Insights

2023 Q1 Review: Stock and Bond Relief Despite Bank Collapse

Despite the failure of Silicon Valley Bank (SVB) in March, the first quarter provided welcome relief to stock and bond investors as the S&P 500 Index gained 7.5%, the MSCI All Country World Index (ACWI) gained 7.3% and the Bloomberg Aggregate Bond Index (AGG) gained 3.0%. The economy is slowing and corporate earnings forecasts continue to decline, raising caution about the near term outlook. Yet, these lower growth expectations are helping lower interest rates, which led to higher bond prices and sparked a rally in a few growth stocks that dominated stock market returns for the first quarter.

Our investment outlook remains consistent. At the company level, we focus on the trajectory for growth and profitability (typically captured by revenue, earnings per share growth and operating margin) and in light of these trends, we review the company’s valuation as compared to the overall market. We look at the price-to-earnings ratio for a company relative to its closest peers and its own history, and ask ourselves: Are investors overvaluing or undervaluing current growth and profitability trends, and can we capitalize on any apparent discrepancy?

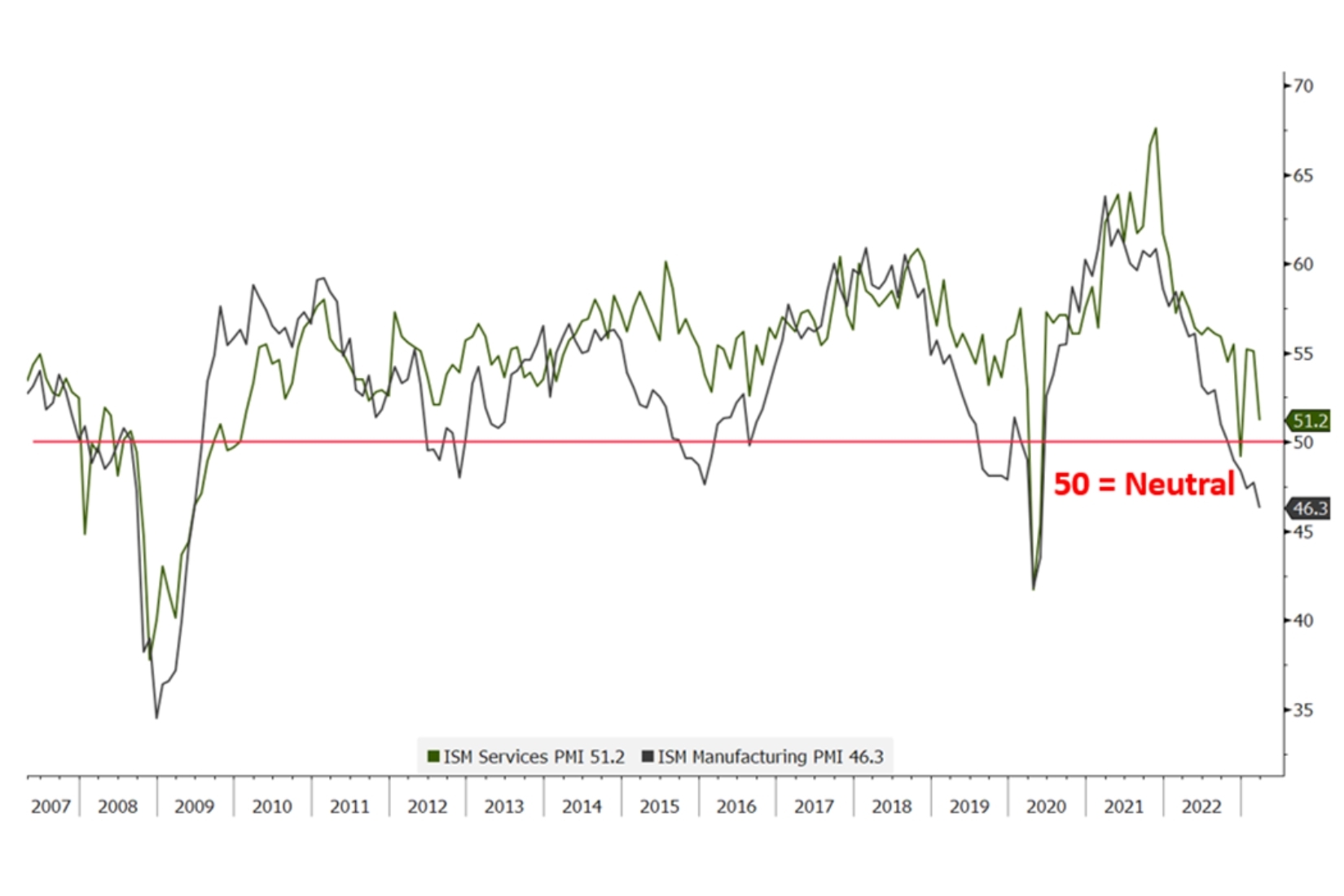

At the macro level, we aim to interpret economic data through this same prism. What do leading economic indicators such as the ISM surveys say about economic growth? How are company earnings forecasts trending? What does the current unemployment rate say about household consumption (a key pillar of economic activity), and what are expectations for inflation?

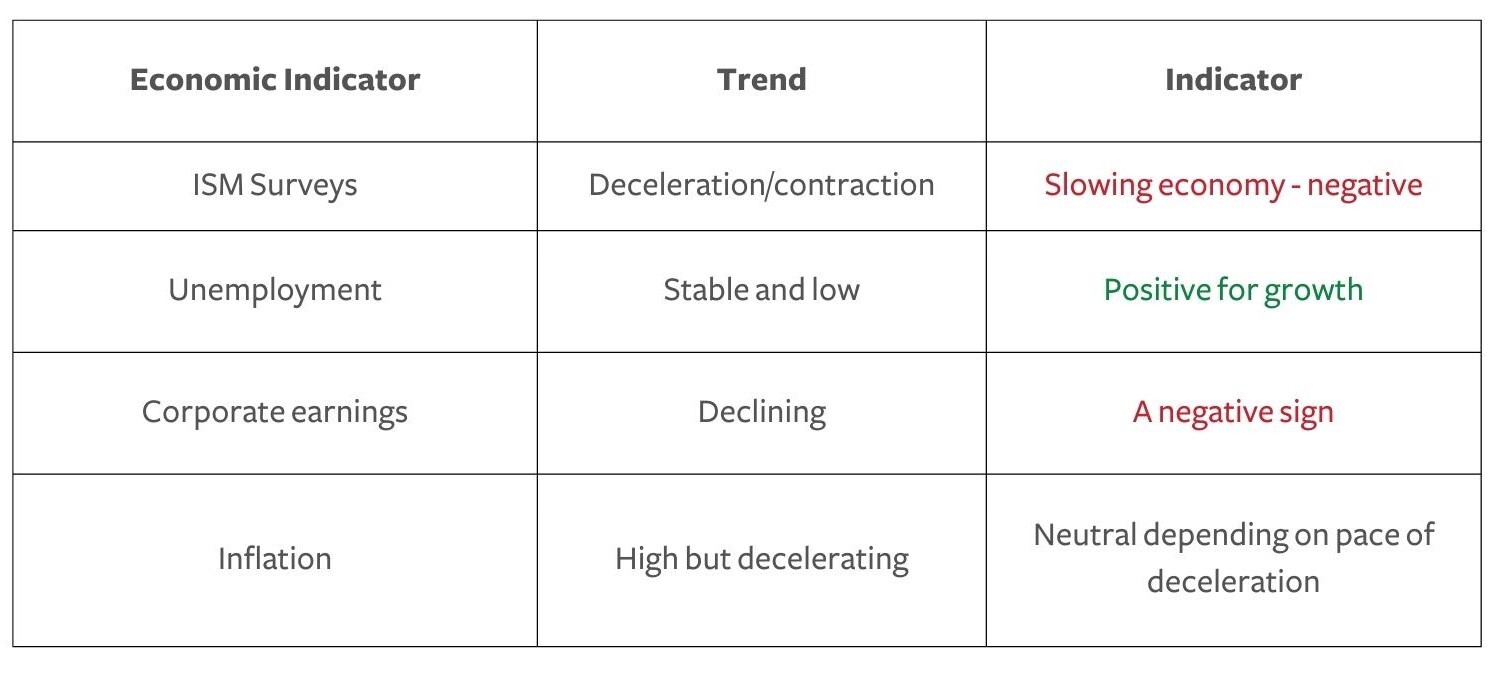

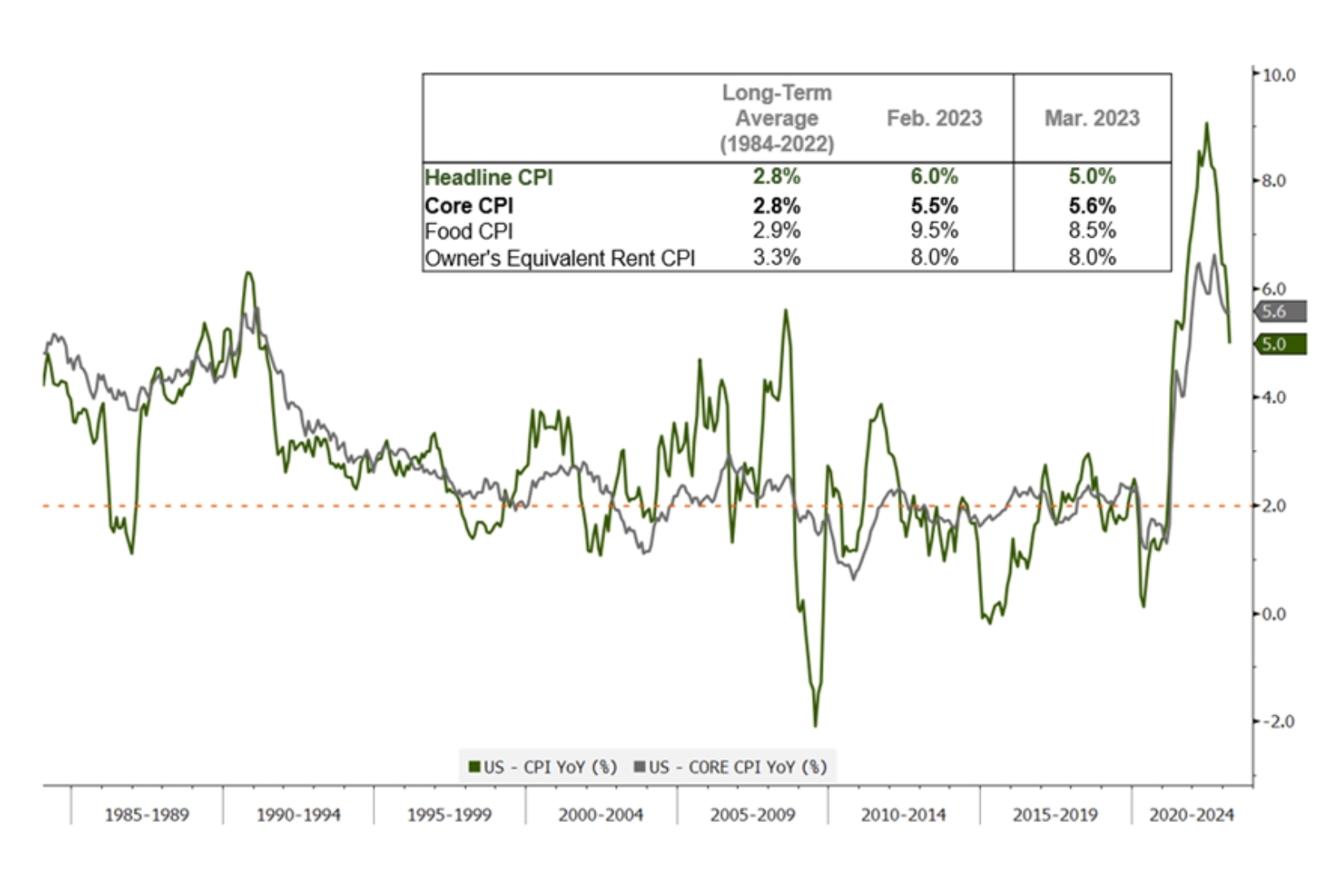

With the Federal Reserve raising interest rates rapidly in order to slow the economy, inflation trends are having an important impact on economic activity, corporate profitability, and company valuations. As long as inflation remains strong, the Federal Reserve will continue to act to brake economic activity. The table below highlights the contradictory trends that affect the economic forecasts. We remain cautious.

The surprising collapse of SVB and Signature Bank rattled investors in March and strained liquidity at many deposit institutions across the country. Unlike the credit concerns that caused most bank collapses in the past, the main problem at SVB arose from the rapid rise in interest rates last year and the subsequent mark-to-market losses in the bank’s investment portfolios in recent months.

If SVB had been able to hold these securities until maturity, the Bank would not have incurred any loss. However, there was a timing mismatch between the duration of the investment portfolio and the stickiness of the deposits that funded this portfolio. SVB catered to Venture Capital and younger companies, which raise and consume lots of capital as they struggle to survive and thrive. SVB saw tremendous deposit growth over the last few years. Unable to originate loans at such a pace, SVB made two fateful decisions in order to earn a yield on these new deposits.

- Like most banks, SVB assumed that savings and checking account deposits would be sticky and a stable, long term source of funding. This turned out to be a wrong assumption.

- Like many investors, SVB thought that interest rates would remain low in 2022, and that the Federal Reserve would not raise interest rates rapidly. With short-term interest rates near zero, SVB decided to buy longer maturity securities to “pick up yield.” The longer the maturity of a bond, the more sensitive its price is to rising interest rates.

These two decisions created a timing mismatch and a liquidity crisis when the Federal Reserve surprised markets and rapidly increased rates. This caused SVB to post unrealized losses on its investment securities. In addition, deposit outflows increased as venture funding cycles lengthened and startups burned through their cash. Fears mounted that SVB would need to sell securities in order to fund deposit outflows, which would require the bank to realize losses, hurting capital ratios. This became a self-fulfilling prophecy and eventually the institution suffered a mass exodus of deposits, forcing the bank to close and regulators to step in.

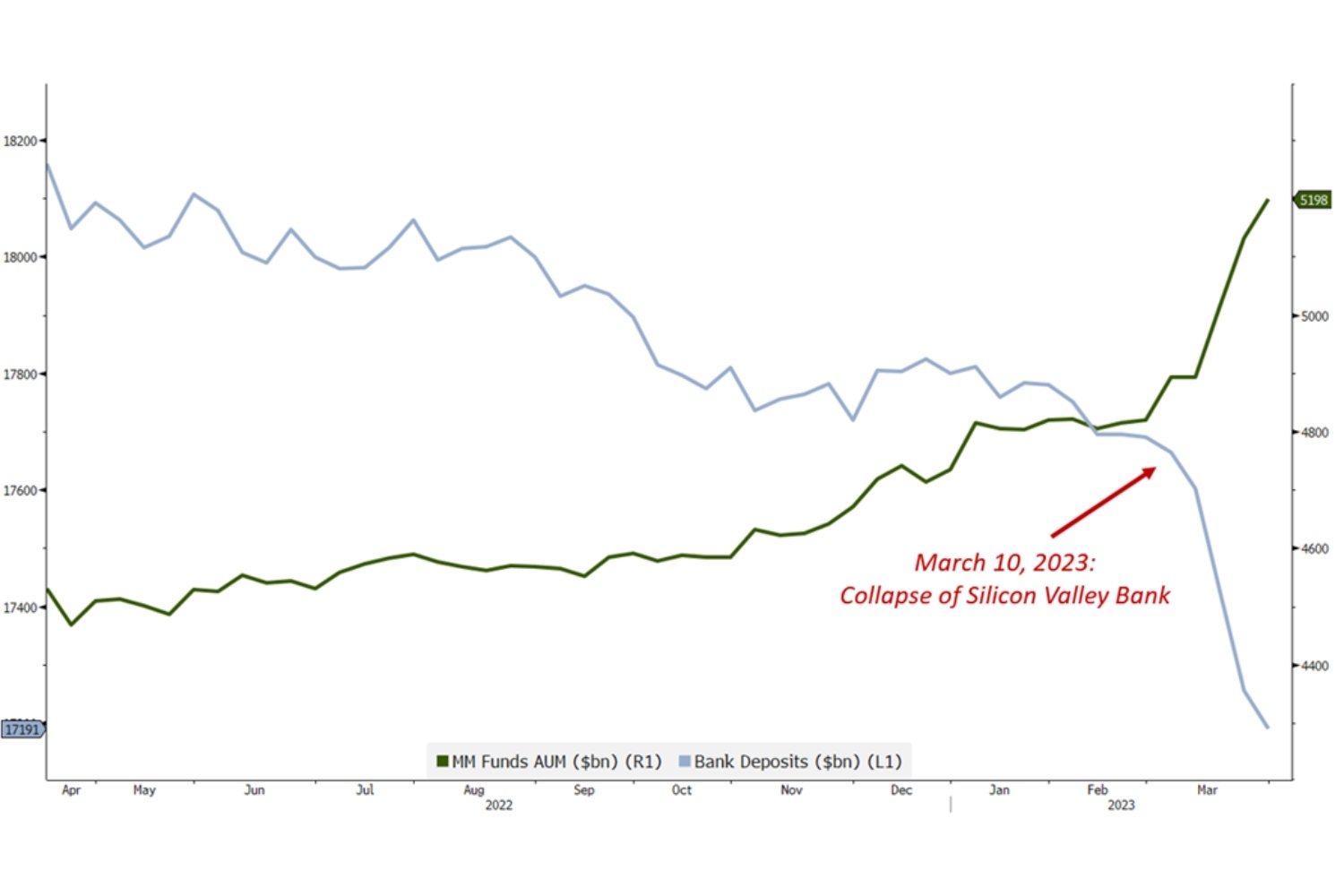

SVB’s concentration of deposits from the close knit venture industry was an outlier, but most banks are facing some deposit outflows as depositors realize that money market funds are offering substantially higher rates of returns. To stem the outflow, banks will need to significantly raise deposit rates, which will hurt their profitability. The chart below demonstrates how bank deposits were shifting to money market funds prior to SVB’s demise, but the flows have accelerated since that date.

Other banks also face mark-to-market losses on their investment securities. Not knowing the extent of deposit outflows and seeking to avoid being forced to sell these securities, banks will preserve liquidity by reducing the pace at which they make new loans. In the last two weeks of March, the Federal Reserve indicated that total commercial loans decreased by 1.2% or $35 billion. This pullback may be temporary, but if there is further retrenchment, it will slow the economy, potentially lowering corporate growth and profitability.

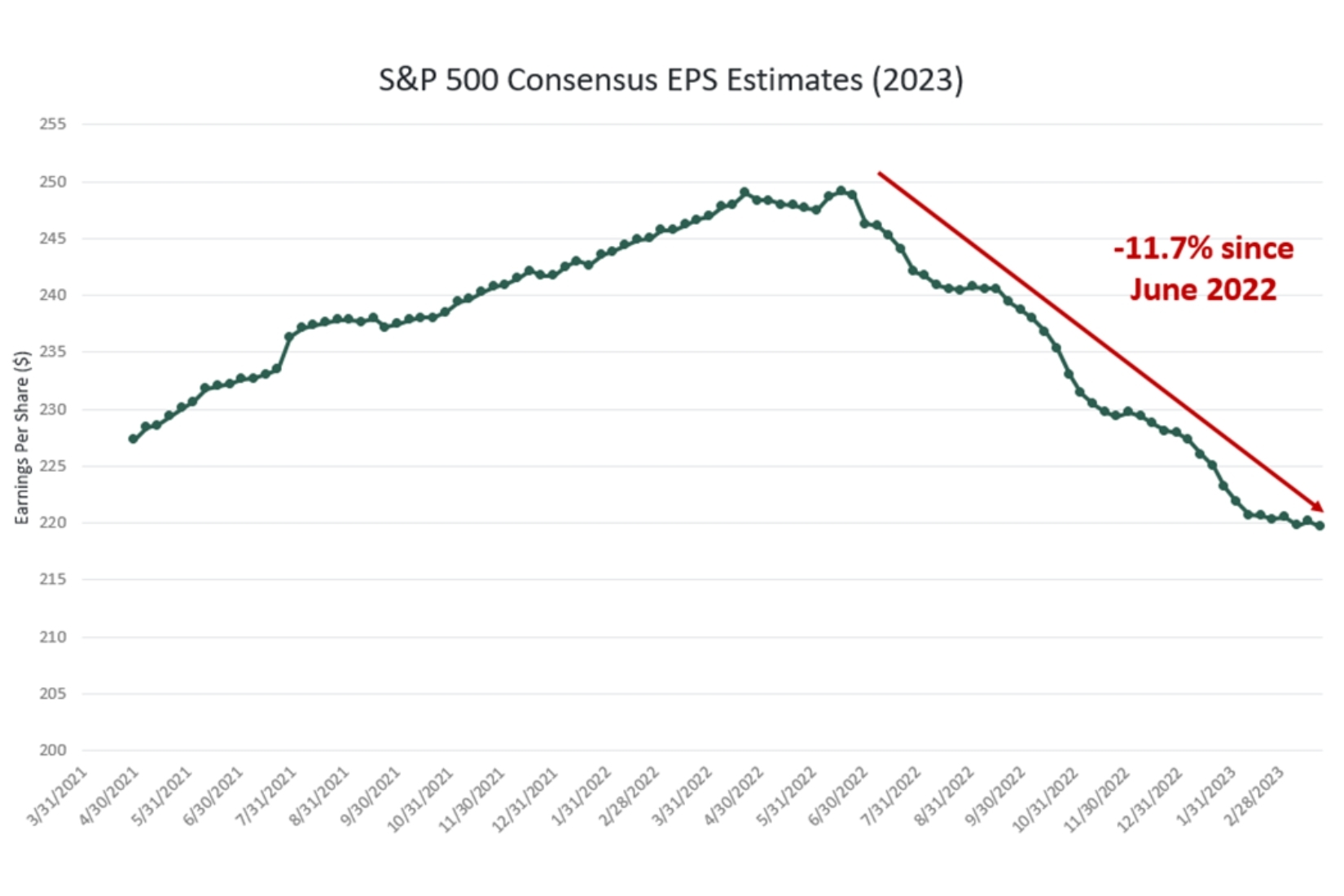

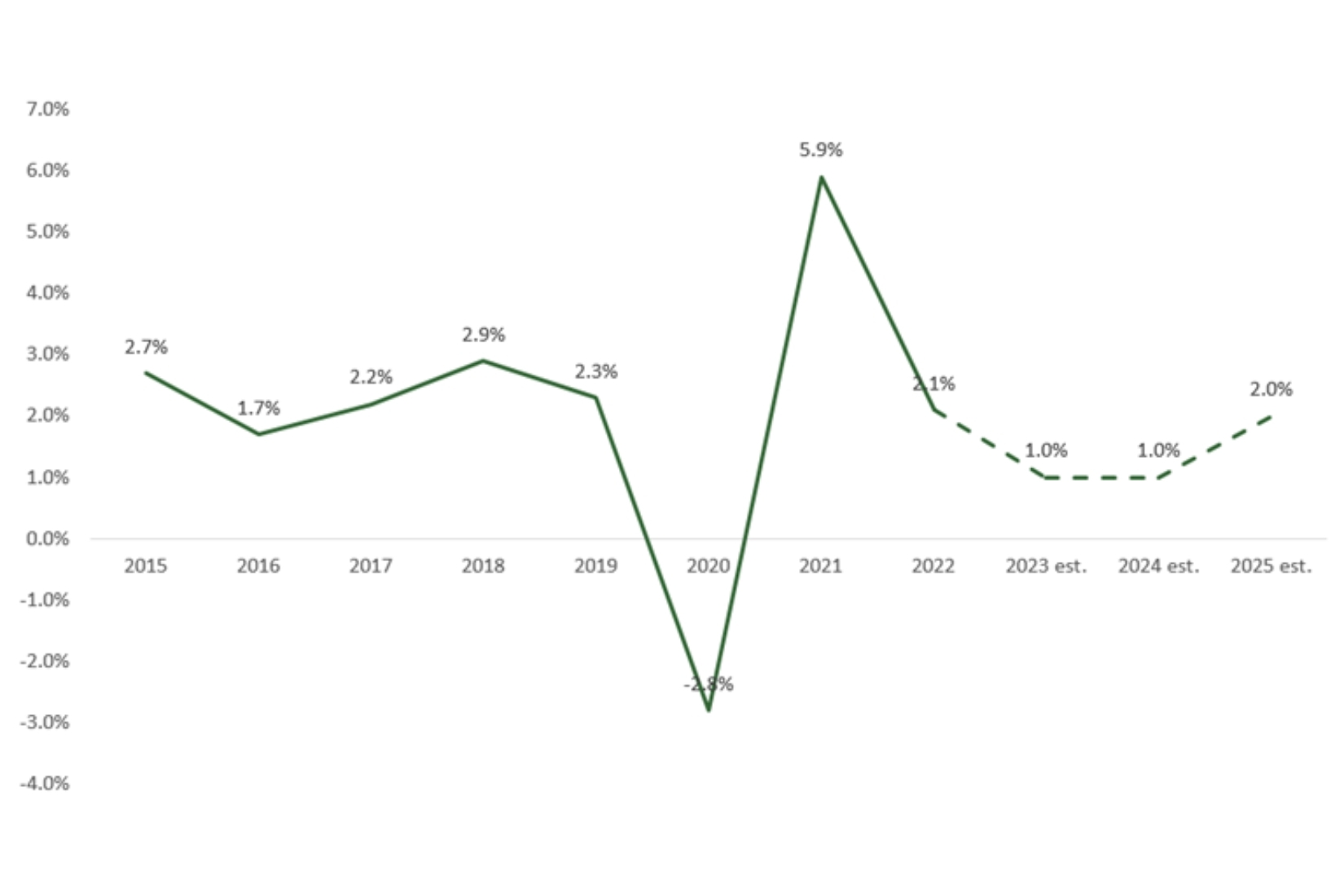

As we highlighted in our opening paragraph, corporate earnings forecasts have declined over the last few quarters:

Banks were expected to be a significant driver of 2023 corporate earnings, so any decline in bank earnings will affect forecasts for the market as a whole. In addition, recent economic data point to softness in manufacturing activity and a deceleration in spending on services.

A broad slowdown in economic activity will put further pressure on corporate earnings. For example, Goldman Sachs reduced their 2023 economic growth forecast from 1.6% to 1.1% on the back of lower bank lending.

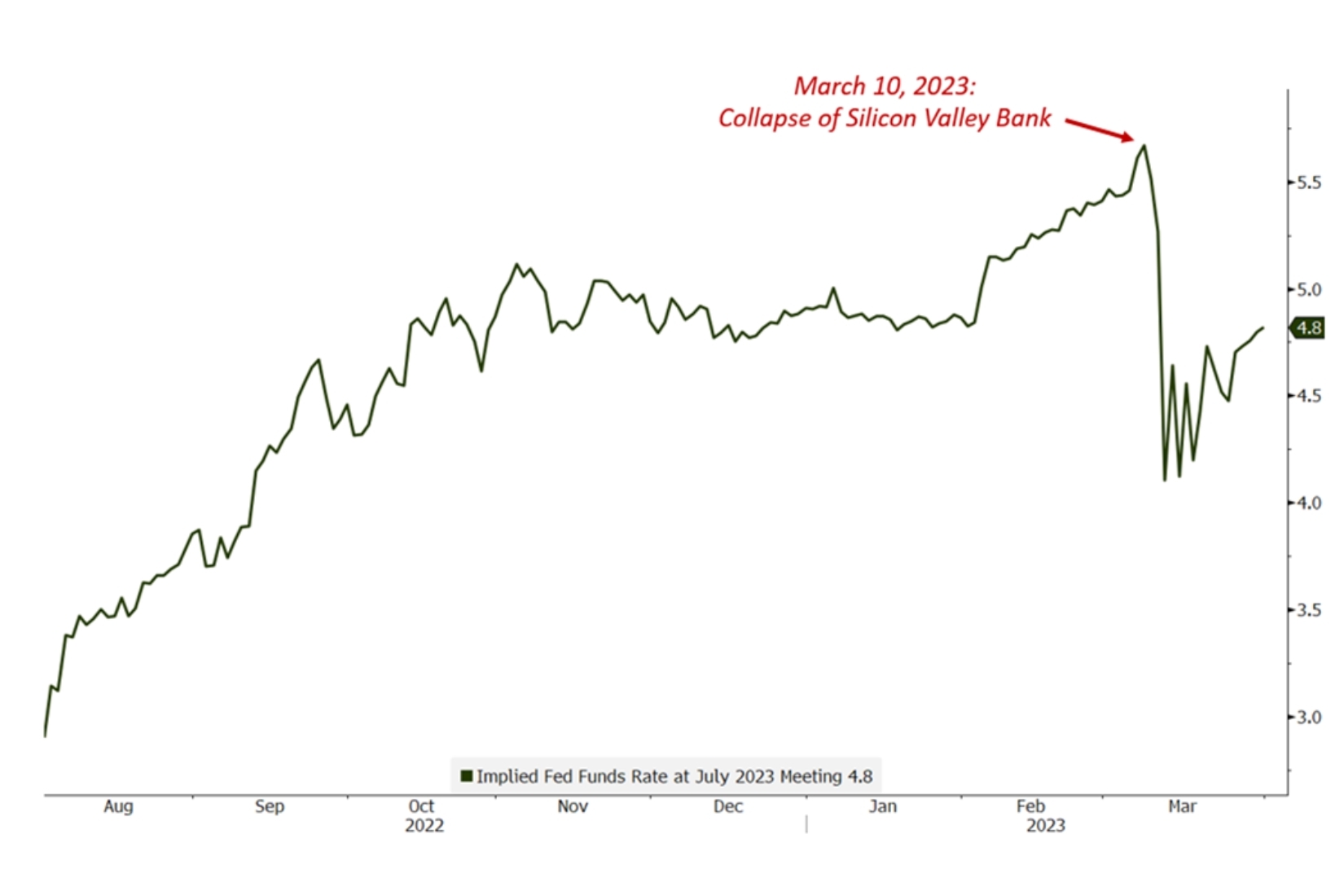

Offsetting these headwinds, slower growth will help reduce inflationary pressures and future expectations for higher interest rates. These factors will be more supportive of economic activity in the medium term. Markets quickly reacted to the SVB issue by quickly shifting expectations downwards for Federal Reserve action in the future.

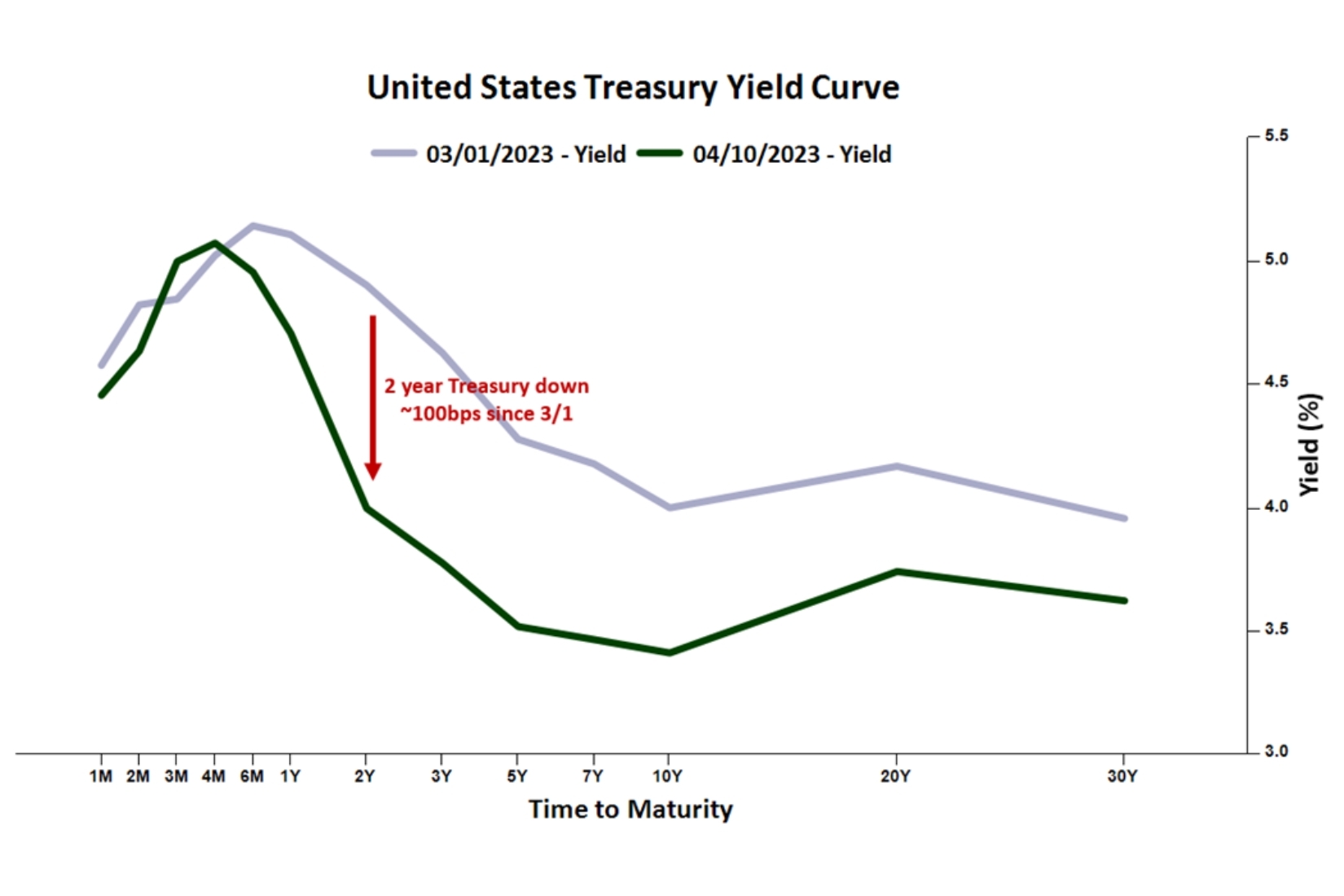

Also, interest rates across the yield curve shifted downwards, which is lowering interest rates for companies and households, and reducing the level of mark-to-market investment losses for banks and others. This market reaction is a positive for economic activity.

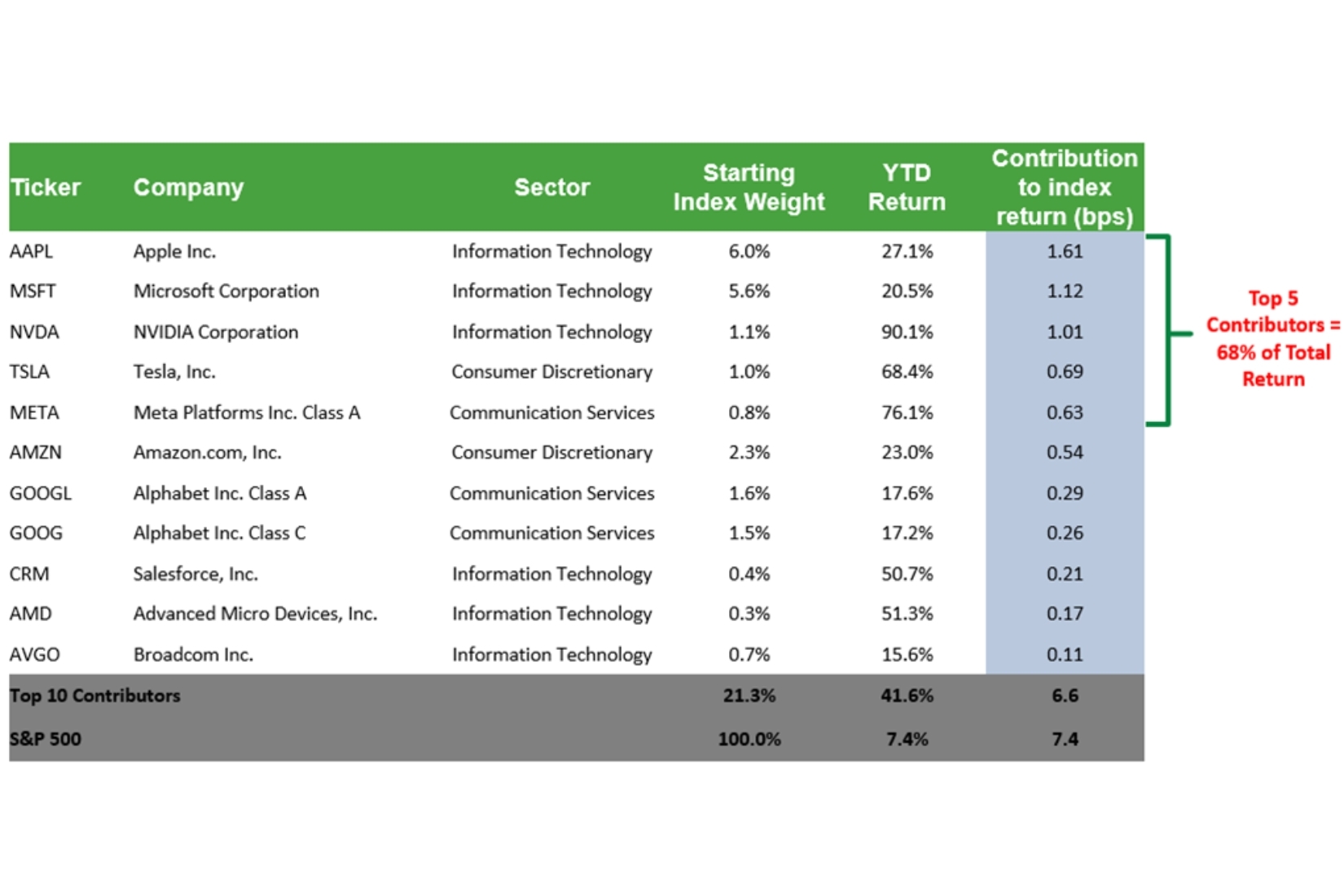

Spurred by the potential of lower interest rates, stock investors jumped back into mega cap tech stocks, such as Apple, Nvidia, Tesla and Microsoft. In essence, bad news on the economy was viewed as good news for interest rates and investors. However, the equity market returns were highly concentrated in a few securities.

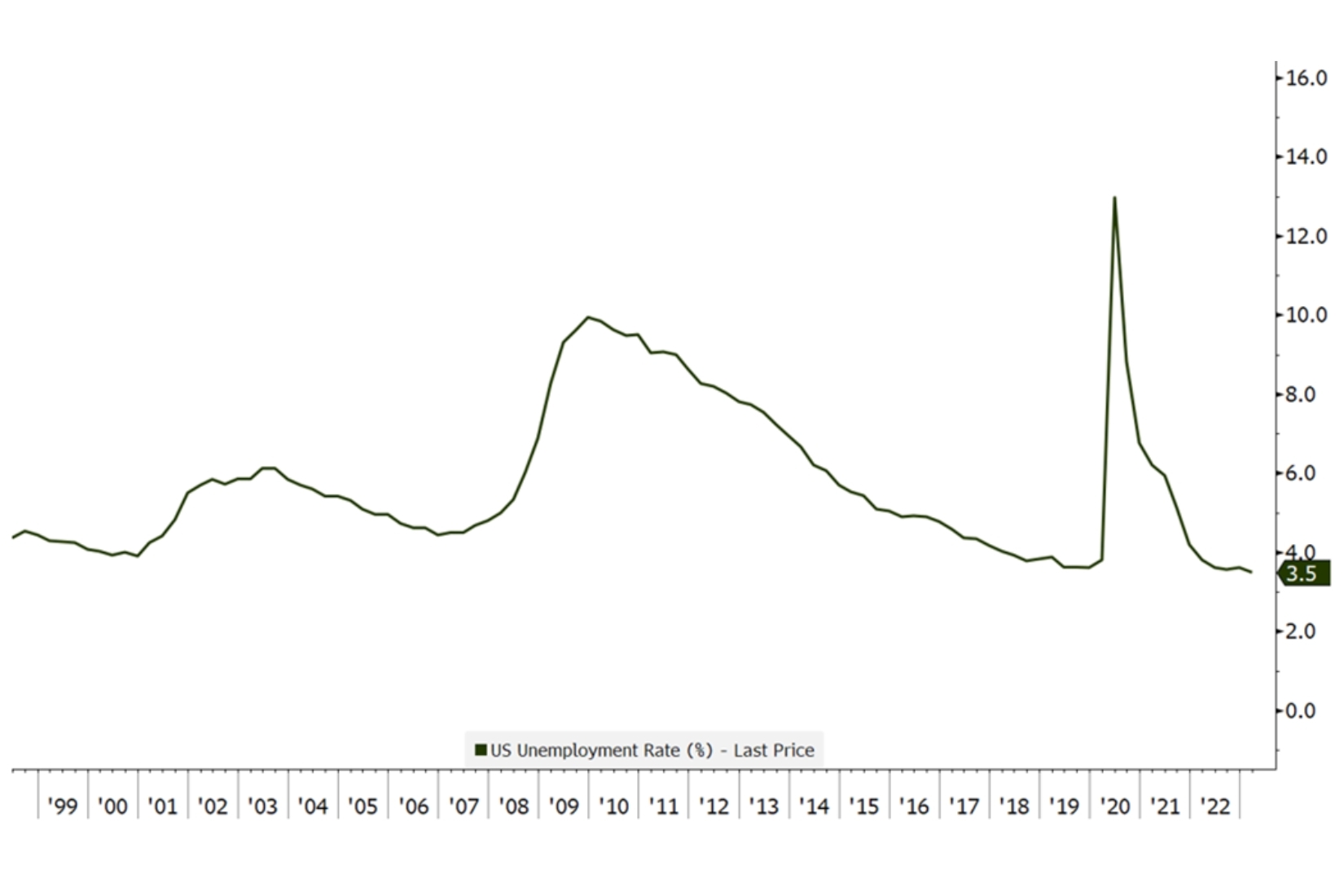

Until earnings trends stabilize and begin to move higher, it is hard to have conviction about higher stock prices. Therefore, at the moment we generally own relatively fewer stocks and relatively more bonds across client portfolios. This does not mean that we think a recession and a subsequent large market decline are inevitable. We note that unemployment levels remain very low and household spending remains robust.

In addition, although GDP growth is decelerating, it is not expected to turn negative. A stabilization and eventual return to pre-pandemic trends would be positive for investors.

Inflation continues to slow (though still high and above the Federal Reserve target). In addition, long term inflation expectations are well anchored. This downward trend in inflation provides the Federal Reserve with additional room to maneuver and react if necessary.

In this volatile market, it is important to remain patient even as you monitor rapidly shifting conditions, such as the SVB failure. We look forward to hearing from you and understanding your portfolio goals, and we hope to discuss your accounts and our outlook for this year. We want to help you navigate this nervous market and prepare you for favorable conditions on the horizon.

Best regards,

The ChoateIA Investment Team