Insights

COVID-19 Update: Examining the Road to Recovery

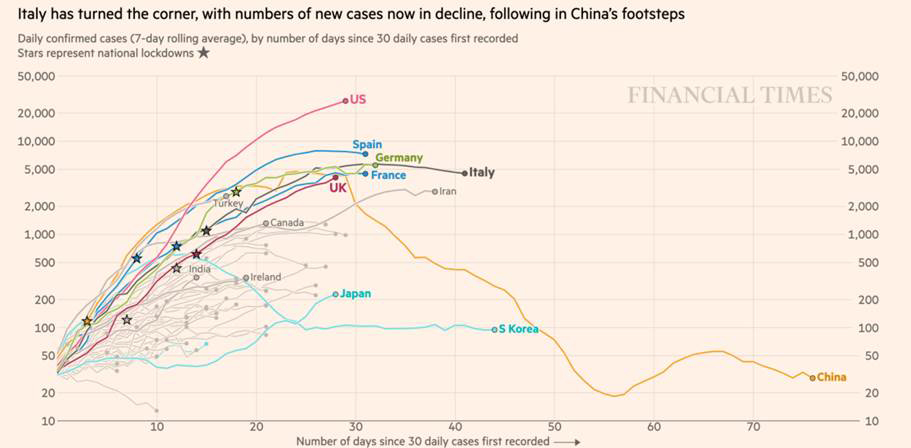

We begin this update with some good news. Both Italy and Spain seem to be following the example of South Korea in successfully decreasing the numbers of new cases and “bending the curve” of viral infections. Social distancing and rigorous testing appear to be key policies to bend the arc of the spread of the COVID-19 virus.

FT graphic: John Burn-Murdoch

Source: FT analysis of Johns Hopkins University, CSSE; Worldometers. Data updated April 5, 2020.

The experiences of South Korea and Italy seem to demonstrate that developed, democratic societies can successfully bend the curve and bring the spread of the virus under control. This needs to happen in the United States, which now has the highest number of new cases in the world, before the markets and the global economy can begin to recover. Because the United States is the world’s largest economy, and 70% of our economy is based upon consumption, the spread of the virus here will have a major impact on the rest of the world. China, for example, cannot fully recover unless there is US demand for its products.

The United States has not implemented a comprehensive national lockdown. Instead, quarantine efforts have been implemented bottom-up at the state and local levels. This has resulted in a patchwork of restrictions that too often have been put into place after the virus has had time to spread in a community.

Source: New York Times

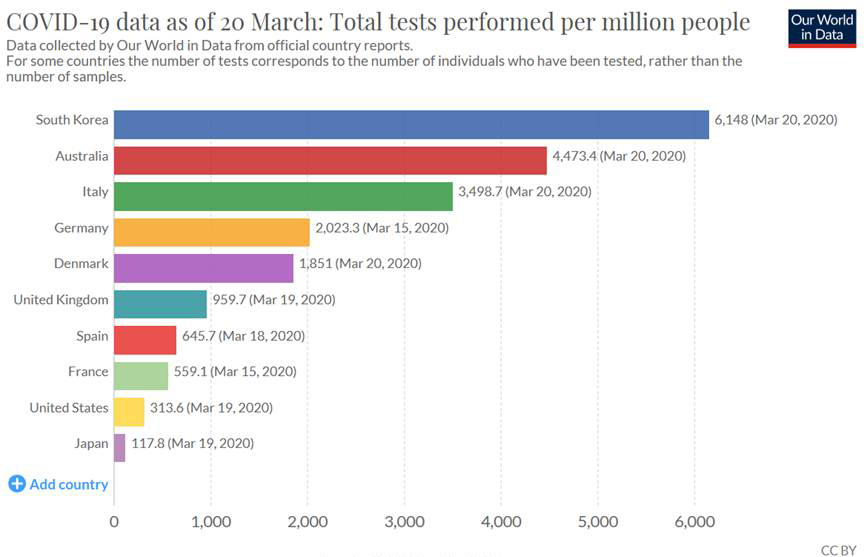

Coronavirus testing has increased in the US, but unfortunately has lagged behind many other developed nations.

Source: Oxford University, Our World in Data

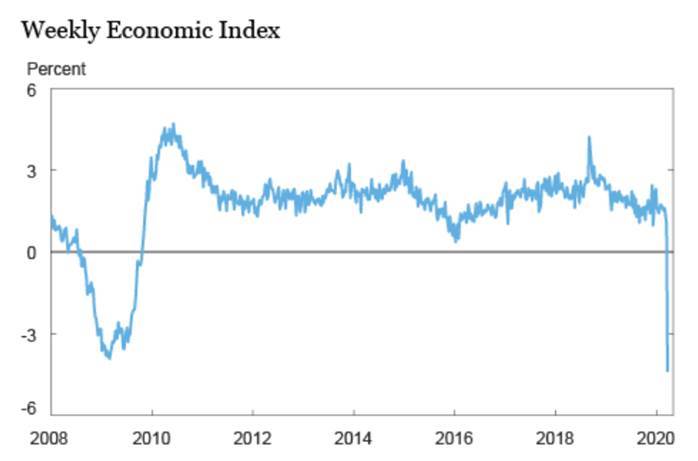

Among the types of bad news, it is also now clear that the social distancing necessary to slow the spread of the virus imposes extremely heavy economic costs. Detailed regional estimates indicate that as much as one-third of economic activity in the US is shut down at the moment. The New York Federal Reserve’s Weekly Economic Index is a high frequency indicator of the state of the US economy based on factors such as unemployment claims, electricity output, and fuel sales. Any given week’s reading means that if conditions persist for a full quarter, US GDP would change by the corresponding amount relative to the prior year. This indicator shows that the current economic contraction is already as deep as that of 2008, and has occurred much more swiftly.

Source: Vox

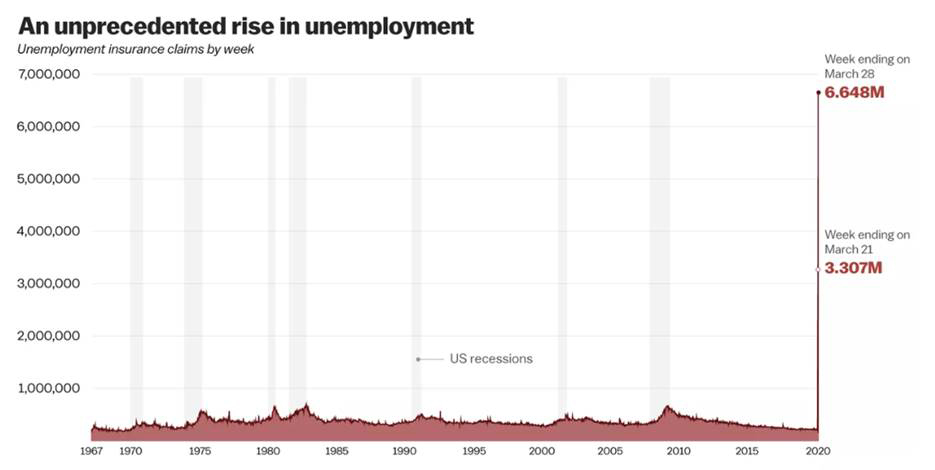

Even though the US adopted lockdowns more gradually than other economies, they have caused unprecedented job losses. Economists had expected the US economy to lose about 100,000 jobs in the latest payroll report, which covers data from early March, but on Friday we learned that the true toll was 701,000. Initial jobless claims (applications for unemployment benefits) rose by a staggering 10 million in the past two weeks.

Source: Vox

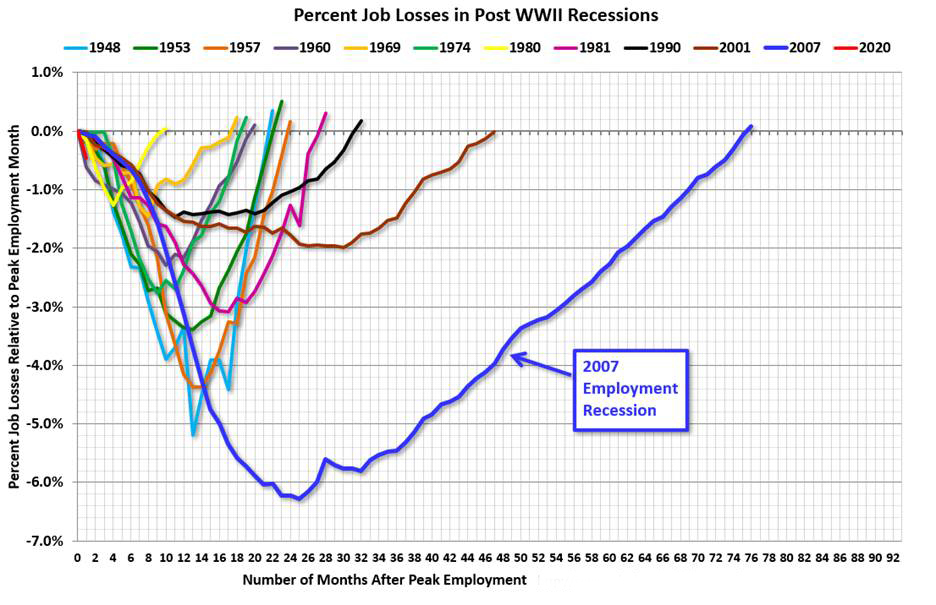

The graph below shows the arc of unemployment in past recessions. The experience of 1948 demonstrates that it is possible for employment to recover quickly from a major dislocation (such as the transition from a wartime to a peacetime economy). The depth of unemployment in this recession will likely be greater than any of these past recessions – many forecasters expect it to fall into the -8% to -10% range. Even a sharp rebound from these levels likely means several months of very high unemployment.

Source: Calculatedriskblog.com

Fiscal and monetary support on a huge scale will be necessary to bridge this chasm. As we mentioned in our previous update, the Fed has acted swiftly to implement its 2008 playbook, and the banking system is much healthier than it was during the Global Financial Crisis. The CARES Act, at $2 trillion, is a major fiscal stimulus. Workers will not lose their skills after a brief hiatus and will hopefully be able to return to their prior employment in many cases. More stimulus will likely be necessary to support the economy during the coma of social distancing. So far, traditional “deficit hawks” have not raised objections, but this may change after the election in November.

The global economy will only fully recover when the threat of the virus lifts, either through innovative treatments, the development of a vaccine, or rising levels of “herd immunity” as populations recover from infections. Like the onset of the virus, the reopening of the global economy will likely be gradual, regional, and beset by setbacks. After depleting their savings, consumers may focus on saving to rebuild their balance sheets and spend less. They might also change their behavior for some time (e.g., avoiding theaters and restaurants). Companies may reconfigure their supply chains and source more inputs locally. But the markets will not wait for a full economic recovery. As soon as a viable path becomes clearer, the markets will be looking to front-run the recovery just as they anticipated the decline. The surge in global markets as resolution of the virus crisis comes into view may be as dramatic and sudden as the fall. We therefore recommend that investors continue to be cautious but do not retreat from long-term equity positions, particularly in high quality developed market stocks.