Insights

COVID-19 Update: Current Market Conditions

As you are well aware, this has been a highly volatile two weeks in the markets. Monday was particularly challenging, as the S&P 500 was down -7.6% in a single day. Bond yields fell precipitously to record lows. The coronavirus (COVID-19) is spreading to multiple countries despite China’s extensive quarantines in response to the outbreak. The spread of the coronavirus introduces a dimension of anxiety that goes beyond economic gain and loss, as people fear for their health and the health of their friends and loved ones. We urge you to be safe and to follow the recommendations of health professionals.

From an economic perspective, highly interconnected global trade and transportation routes have enabled the virus to spread to every continent except Antarctica. Italy, a nation of 60 million people, the third-largest economy in the euro zone, and the eighth-largest economy in the world, is now locked down. As the New York Times noted, “Italy is beginning perhaps the largest restriction on the free movement of people ever attempted in a Western democracy in peacetime to try to slow the spread of the virus.” In what may be a preview of things to come, hospitals in affected areas in Northern Italy are reaching capacity and setting up temporary rooms in the hallways. California, New York, Washington State, and Oregon have all declared emergencies.

Nobody knows how bad the epidemic will get, both from a human health and from an economic impact perspective, and that uncertainty is roiling the markets. It is not possible to calculate risks because so much is unknown about the future. In such an environment, following a disciplined and well-diversified investment strategy is paramount. For investors, the issue is not so much the virus itself, but the fear it creates and the economic impact of measures to contain it. These impacts are twofold: a “supply shock” and a “demand shock.” Both are compounded by an increasingly fractured political landscape and a delicate moment in the US political cycle due to the upcoming Presidential election.

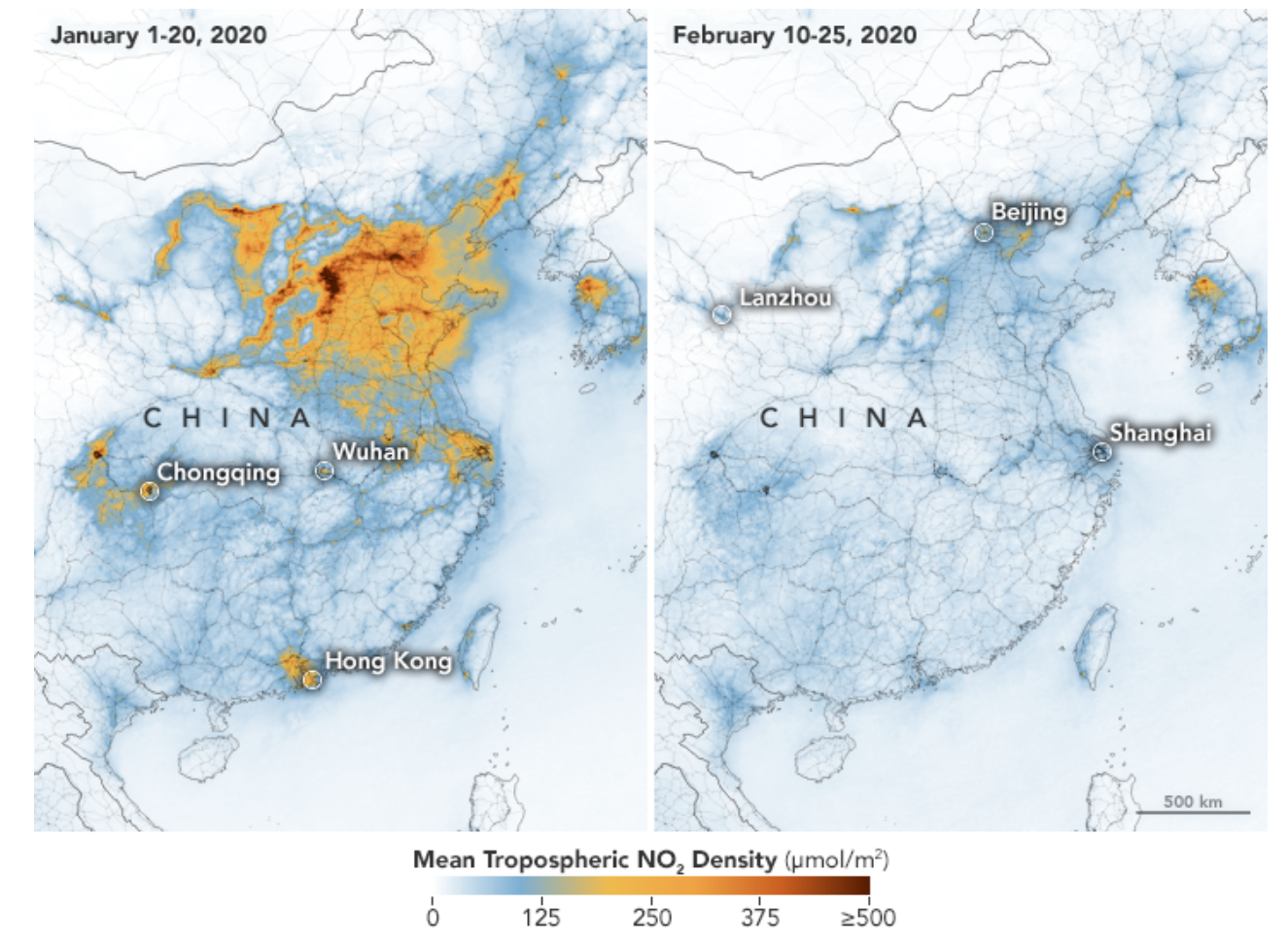

On the supply side, the effect of this virus is akin to an escalation of the trade war, in the way that it disrupts supply chains, particularly across international borders. China in particular is at the center of global supply chains as well as the epicenter of the virus. In addition to finished products, China supplies a vast number of intermediate goods that end up in other products. The scale of China’s recent industrial slowdown is perhaps best captured by the NASA satellite imagery below, which shows how much pollution levels declined as China imposed draconian quarantines to limit the spread of the virus.

In the longer term, companies may decide to accelerate moves away from dependence upon China, but there are few attractive alternatives in the near term. Reconfiguring global supply chains away from China will be expensive and take time.

On the demand side, we are already seeing less consumer spending as people change their behavior. For example, box office revenues in China are essentially zero. Travel bookings are plummeting. Apple, MasterCard, United Airlines, and many other companies are warning about the potential revenue impact. The US economy is heavily oriented toward the consumption of services, and changes in consumer behavior in response to the virus will have a significant impact. These services often involve interpersonal interactions (such as attending a sporting event, getting a haircut, or dining out at a restaurant). When normal activity resumes, those lost services revenues will not be made up as delayed purchases (e.g., people will not go out to eat twice as much to make up for the restaurant meals they missed in the past).

Monday’s sharp decline was precipitated by a third shock, in the oil markets. Saudi Arabia increased production and slashed oil prices after Russia refused to join in production cuts. While lower oil prices benefit consumers, the US is now a net oil exporter producing about 13 million barrels per day, and energy companies are a major source of capital investment. Layoffs in this sector are inevitable. Energy is the worst performing sector of the S&P 500 this year, by a wide margin. Because we believe that climate change is an important investment theme, our clients have very little direct exposure to fossil fuel companies.

A cardinal rule in highly volatile markets is do not turn a temporary loss into a permanent one. We have worked hard to ensure that all of our clients are following a disciplined investment strategy that will allow them to wait out volatility without being forced to sell stocks. In addition to growth investments like stocks, our clients hold an appropriate allocation of “safer” assets that are calibrated to their circumstances. In addition to their strategic positioning, our clients have a tactical reserve of “dry powder.” We have been concerned for some time that the current economic expansion may be drawing to a close and that stock valuations are extended, and therefore added an extra measure of safety to our strategies. This will further mitigate losses.

With uncertainty so high, the best thing to do is to stay very disciplined and consistent. Times like these are why we follow diversified investment strategies with clear parameters. It is possible that we may see positive news in the coming days as well. We hope to see an effective monetary and fiscal response to offset the economic impact of the virus. China will likely engage in significant economic stimulus, particularly given that it has caused widespread resentment against the Communist Party. The Federal Reserve is likely to continue to cut interest rates and the US may employ fiscal stimulus as well. When we see this kind of stimulus coming on line, particularly if stocks have returned to more reasonable valuations, it will likely be time to put some of the dry powder we have set aside back to work. Just as we were cautious when other investors were giddy, we will look for opportunities in this volatility.