Insights

COVID-19 Update: Stock Valuations Amid Uncertainty

Markets were buoyant last week. The white line on the chart below shows the sharp fall and rise of the S&P 500 since the start of the year. Although it has bounced, the stock market remains well below its February peak. But the blue line, which represents the price of shares divided by expected future earnings, has rebounded to pre-crisis levels. This “forward price/earnings ratio” measures how much investors are willing to pay for a dollar of future corporate profits, and is thus a measure of how cheap or expensive the stock market is at a given time. The forward price/earnings ratio of the S&P 500 rose dramatically last week, even though corporate earnings are under significant pressure. High ratios typically mean that stocks are expensive and will provide lackluster future returns.

Source: Bloomberg

Typically in a time of crisis, investors with “dry powder” can purchase companies that trade at low price/earnings (“P/E”) multiples of diminished, crisis-impacted earnings. Thus they doubly benefit from the growth of earnings as the economy recovers and the expansion in P/E multiples as confidence returns. This combination can lead to very high stock market returns. For example, in December 2008, the P/E multiple on estimated future earnings was 12.5. In addition, estimated future earnings had declined by 33%. Over the ensuing bull market, earnings grew by 170% and P/E multiples also expanded to 20 times forward earnings. By January 2020, investors were therefore willing to pay 60% more for a future dollar of earnings than they were in 2008!

Where are we now? Unfortunately, given the speed of the crisis, its uncertain duration, and growing economic impact, there is a very wide dispersion in estimates of future corporate earnings. Many public companies are simply retracting any future guidance on profits, leaving analysts to make their own estimates. This means that bottom-up estimates of future market earnings, compiled from company-specific forecasts, are lagging the top-down estimates that are created based on macro-economic forecasts. As we go through this year’s earnings season, which starts this week, these views will converge. For now, we must look at each independently.

First, the top-down perspective. When we aggregate forecasts by our research providers and major banks such as Goldman Sachs, we estimate that the top-down consensus for 2020 S&P 500 index aggregate earnings is approximately $115/share for 2020 and about $152/share for 2021. The closing price for the S&P 500 on Thursday was 2789. This means that the market is trading at a forward P/E multiple of 24 times 2020 earnings estimates and 18.3 times 2021 estimates. Remember that in 2008, the comparable multiple was 12.5 times forward earnings. For additional context, last year’s S&P 500 earnings were estimated in January to be $161/share. In January, analysts also forecasted approximately $175/share in earnings for the S&P 500 for 2020. At the market peak in early February, this resulted in a P/E multiple of 19.3 times 2020 earnings. Estimates for 2021 earnings at the start of this year were $193/share. This means that top-down estimates of earnings for 2021 have declined by 21%. At the market peak in early February, investors were willing to pay 17.7 times 2021 earnings estimates, and at present they are paying 18.3 times the revised 2021 estimates. Paying a higher multiple for less certain future earnings is unusual. Typically in periods of extreme uncertainty, investors heavily discount future earnings, and pay a lower multiple.

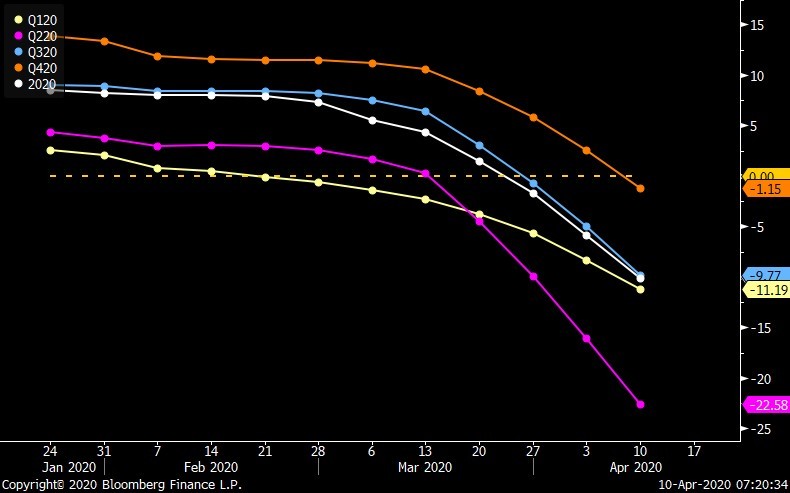

Next, the bottom-up perspective. Bloomberg aggregates individual analyst estimates of future corporate profits. These estimates have been declining steadily as analysts assess new information and revise their opinions about the future profitability of the companies they follow, as you can see in the chart below. Estimated profits for the second quarter (the pink line) are dropping particularly fast.

Source: Bloomberg

Although they are coming down, bottom-up estimates for the second quarter look too high to us given that we expect the global economy to face severe disruption in the next few months. Current bottom-up forecasts for 2020 result in $146/share and 2021 forecasts are for $173/share. Compared to top down forecasts, 2020 bottom-up earnings estimates are approximately 20% too high and 2021 estimates are approximately 12% too high. Stocks usually do not enjoy a sustained rally when expected company earnings are declining, as investors are cautious about placing a forward multiple on a moving target. Generally, the end of downward revisions in estimates sets a floor for stocks as it signals that future bad news is now priced in.

Expected future earnings drive stock market returns. Even as we try to look beyond the massive short term dislocation, we believe that the economic impact of the pandemic will linger, and company earnings in 2020 and 2021 will be materially below the pre-pandemic forecasts. China seems to demonstrate this, as consumers there have been slow to spend and many social distancing measures, such as the closure of cinemas, remain in place even now. If the more conservative top-down forecasts are correct, investors are placing an elevated multiple of 18.3 on 2021 earnings. If the economy is slow to open this year and the economic damage stemming from the pandemic lingers into 2021, then stocks are relatively expensive now. We continue to be cautious with the “dry powder” we have set aside for our clients because stocks do not seem cheap.