Insights

2023 Third Quarter Review: The Jury is Still Out on a “Soft Landing” for the US Economy

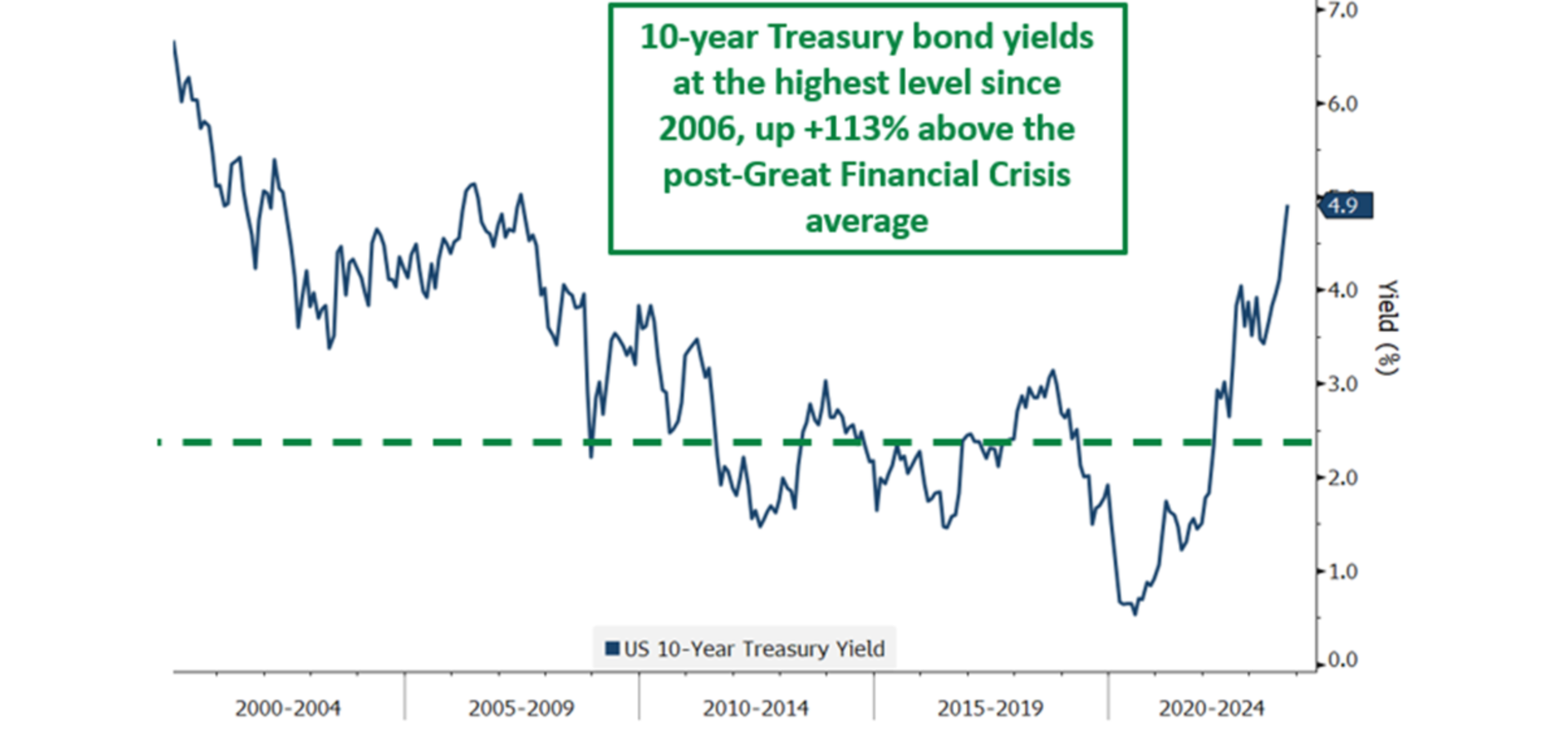

Rising interest rates remain the primary issue for many investors, and it looks like interest rates may remain “higher for longer.” The 10-year yield on newly-issued US Government bonds increased from 3.8% on June 30th to 4.6% at the end of the quarter, pushing bond prices lower and resulting in negative returns for the Bloomberg aggregate bond index of -3.2% for the quarter. Labor markets are resilient, despite the potential negative headwinds from higher interest rates on the economy and corporate earnings.

Chart 1: Government 10-year Bond Yields Since 2000 with Current Yields at Highest Level Since the 2008 Global Financial Crisis

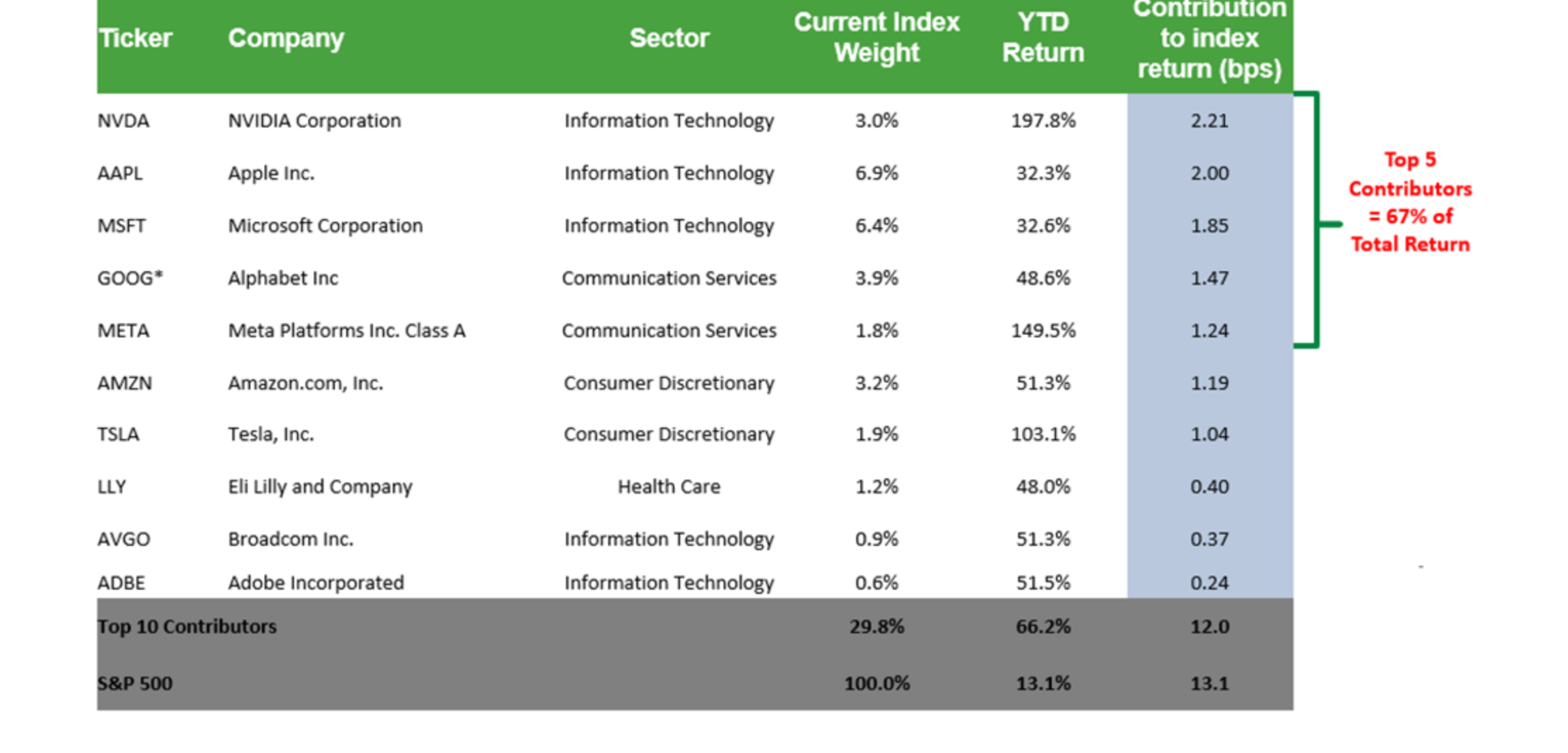

The S&P 500 Index declined 3.3% this quarter, yet remains up 13.1% year-to-date. Likewise, the MSCI All Country World Index (ACWI) lost 3.4% this quarter and is up 10.1% through the end of September. In the US, the 5 largest ‘mega-tech’ companies are driving most of the market returns this year, while the equal weighted S&P 500 index is up only 1.7% for the year, underlining the narrow focus of this market rally.

Chart 2: Top 5 Stocks Contributed 67% of Total S&P 500 Year-to-Date Increase

Over the past several decades, stock market investors benefited from several secular tailwinds:

- Globalization and outsourcing lowered labor and operating expenses for goods and many services

- Capital efficiency increased as a result of just-in-time inventory and global supply chains reducing capital held as inventory and expenditures on capital equipment, boosting Returns on Invested Capital

- Lower taxes for consumers and corporations spurred consumption and increased earnings

- Falling interest rates reduced the cost of capital and increased profitability for shareholders

Many of these long-term trends are slowing or beginning to reverse:

- The Covid pandemic revealed the vulnerability of global supply chains to disruption. Many firms now plan to hold higher levels of inventory and to source key components from multiple vendors, creating higher cost and redundancy.

- Adversarial geopolitics are shifting global trade alliances. Calamity in the Middle East, war in Ukraine, and rising friction between the United States and China are changing corporate spending priorities.

Moreover, the United States’ embrace of an active industrial policy (the Inflation Reduction Act and the CHIPS Act) marks the end of globalization as a primary policy goal.

- While Congress struggles with leadership changes and an upcoming Presidential election, investors worry about the Federal budget and fiscal spending issues over the next year. This could also result in higher taxes in future years.

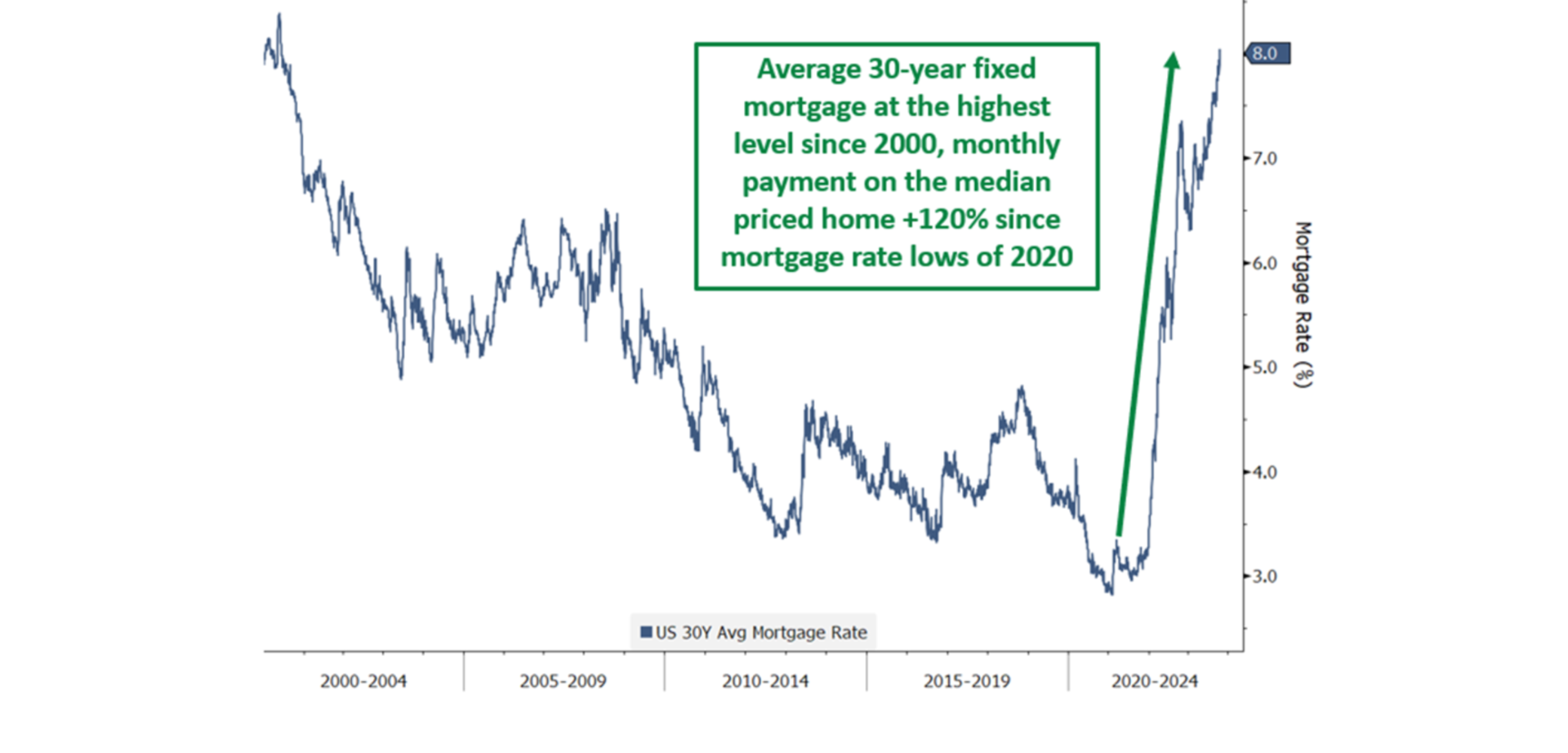

- Interest rates are rising. We believe the impact will first hit the capital-intensive segments of the economy, including biotech and housing, but will also spread to other sectors of the economy. Mortgage rates have surged higher, with the national average for a 30-year fixed rate mortgage at 7.74% - the highest level in 25 years.

Chart 3: Average 30-Year US Fixed Mortgage Rate Since Year 2000

For investors, higher interest expenses mean that company management must either 1) pay higher interest expenses and see profit margin decline, or 2) allocate more free cash flow to paying down debt (instead of paying out dividends or buying back shares), or potentially 3) curtail future growth expenditures.

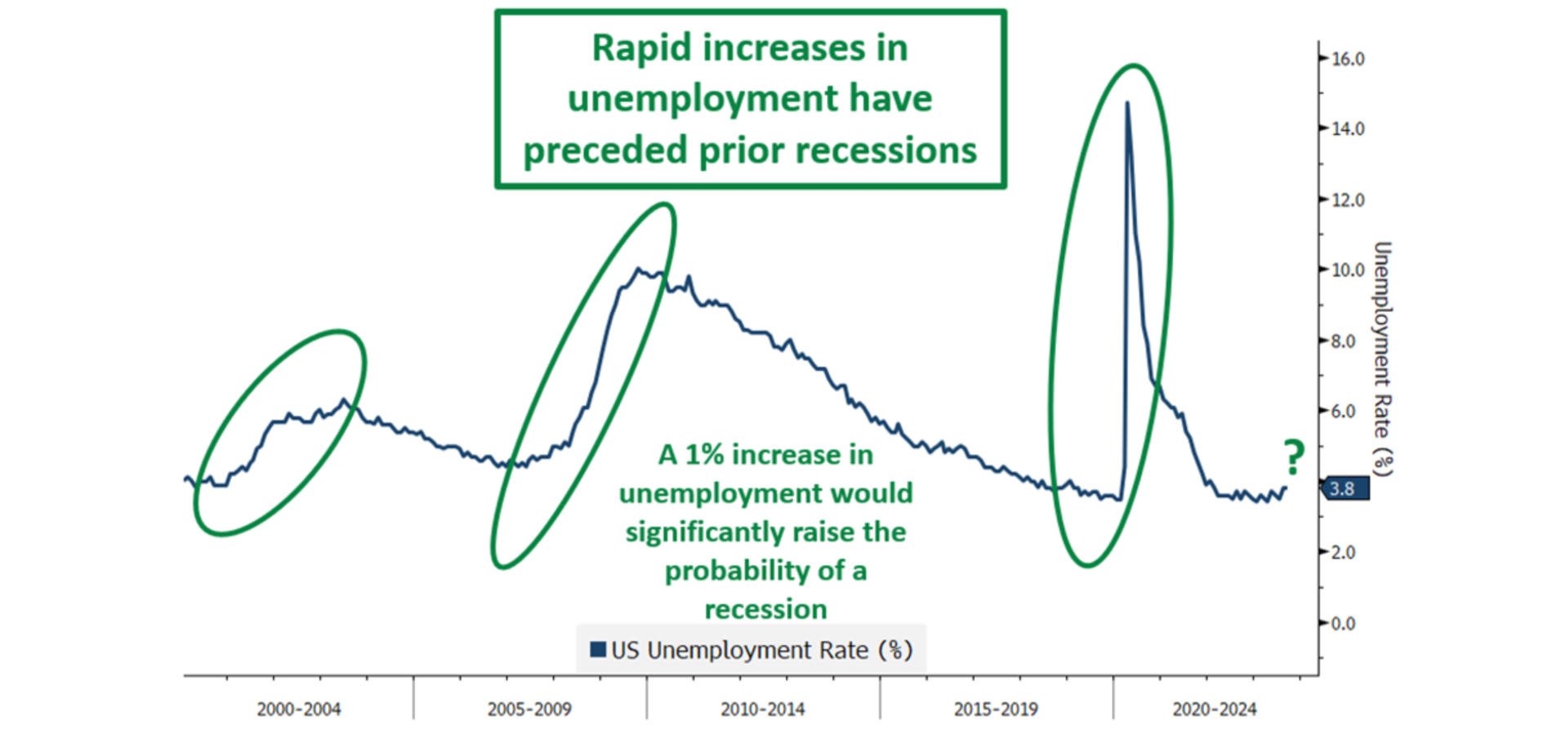

On the positive side of the ledger, initial jobless claims are well below the levels that would presage a significant increase in the rate of unemployment, and the rate of unemployment remains at cycle lows.

Chart 4: Unemployment Rates Since Year 2000 Show Low Unemployment Supports Household Consumption and the Broader Economy

We have consistently said that a rise in the rate of unemployment would be a key signal for predicting an economic recession and to date, that signal has not emerged.

In addition, corporate earnings expectations look to have bottomed for 2023 and expectations are for growth in 2024. This is a positive sign for stocks. By contrast, typically, market corrections or bear markets are triggered by a decline in earnings.

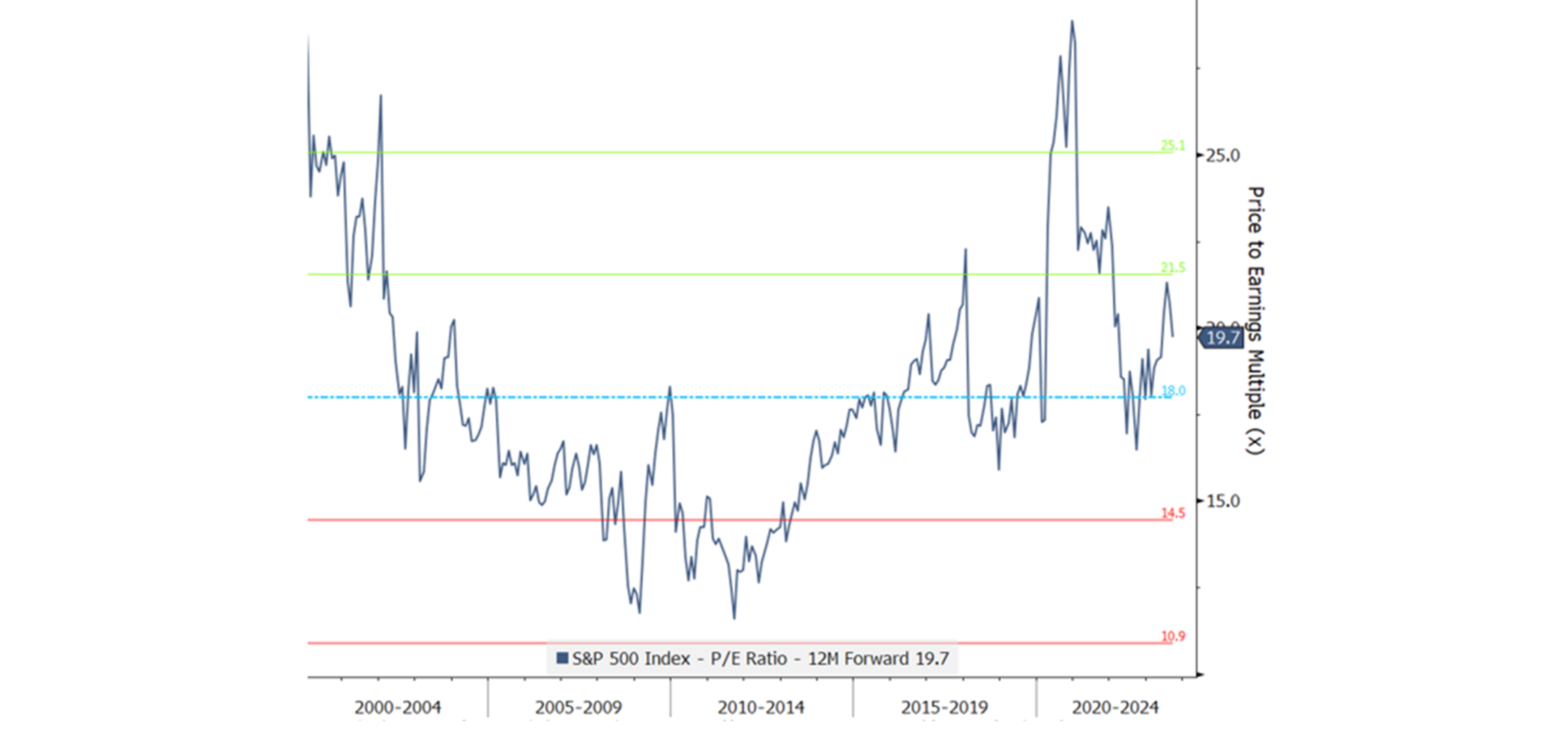

The S&P price to earnings ratio is slightly above historical averages and the backdrop of higher interest rates would favor lower multiples rather than higher multiples. Thus, we think earnings will be the primary driver of stock returns.

Chart 5: S&P 500 Price-to-Earnings (P/E) Ratio (12-Month Forward) Since Year 2000

Although the economy is facing headwinds such as higher interest rates, the current low unemployment rate underlines its resiliency. Looking ahead to 2024, we believe there are two potential scenarios:

- The Fed May Stick the Landing: The Federal Reserve may manage to tame inflation without causing a significant economic slowdown or a surge in unemployment. This scenario would be good for both stock and bond investors. We should note, history has proven that it is very difficult for central bank actions to navigate changes in the economic cycle.

- Fed Policy May Lead to a Slowdown: High interest rates may curtail consumption and investments, leading to a recession and a drop in GDP. In this situation bonds should do well while stocks will underperform.

The rise in bond yields has been painful for bond investors these past three years. However, yields are increasing, and prospective returns look increasingly compelling. We expect bond returns should be positive in both our outlined scenarios. In light of this, our positioning remains incrementally overweight in bonds and underweight in stocks.

We look forward to hearing from you and understanding your portfolio goals, and we hope to discuss your accounts and our outlook for this year.

Best regards,

The ChoateIA Investment Team