Insights

COVID-19 Update: Long-Term Stock Investing in a Noisy Market

In theory, the stock market is highly “efficient.” An efficient market should accurately reflect the value of any given company based on all available information. In practice, we observe that often there is indeed a strong correlation between the growth in a company’s earnings and the growth of its share price in the long term, but in the short term stock prices sometimes diverge significantly from the actual value of the business. We focus on working with managers whose portfolios include stocks that we believe will appreciate over time as the market reflects a company’s true potential. We, and the fund managers with which we work, evaluate the underlying prospects of a business and compare the company’s potential value to the current market price. If the current stock price trades at a discount to its perceived true long-term value, then it is typically rewarding to hold for an extended period.

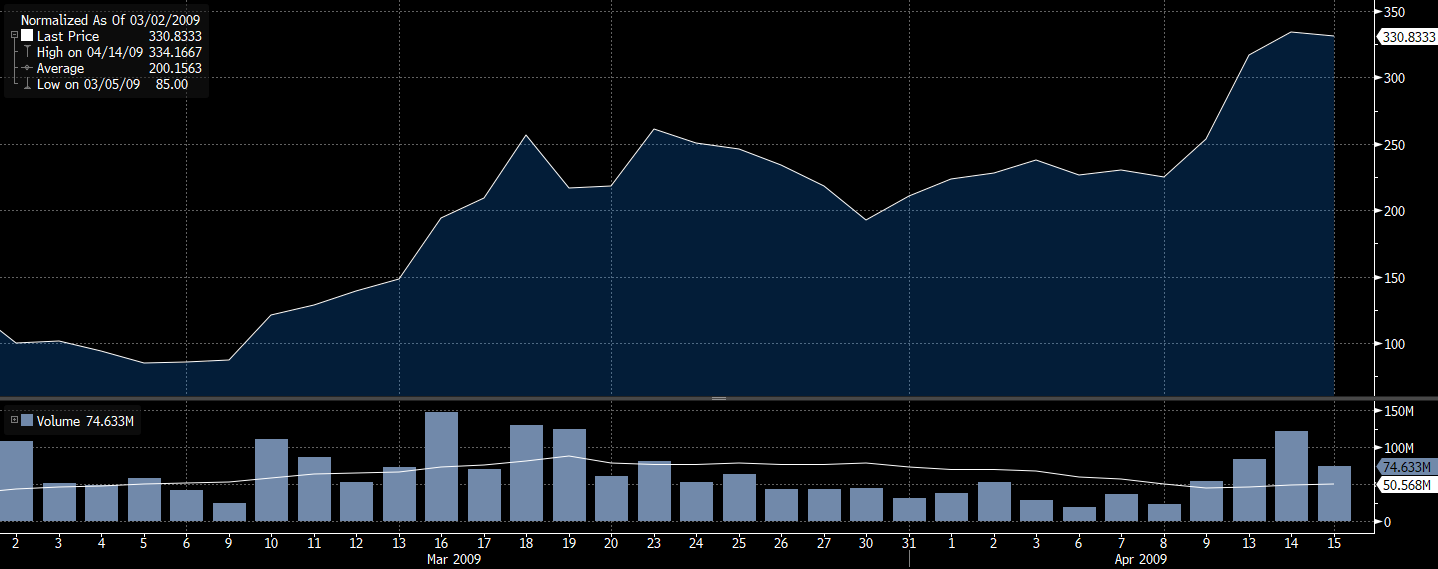

In the current market, we have seen rapid and sometimes highly erratic stock price movements due to sentiment, market fluctuations, and other short-term dynamics. Even in less uncertain times, stock prices can be highly volatile notwithstanding the long-term value of a company remains fairly constant. Cheaply priced stocks (e.g., those trading below $5) tend to be particularly volatile. Many companies with a cheap share price face the possibility of going out of business entirely. This can create a binary outcome for traders that is similar to a call option. If the company recovers then the trader’s option will be “in the money” and can be highly profitable. For example, the chart below shows that a trader could have tripled her money in 45 days by purchasing Citigroup on March 02, 2009.

Source: Bloomberg

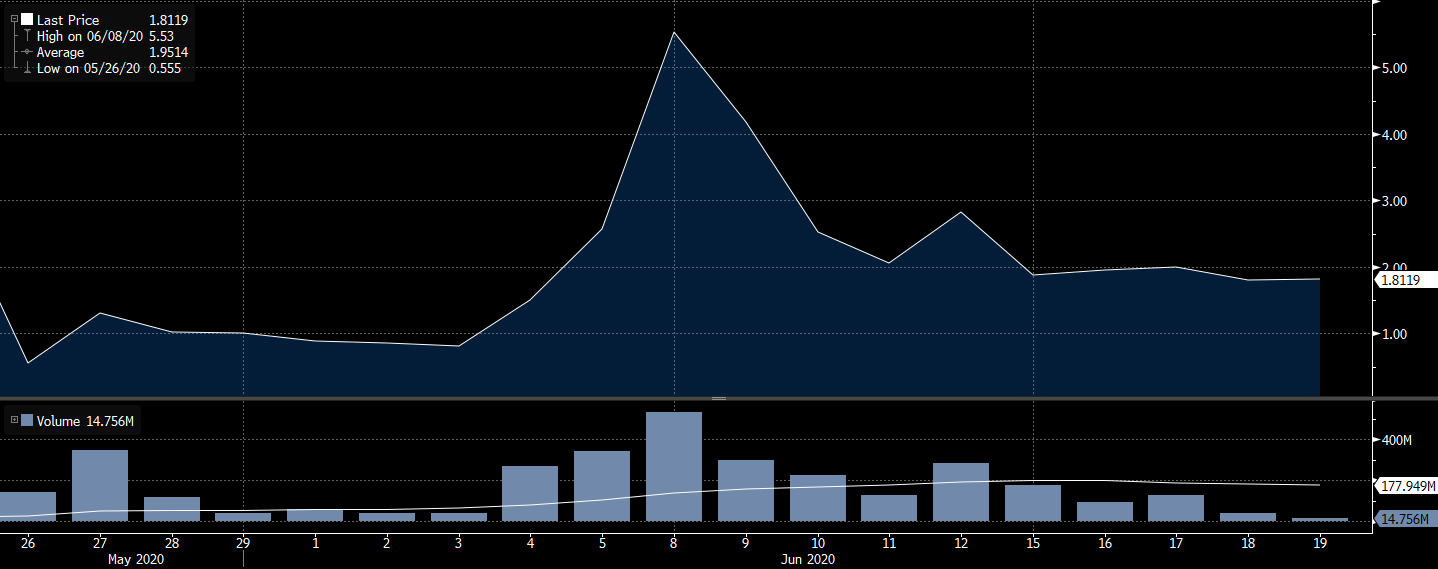

Recently, traders have piled into cheaply priced stocks such as Hertz. However, unlike the Citigroup situation where there was only a threat of bankruptcy, Hertz is truly distressed due to the pandemic and has declared chapter 11 bankruptcy. Stock owners have the last claim on the company’s assets after all creditors have been paid. We believe that the odds of the stock having substantial residual value for equity holders are very low. Hertz’s unsecured debt is trading at $0.31 to the dollar, so it is likely that the stock is totally worthless.

Source: Bloomberg

Despite anticipated long-term realities, after Hertz filed for bankruptcy on May 24th, its stock price rose from less than a dollar to a peak of $5.50 after the bankruptcy filing. A trader with perfect timing could have made a return of five times her money.

Source: Bloomberg

Buying Hertz stock now is not an example of sound long-term investing nor do we believe the stock’s recent rapid rise is an example of an efficient market.

Given the potential for outsized returns, it is understandably tempting to wager on shares in stocks facing financial difficulties. But this is betting, not long-term investing, because it depends on a lucky outcome to salvage a company’s fortunes. This does not mean we avoid all companies that are facing significant headwinds from the current crisis. An investor must have a thesis about why the company is resilient and will be able to capitalize on the crisis despite the headwinds it faces.

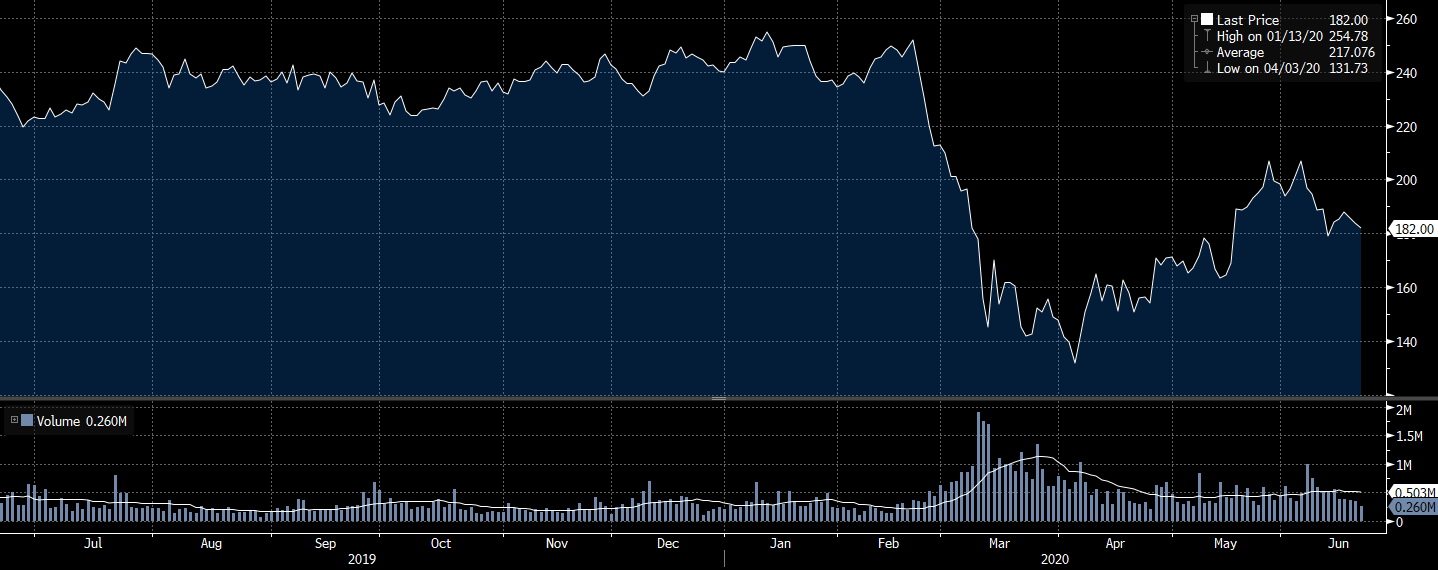

Consider Vail resorts, a company whose shares are owned by one of our fund managers. Vail is the premier ski resort operator in the country and as you would expect has faced headwinds from the pandemic. But it also has the opportunity and resources to grow further by capitalizing on the distress of many smaller operators. Vail’s bonds are trading at a premium to par, so there no hint of financial distress, and its stock price has begun to slowly recover from the lows of March.

Source: Bloomberg

We seek to make money for our clients over time by compounding capital. We place capital with managers that aim to avoid a high risk of significant long-term loss. We ask fund managers to state a clear understanding of the stocks they own and the challenges and opportunities they face. We would rather leave Hertz and other cheaply priced stocks to others because they represent a short-term approach to investing that we do not favor.