk with shorter-duration bonds, which are less impacted by rising interest rates (where applicable), and 3) emphasizing “quality” companies we believe have good positions in their markets and long-term earnings growth. Year-to-date, the companies and sectors we believe present the best long-term opportunities underperformed the fossil fuel energy companies, which benefit from elevated oil prices. Our long-term approach of owning profitable, growing companies remains unchanged, but we did reduce exposure to fast growing companies with limited current profits. Given the difficult current environment, we added to the holding of companies that provide a balance of long term growth and strong current profitability. In addition, we are actively harvesting tax losses when available.

We expect to maintain a cautious position in your investments until we see the following:

- Indications that inflation is clearly declining, making the path of future interest rates

more predictable. - Company earnings estimates more reflective of the economic slowdown we believe is coming.

- Valuations, such as the price-to-earnings (P/E) ratio, reflecting a discount relative to market history.

There are some positives for portfolios going forward. We see the silver lining of higher yields rewarding conservative “savings” for the first time in a decade, and continuing dividend growth from equities generating a meaningful increase in portfolio income, which we estimate has almost doubled from a year ago. For this reason, we expect that for many accounts portfolio income will continue to rise as we move into 2023.

We look forward to hearing from you. In this volatile market, it is important for us to remain up-to-date on your portfolio goals and needs. In addition, we are ready to discuss the specific portfolio steps we took for your accounts, as well as our outlook for the next few months. We aim to help you weather any storm, while also preparing for changing conditions on the horizon.

Best regards,

The ChoateIA Investment Team