Insights

COVID-19 Update: Searching for Balance in an Uneven Recovery

In April, global stock markets staged a remarkable recovery from the sharp selloff in March. As of May 1st, the global stock market as measured by the MSCI All Country World Index was down -14.5% for the year. This is a relatively modest decline given that the response to COVID-19 has included sweeping lockdowns, the shuttering of entire sectors of the global economy, and rapidly rising unemployment. Aggressive policy action from the Federal Reserve, the European Central Bank and other institutions has buoyed the equity markets. By pumping trillions of dollars of liquidity into capital markets and backstopping credit markets, central banks short-circuited the panic selling in late March. But closer scrutiny of global stock performance reveals that the stock market rebound has been highly uneven. Indeed, only a few sectors and companies have propelled the market higher. Market dispersion, the variance between returns, is unusually high across countries and sectors. In the United States the technology sector is only down -2.5%, buoyed by Microsoft (up +11%) and others. By contrast, the US energy sector is down -39% this year, and even the once indomitable Exxon is down -37.3%.

There are several reasons why some sectors of the global stock market have rebounded and others have not. First, investors have not surprisingly favored countries with both a strong health care response to the pandemic and the financial strength to stimulate their economies post crisis. A prime example is China. China’s stock market has performed very well in 2020 because of its aggressive and apparently successful campaign to contain the virus, though skepticism about China’s data on the pandemic remains. China also has the financial resources to provide ongoing economic support to domestic industries. The US is another country where investors have responded to huge monetary and fiscal stimulus programs. With regard to both health care and stimulus capacity, developed countries are generally in more favorable positions than emerging markets, with the notable exceptions of China (which is technically still an emerging market), South Korea, and Taiwan. Indeed, Chinese stocks have outperformed US stocks so far this year. The chart below tracks the performance of the MSCI China index in white and the S&P 500 in blue since the beginning of the year through May 3rd.

Source: Bloomberg

Second, stocks in some sectors of the economy have performed far better than other sectors. This sector dispersion is even higher than the differences between countries. For example, in the United States, the health care sector is down -3.5% year to date but financials are down -27.8%. In Europe, health care stocks are actually up +0.5%, whereas banks are down -42%. China’s small cap index performance of -9.7% is surprisingly good when compared to the US small cap index, which is down -24% for the year.

Between sectors and geography, the type of industry a company is in has been more determinative of its performance. Many of the stocks that have performed well during this crisis are in sectors that outperformed for several years before the pandemic. The most obvious examples are well known market leaders such as Microsoft (up +11%) and Alphabet (down -1%) in the United States, and Tencent (up +6.3%) in China. The strong performance of these technology giants has been mirrored in smaller companies in the same economic sectors that share similar characteristics.

As we assess which fund management styles and individual stocks may continue to perform well in this challenging market, we are looking for three key attributes at this time:

- Financial Strength. Companies with significant recurring revenues, high returns on capital, and low financial leverage are better positioned to ride out a crisis. These companies typically generate substantial free cash flow and therefore are less impacted when capital markets freeze up.

- Unique Product. Companies with unique product offerings have stronger market position. These companies add value due to strong intellectual property holdings (e.g., a technology company with a strong patent portfolio in 5G). A negative example would be a commodity export company that faces global competition and cannot add value to the commodity it sells.

- Secular Tailwinds. Companies benefiting from long-term economic trends have an advantage. For example, the world is producing and consuming more and more data. Several different types of companies benefit from this trend, including semiconductor manufacturers and cell phone tower providers.

Companies with these three traits tend to be clustered in technology and health care, and most investors consider them “growth” companies. The stock performance of these companies has far exceeded that of more asset-heavy, high-fixed cost firms in the industrials, energy, and materials sectors, or companies with a high degree of leverage such has banks. Many of these sectors were already facing headwinds before the pandemic. For example, energy firms are challenged by increased adoption of energy efficiency and electrified transportation as households and governments react to climate change. Long-run growth in oil demand was already in doubt, and the implications for investors of even a small shift in fossil fuel demand growth is substantial – as the decline in coal company stocks since 2011 has already demonstrated. We are monitoring additional headwinds, including the following: Governments, households and corporations will exit this pandemic crisis with even more debt. This limits future growth in the financial sector and increases existing balance sheet risk for banks. Further, many industrial firms have significant end market exposure to aviation, an industry whose recovery will be slow and difficult. Finally, for many companies, supply chain disruptions will increase costs at the same time that current demand is soft.

As we consider the prospects for various sectors and companies, we look at the interplay between current valuation and potential future growth. If a company’s earnings increase, it can provide a margin of safety analogous to a cheaper valuation. For example, if you purchase a company trading at 10X earnings that has no earnings growth, in five years the stock would likely not have appreciated. A company trading at 20X earnings with 15% earnings growth can have its multiple cut in half to 10X, and in five years the stock would also be flat due to the growth in underlying earnings.

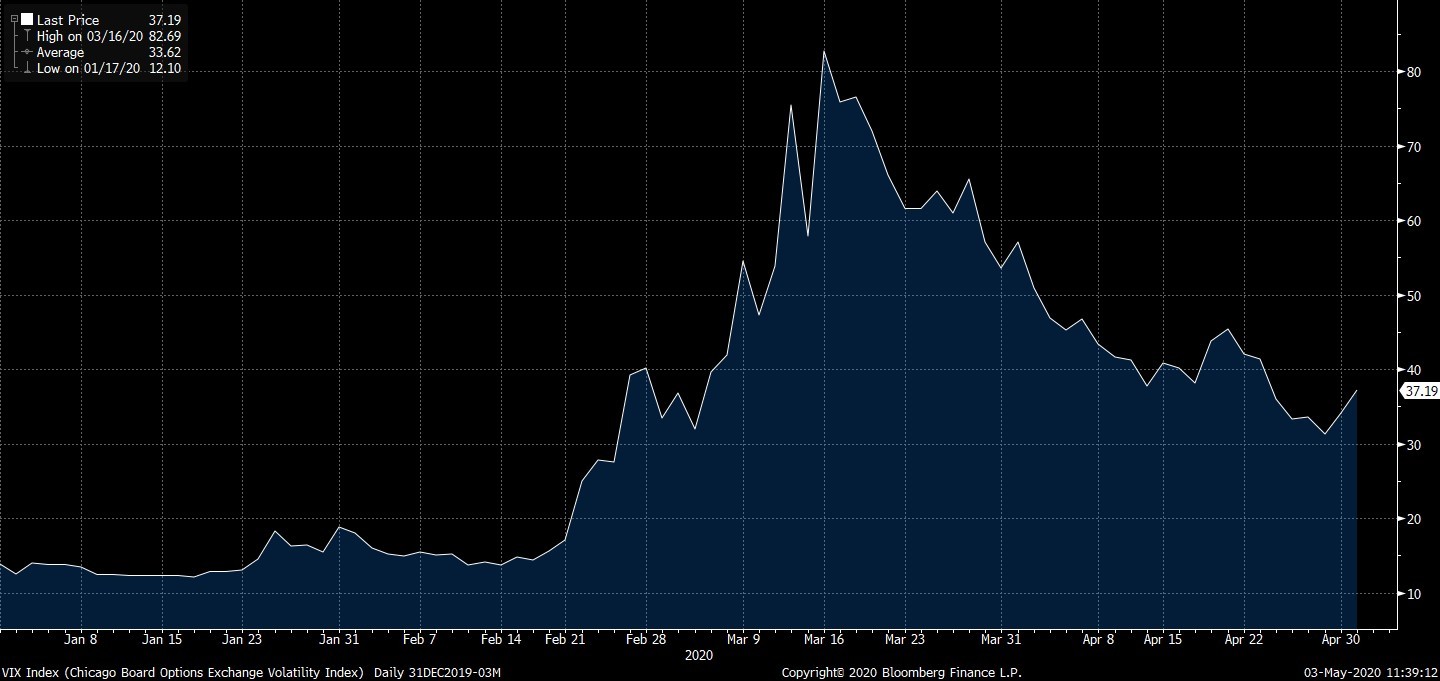

Given the huge uncertainty facing investors this year, we think stocks will remain very volatile. The VIX, a measure of market volatility, has come down from record highs but is still at three times its level in January. The economic shock of the virus has caused many companies to pull future earnings guidance because they still cannot assess the impact on future profitability.

Source: Bloomberg

We think the pandemic will accelerate pre-crisis trends and higher growth companies that were successful prior to the crisis remain well positioned. We remain vigilant, however, as we assess future opportunities for our clients, knowing that the pandemic has impacted various countries, sectors, and companies in different ways, leading to wide divergences in stock performance.