Insights

2020 Fourth Quarter Review

The MSCI All Country World Index (a market cap weighted index that includes 90% of the World’s stocks) finished the year with a 16.3% return as investor optimism surged on expectations that the world will return to normal. This double digit return for 2020 follows a 26.6% return in 2019. We are happy to report that many of the stocks we recommended performed significantly better than the MSCI All Country World Index (ACWI) as a whole. The Bonds we recommended provided positive returns while also serving as a source of stability and safety in our client portfolios. We favor bonds with shorter maturities which have lower exposure to any future rise in interest rates.

The favorable market results do not fully reflect the turbulence we experienced throughout 2020. The pandemic and subsequent lockdowns led to the fastest drop in economic activity ever recorded along with a sudden drop in employment. Streets emptied, restaurants, offices, and other public spaces shuttered, and many employees began working from home. Markets had the fastest decline in history, losing more than 30% in less than a month! Combatting this, unprecedented monetary and fiscal policy response from the Federal Reserve and U.S. government led to a stabilization, and then an eventual surge in stock prices. Although markets recovered quickly, the impact of the pandemic lingered and the human cost remained high. The pandemic accelerated some existing secular trends which we believe could positively affect the investing landscape for years to come. Examples of this include the following:

- Working from home (WFH) became mainstream, and although many workers will ultimately return to offices, WFH has proven surprisingly effective both for employers and for employees. At the peak of the lockdown, 50% of Americans were working from home and by March 2020, data streaming demand had increased by 12%, and web traffic was up by 20%. Increased work from home trends will likely impact office and residential real estate demand and require additional broadband and data capacity and other technology enablers.

- The shift to online commerce continues to accelerate during the pandemic. More than 55% of consumers have tried a new online retailer, 18% have tried curbside pickup, and commerce sales increased by 30%.

- Social media continues to pressure traditional media outlets, especially local news and regional platforms. A “winner takes all” effect is occurring in traditional media as, for example, the New York Times’ stock price rose close to 300% over the past five years as now national audiences gravitate to national platforms such as the Times, and the Wall Street Journal.

- Vaccine research and development took a giant leap forward as time to market was reduced by 75% versus previous vaccine development programs.

- Oil prices declined as stay at home orders curtailed driving around the world. We think the oil & gas sector will remain under pressure as electrification of transportation and the increasingly competitive pricing of renewable energy will continue to transform energy and utility markets worldwide. According to the International Energy Agency, green electricity is on track to displace coal as the largest global source of electricity before 2025.

2020 was a year to forget in many ways, but also a spur for innovation and adaptability. Human ingenuity often mitigates or adapts to real constraints leading to better than expected outcomes.

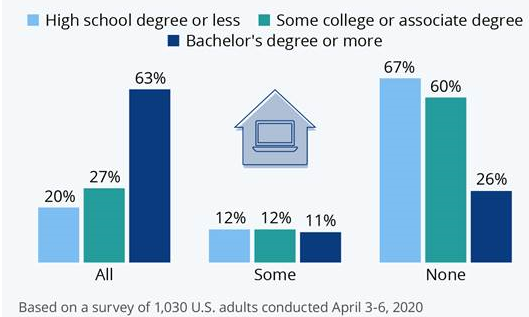

The pandemic also exposed societal fault lines. Our existing social safety net proved inadequate and extraordinary congressional action was required to bolster and buttress our fragmented, de-centralized and byzantine unemployment program, as well as other social support systems. Those that could work from home were relatively spared the job losses and investors, in particular, greatly benefited from the market rally since March. Thus work from home intensified social inequality during the pandemic, and the ability to work from home ranged dramatically by education level.

Degree of WFH Based on Education Level at the height of the “lockdown” in April

Source: Board of Governors of the Federal Reserve System

Frontline workers, typically in lower paid service positions, remain under tremendous strain as we begin 2021. An extremely contentious election became even more partisan afterward, and our core democratic institutions were attacked in an unprecedented Presidential transition period. We are all happy to be turning the page toward 2021, but as citizens, the work has just begun.

In such a turbulent world, innovation and disruption remain an investment constant. At Choate Investment Advisors, we look to work with investment managers that are seeking out and investing in companies that have the potential to continue to gain market share by disrupting the status quo, and/or benefiting from secular tailwinds. We remain convinced that over time these companies will grow more rapidly than many others, and investors will ultimately benefit from such growth.

However, in shifting economic environments such as this one, more cyclical companies – that we do not have as much exposure to – may be in favor with investors and thus may perform well over the near term. Value stocks in industries such as materials, energy and financials could do well in 2021, as investors focus on a cyclical recovery and economic normalization. For this reason, after a year where our secular growers significantly outperformed, it is possible that our overall equity portfolios may lag in 2021. We intend to continue our approach of investing in high-quality and profitable growth companies, and remain confident that over time, investors will be rewarded when they own growing franchises.

As we highlighted in our letter in May 2020, ChoateIA seeks three key attributes for the investment managers and companies that we invest in:

- Financial Strength. We believe companies with significant recurring revenues, high returns on capital, and low financial leverage are better positioned to ride out a crisis. These companies typically generate substantial free cash flow and therefore are less likely to be impacted when capital markets freeze up.

- Unique Product. We believe companies with unique product offerings have stronger market positions. These companies can add value due to strong intellectual property holdings (e.g., a technology company with a strong patent portfolio in 5G). A negative example would be a commodity export company that faces global competition and cannot add value to the commodity it sells.

- Secular Tailwinds. We believe companies benefiting from long-term economic trends have an advantage. For example, the world is producing and consuming more and more data. Several different types of companies benefit from this trend, including semiconductor manufacturers and cell phone tower providers.

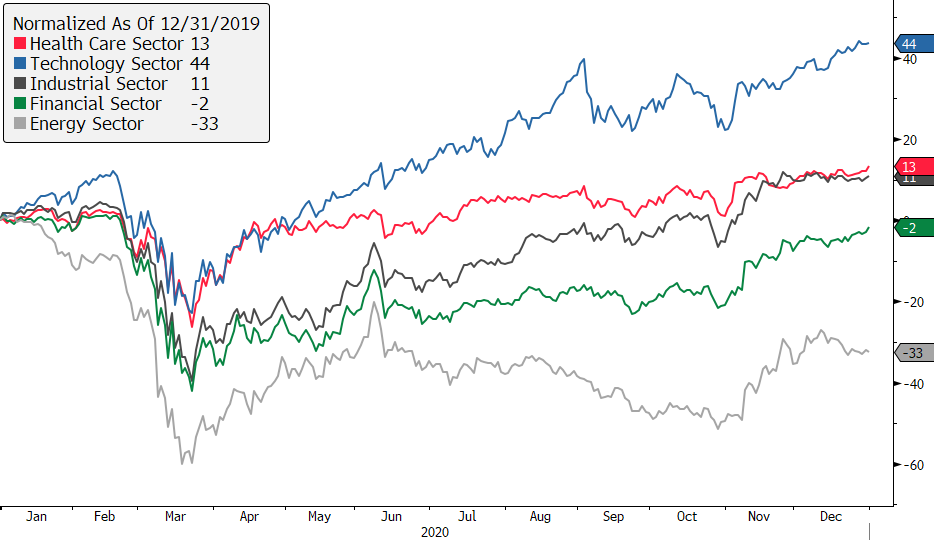

Companies with these three traits tend to be clustered in technology and health care, and most investors consider them “growth” companies. Since the global financial crisis, the stock performance of these companies has far exceeded that of more asset-heavy, high-fixed cost firms in the industrials, energy, and materials sectors, or companies with a high degree of leverage such has banks. Many of these sectors were already facing headwinds before the pandemic. For example, energy firms are challenged by increased adoption of energy efficiency and electrified transportation as households and governments react to climate change. For another example, when this pandemic crisis ends, households and corporations will have more debt, and we believe this will limit future growth in the financial sector.

2020 Returns by Select U.S. Sectors (normalized to 0 as of 12/31/2019)

Source: Bloomberg

Although more cyclical sectors such as financials and energy did rebound after the election, technology and healthcare companies continued to lead the way in 2020. Our focus on the types of companies described above was the key driver of why the active equity managers we have selected have outperformed by so much this year.

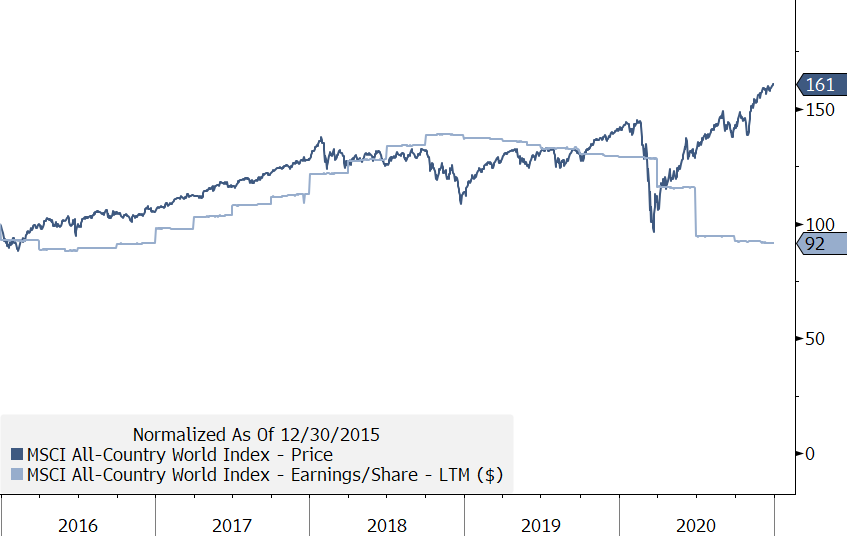

Interestingly, aggregate earnings for public equities (in blue in the chart below) peaked in late 2018 and have declined by 40% since then. Despite the drop in earnings, equity prices (in dark blue) are at all-time highs.

5-Year Global Stock Market Price versus Earnings per Share (normalized to 100 as of 12/30/2015)

Source: Bloomberg

Even with an expected surge in earnings for 2021, next year’s forecasted earnings will only be $1 per share higher than in 2018. It is evident that investors today are willing to pay a higher multiple for forecasted earnings than investors were willing to pay in the past.

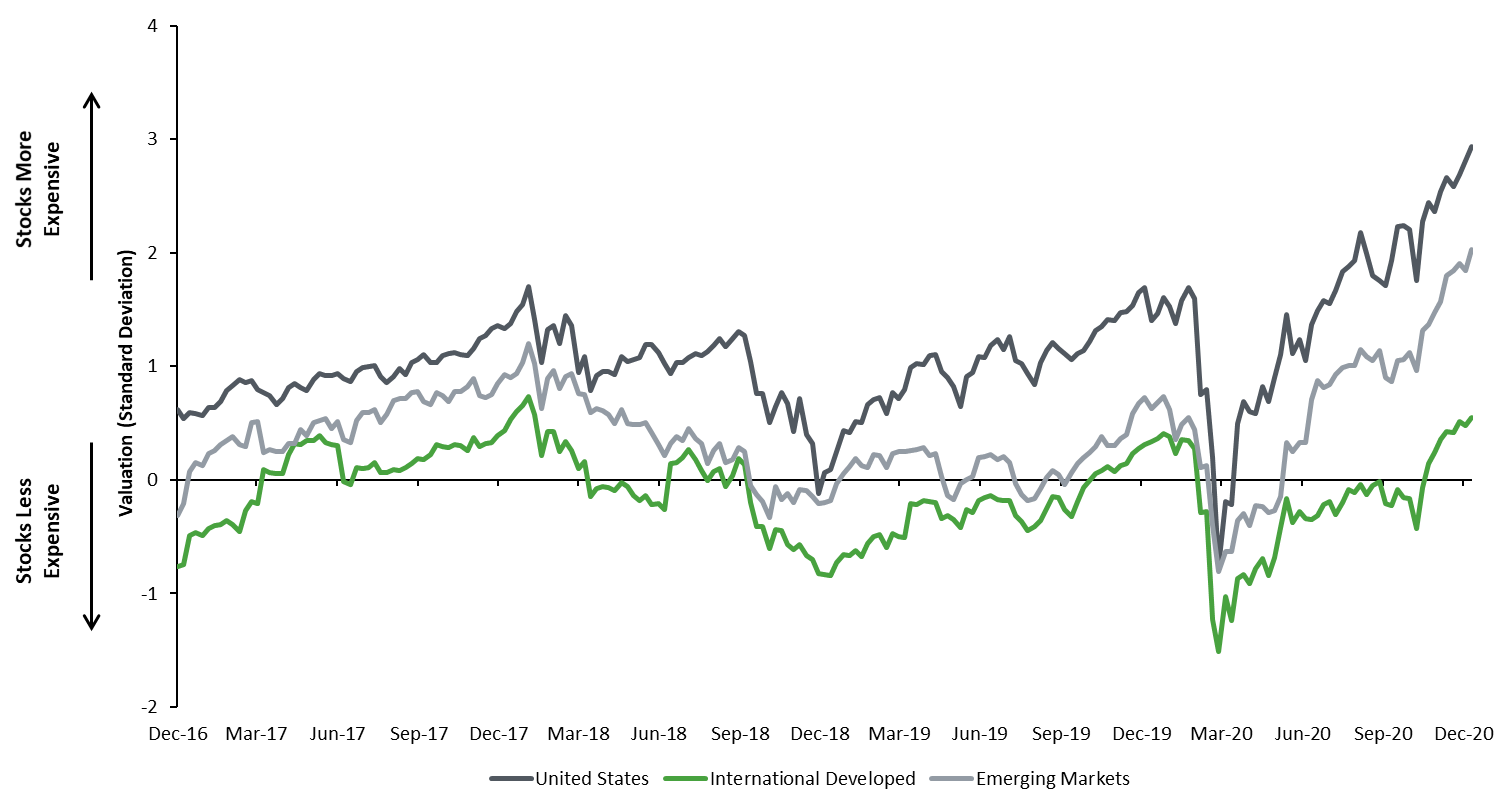

As shown in the chart below, current stock valuations in the United States (dark grey) are over 2.5 standard deviations above long-term averages. The only time that stocks have had higher valuations was during the peak of the dot-com bubble.

Composite Valuation Measure by Market

Source: ChoateIA, Bloomberg

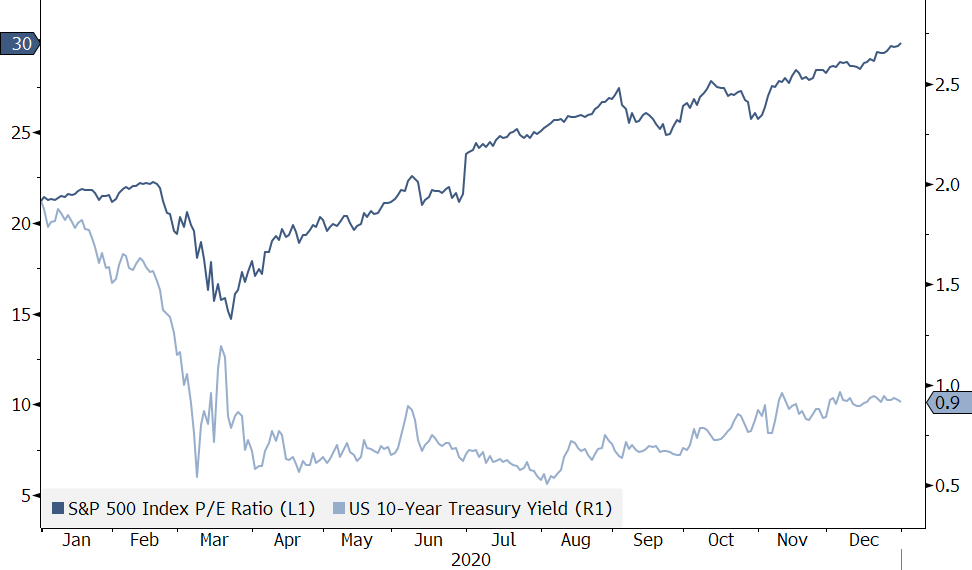

Declining bond yields have played an important role in supporting rising stock valuations in two respects: 1) equity dividend yields look attractive versus interest earned on bonds and 2) stock prices represent discounted future company cash flows and when interest rates are low, this makes future cash flows more valuable. This factor can justify a higher current valuation (price to earnings multiple) for the same stream of future cash flows. It also means that stock valuations are vulnerable to a rise in interest rates.

10-Year Treasury Yield versus S&P 500 Price to Earnings ratio

Source: Bloomberg

Despite these rising valuations, we remain confident that investing in the types of firms referenced above continues to make sense for our clients with long time horizons.

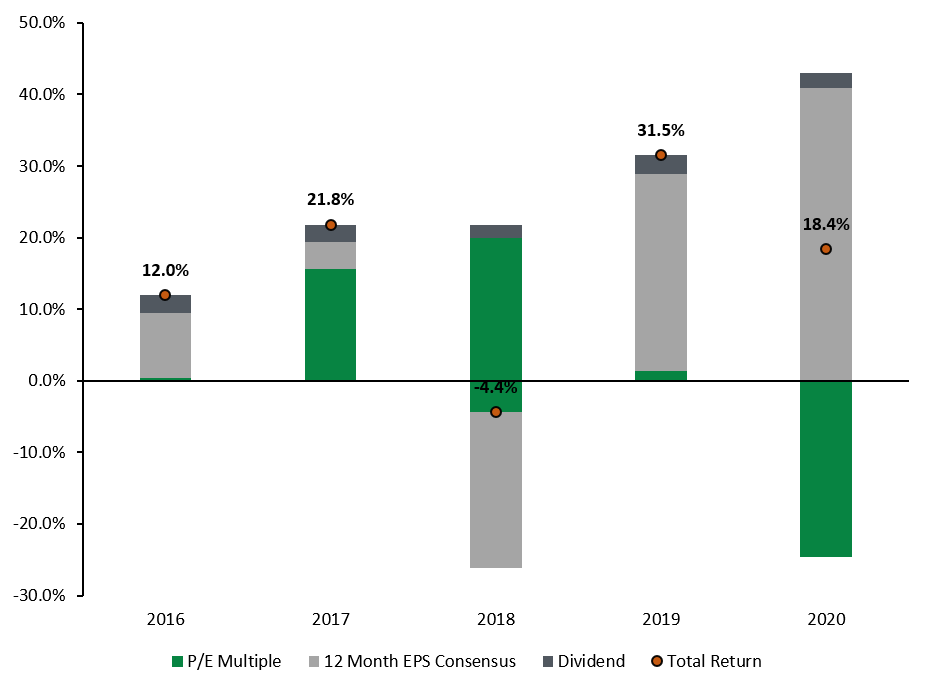

It is helpful to break down stock market returns into their three components: 1) the return from dividends, 2) the earnings growth of underlying companies and 3) the change in price to earnings multiple.

S&P 500 Total Return Attribution

Source: ChoateIA, Bloomberg. Numbers rounded for accuracy of total return

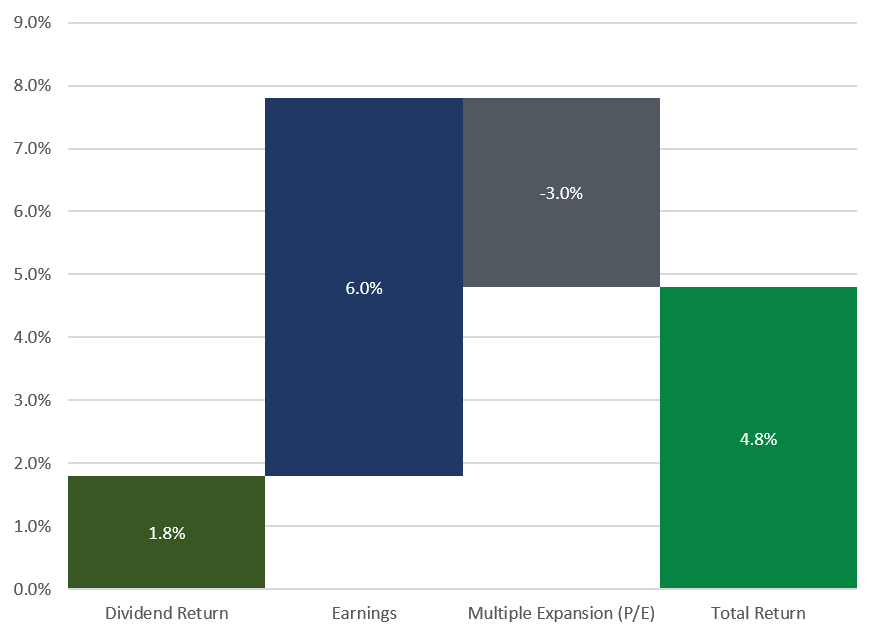

Given current elevated valuation metrics, we expect that price to earnings multiples will likely compress over the next three-to-five years. Taken by itself, this factor could tend to drive stock prices down. The current dividend yield for the S&P 500 is 1.8% and Goldman Sachs forecasts an earnings growth rate of 6% per year for the S&P 500 over the next 10 years. For the sake of illustration, if we were to assume that multiples would compress from 28X earnings to the long term average of 18X (or decrease by 36%) over the next 10 years, with all other things held equal, then we could estimate an annual return for the stock market as follows: 7.8% (dividend yield plus earnings growth) less ~3% from multiple compression, or something in the range of 5% per annum.

Illustration Of The Factors Composing Return

Source: ChoateIA

However, if we could invest in firms that are growing earnings at 12% a year (or twice the market average), then we could earn higher returns even if we factor in significantly more multiple compression. This arithmetic exercise underscores two important points:

- We expect market returns over the next three to five years to be significantly lower than the prior five years.

- We will remain focused on companies which have demonstrated the potential for higher growth while recognizing that, as described earlier, in the short term, investors may flock to more cyclical or less expensive stocks in 2021 as a wager on economic normalization. We believe constructing a portfolio with higher underlying earnings growth should lead to higher returns over time. We can’t predict what valuation a stock will trade at five years from now, but a company that doubles its earnings over five years has doubled the fundamental value of the business itself and we believe the market will ultimately recognize and reward this.

In addition, the very low bond yields that currently prevail (the 10-year Treasury finished 2020 yielding 0.94%) also point to low returns for bond holders. Since bond returns are so low, investors will likely need a healthy equity allocation in order to seek their long-term return goals. This may expose investors to periods of volatility and underperformance. However, investing in an appropriate mix of safe assets and more stable, growing companies remains, we think, the key to long-term success.

With a strong year in the rearview mirror, now is a good time to review your portfolio and consider whether your current strategy remains appropriate for your long-term goals. We look forward to connecting with you in 2021.

Printable version.

Disclosures:

This report is prepared by Choate Investment Advisors LLC (“ChoateIA”), a subsidiary of Choate, Hall & Stewart LLP. ChoateIA is registered as an investment advisor with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the firm can be found in its Form ADV Part 2, which is available upon request by emailing info@choateia.com.

This presentation is for informational purposes and does not constitute investment advice. None of the information contained in this report constitutes, or is intended to constitute, a recommendation of any particular security, trading strategy or determination by ChoateIA that any security or trading strategy is suitable for any specific person. Investing involves the risk of loss of principal. To the extent any of the information contained herein may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

The opinions expressed are solely those of ChoateIA. The information contained in this report has been obtained and derived from publicly available sources believed to be reliable, but ChoateIA cannot guarantee the accuracy or completeness of the information. Past performance is no guarantee of future results.