Insights

2023 Second Quarter Review: Markets Higher Due to Better Than Expected Data in Still Slowing Economy

Stocks continued to march higher in the second quarter, reflecting a better near-term outlook for the slowing economy: rising interest rates continue to lower inflation, labor markets remain resilient, and investors show enthusiasm for Artificial Intelligence (AI) and the mega-cap technology stocks that may lead the adoption of AI. We will spend the back half of this report exploring Artificial Intelligence in greater detail.

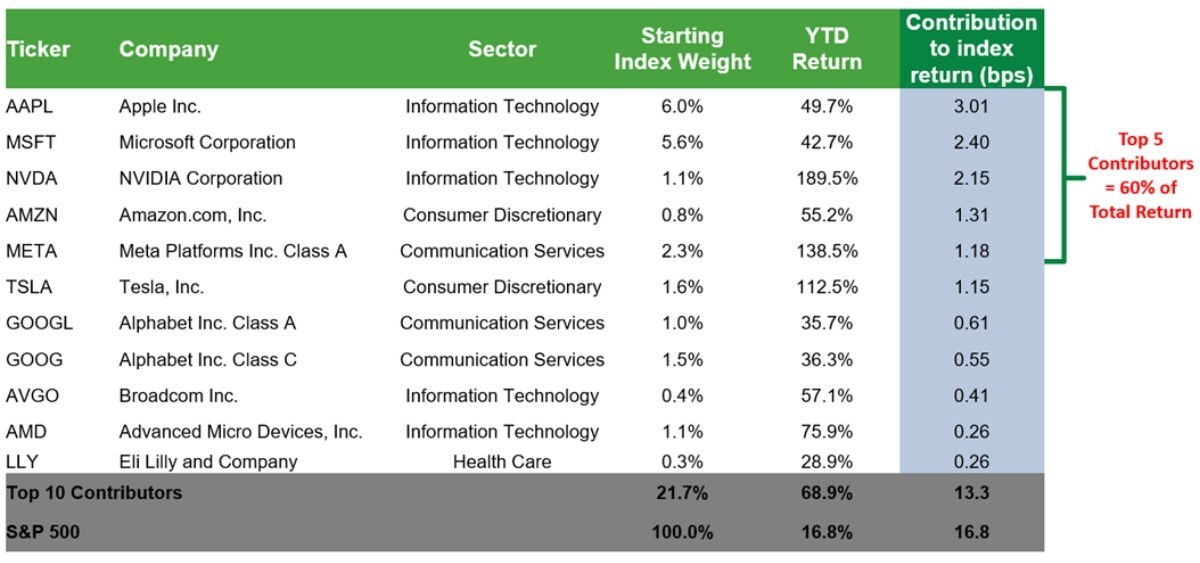

The S&P 500 Index gained 8.7% this quarter and is up 16.9% year-to-date, the MSCI All Country World Index (ACWI) gained 6.2% and is up 13.9% through the end of June. In the US, performance remained narrow, with the top 5 companies driving most of the market returns this year.

Chart 1: Top 5 Stocks Contributed 60% of Total Year-to-Date Increase

Source: Bloomberg, Choate as of 6/30/2023

In fixed income, the Bloomberg Aggregate Bond Index (AGG) fell -0.8% this quarter, but is up 2.1% year-to-date, offsetting some of the declines in bond prices last year due to an increase in interest rates.

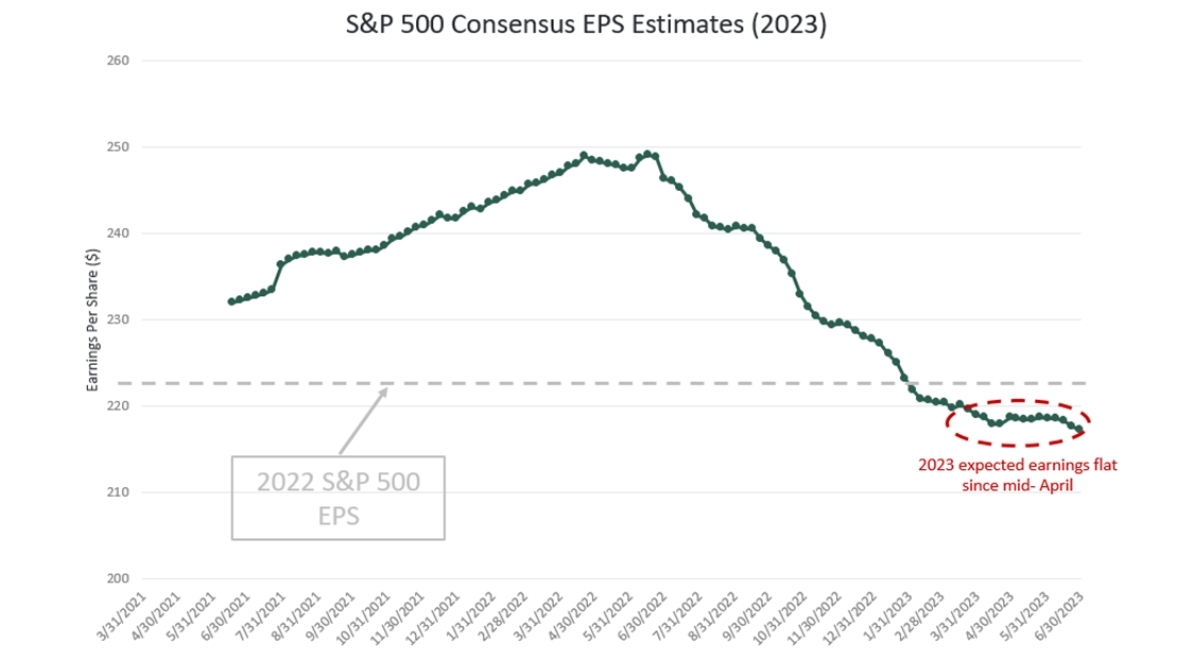

In last quarter’s update, we outlined our investment process at ChoateIA: we focus on growth and profitability at the company level, while assessing how an evolving macro environment will influence company prospects. Earnings estimates for 2023 continue to trend down and have decreased 13% over the last year (see Chart 2 below), but seem to be stabilizing, which is a necessary first step for sustained stock market returns. We will be watching the second quarter earnings season for how these trends develop over the remaining summer.

Chart 2: 2023 S&P 500 Earnings Per Share (EPS) Estimates Down 12.7% Since June 2022 Peak, but Have Stabilized

Source: Bloomberg, Choate as of 6/30/2023

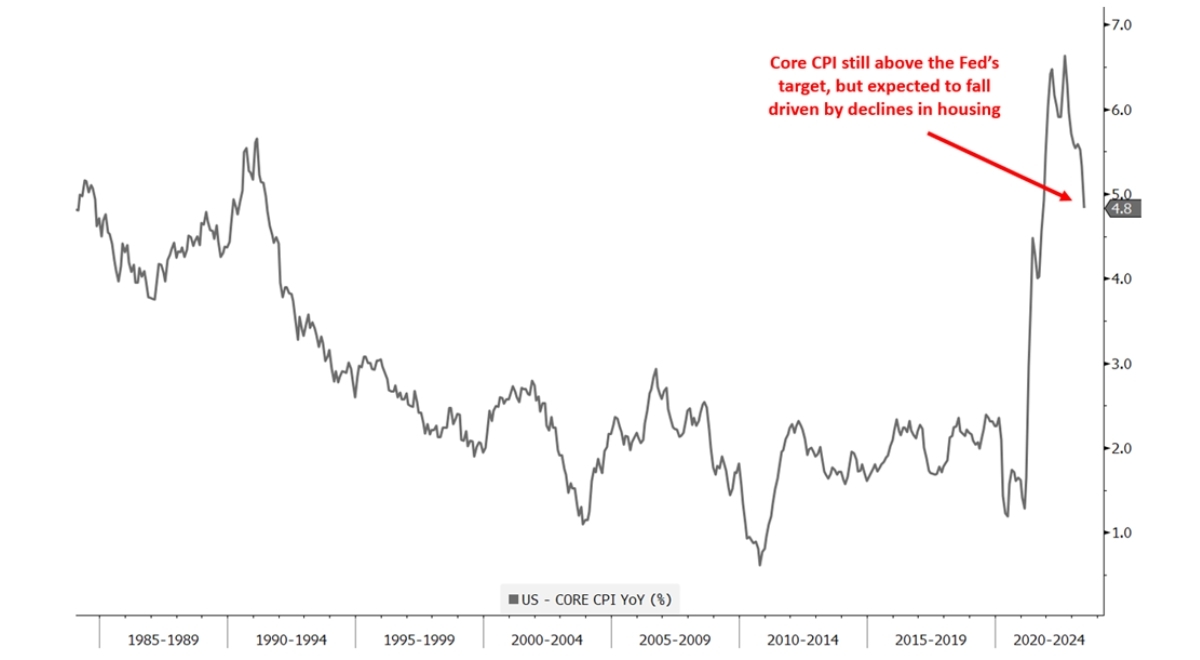

The overall economy continues to decelerate, but performance is better than many feared. We remain focused on some key indicators such as unemployment, inflation, and industrial production. Inflation is still trending downward, and it is very encouraging to see steady job growth and the stubbornly low 3.6% unemployment rate.

Chart 3: US Core CPI (% Change YoY)

Source: Bloomberg, Choate as of 6/30/2023

More importantly, investor expectations look to be more in sync with Federal Reserve policy guidance right now. Consensus on future interest rates indicates that current rate levels are somewhat “priced in” by market participants, reducing the risk of a negative surprise. Meanwhile, industrial production and other economic metrics, as captured below, in the leading economic indicators continue to come in below expectations.

Chart 4: US Leading Economic Indicators (LEI)

Source: Bloomberg, Choate as of 6/30/2023

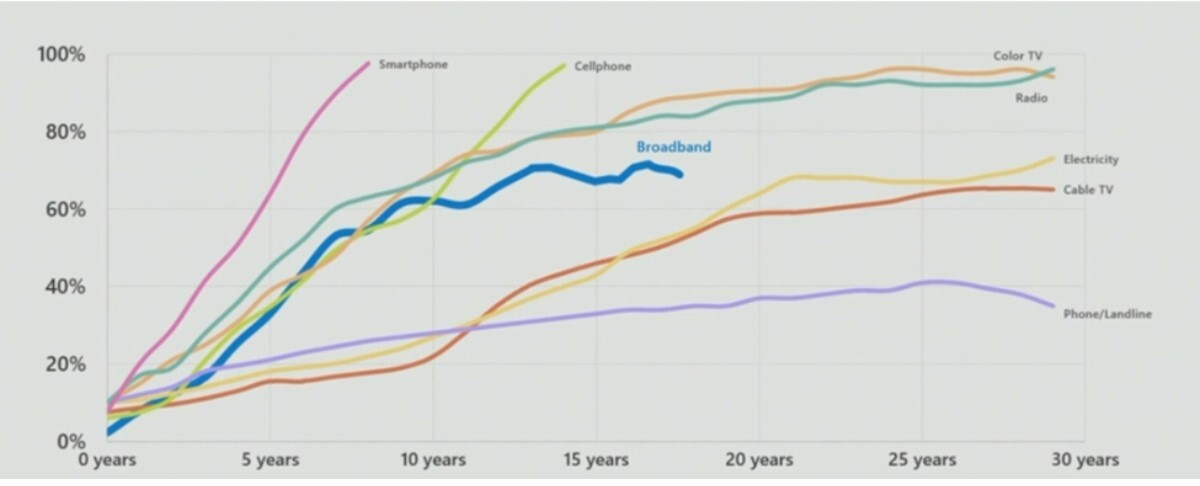

Why is AI dominating the corporate world? We are assessing secular changes in the economy, and the opportunities and challenges these shifts create for investors. AI has captured great investor interest recently. Will AI technology produce a seismic shift in worker productivity and employment or will AI’s tangible impact disappoint? Past examples of clear technology breakthroughs include the widespread adoption of electricity in the early 1920s and the broad spread of the internet and PCs in the late 1990s (see Chart 5 below). Both of these technologies transformed how we work and produce goods, and led to major shifts in productivity and economic growth. Adoption curves for new technologies vary, although recent smartphone and social media trends show rapid adoption in the first decade.

Chart 5: Adoption Curves Have Accelerated but Vary Across New Technologies

Source: Microsoft, Our World in Data, 2015

New technologies may generate winners and losers for investors, and can spark equity bubbles that ultimately burst despite the resounding success of the underlying technology. It is still very early days for AI, but we will share some initial thoughts below:

1. What is AI? Recent ‘predictive’ AI tools use algorithms to anticipate future situations and have no capacity for deliberate reasoning in performing statistical analysis and responses to prompts. However, new versions of ‘generative’ AI can create new content and bring these statistical and computational tools to everyone in the workforce without the need to write tailored programming language code. This breakthrough may open up the power of machine learning to be used by the broad population to replicate many actions/duties that are normally conducted by people, such as writing text, making videos or answering questions.

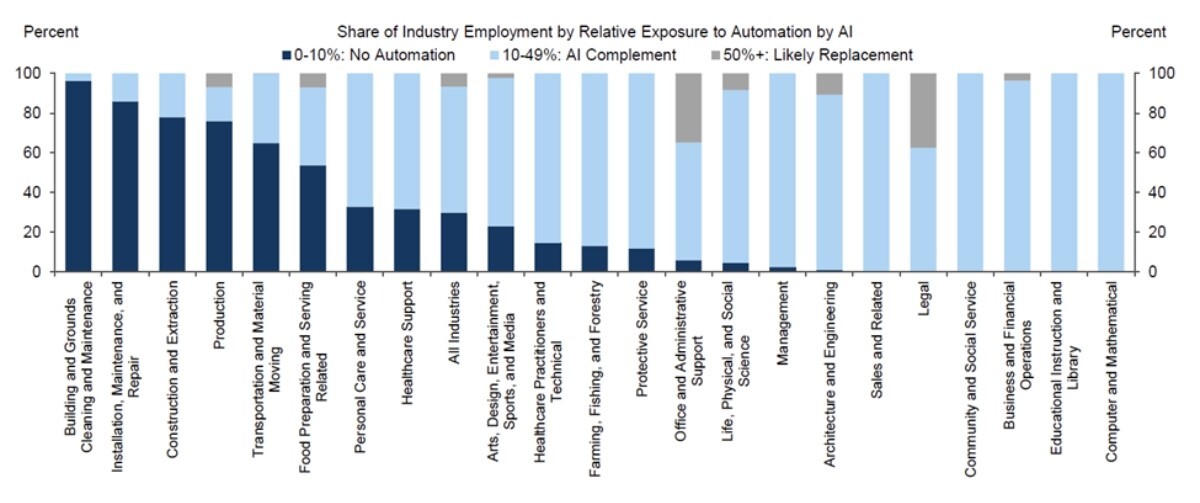

2. Where could we see the first impact of AI? Anecdotally, software developer productivity has increased by 15-20% (per Goldman Sachs) and possible future applications could include administrative activities, such as completing routing paperwork or drafting email responses, data analytics (for example, trend and statistical analysis), and design and media content generation. Many industry analysts estimate that a significant share of various workflows could be supplanted by AI (see Chart 6 below).

Chart 6: AI Can Complement or Replace Many Work Tasks Across Employment Sectors

Source: Goldman Sachs, June 2022

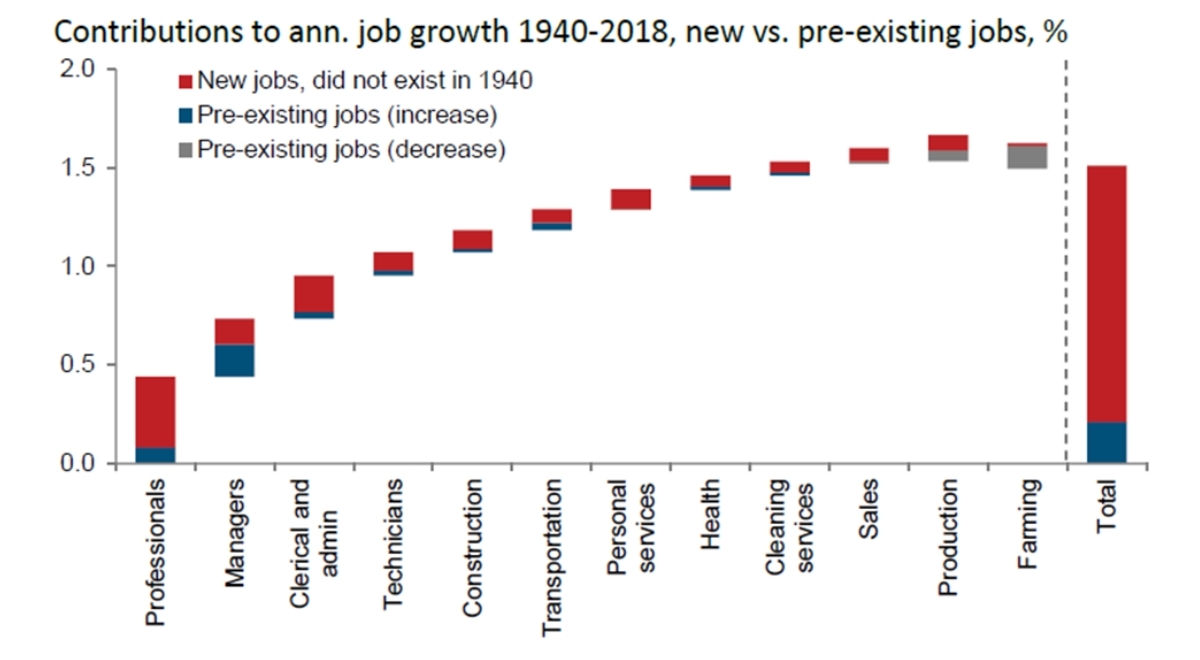

It is important to remember that the adoption of new applications can also create whole new job categories:

Chart 7: Innovation Leads to New Opportunities in the Workforce

Source: Goldman Sachs, Autor et al., 2022

3. What could be the broad impact of a wide adoption of AI? Some clerical, analytical and administration jobs will likely be replaced by AI applications. However, AI could boost overall labor productivity to 1.5% per annum or almost double the current level, according to Goldman Sachs. This would be of similar size to the boost from the adoption of the electric motor or personal computer. We believe this will benefit investors over time, but the scale and impact is impossible to determine at this early stage.

In addition, there can be a large lag of up to 20 years between the initial adoption of new technologies, and when they are fully integrated into the economy and enhance productivity. Market returns over the next twelve months are more likely to be impacted by traditional factors such as inflation, interest rates, and corporate earnings.

4. How to think of AI as an investor? Though investors may have to wait decades to assess whether AI will transform how we work, investor enthusiasm for AI is already predicting winners. At present, investors are focused on a few themes, such as:

- “Picks and shovels” companies that enable AI. These include ‘hardware’ semiconductor companies such as NVIDIA and AMD.

- Hyperscalers - companies such as Microsoft, Amazon, Alphabet and Facebook. These companies already have large and extensive computing cloud infrastructures that enable commercialization of AI data usage.

Referring back to our first chart, we note that all the companies identified as early AI winners are among the top 10 S&P 500 Index performers year-to-date. It is not enough for a technology to change how we work, results must flow to higher earnings. In addition, as with all popular investment themes, there is the heightened risk of overly optimistic stock prices. Investors need to balance enthusiasm with realistic expectations and focus on tracking benefits to earnings from AI, while also weighing company valuation.

We look forward to hearing from you and understanding your portfolio goals, and we hope to discuss your accounts and our outlook for this year.

Best regards,

The ChoateIA Investment Team